Global equity investors faced a challenging first half of the year. An optimistic start quickly gave way to turmoil as President Trump’s trade war and escalating geopolitical tensions unsettled markets.

This uncertainty caused investors to retreat. Although broader markets recovered slightly in the second quarter, the Morningstar Global TME Index still posted a loss of 3 percent over the first six months of 2025. European stocks regained some prominence, while US-listed equities suffered under the weight of a weak dollar.

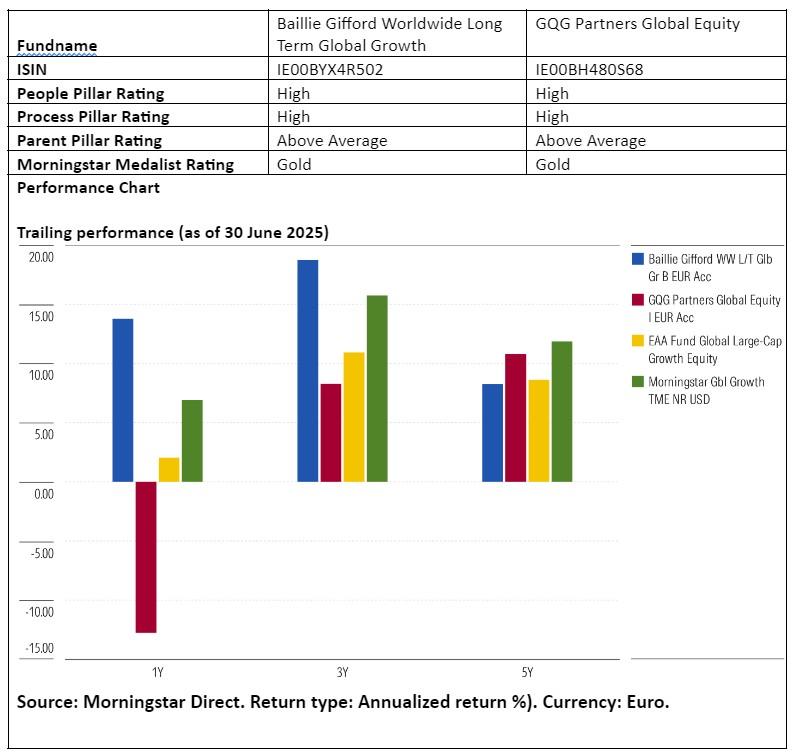

Against this backdrop, we examined two investment funds in the Morningstar category Global Large-Cap Growth Equity. Both funds have received qualitative ratings from Morningstar analysts and are considered top picks within their category. We compared Baillie Gifford Worldwide Long Term Global Growth with GQG Partners Global Equity, discussing their similarities and differences.

People

A wealth of experience, strong proven results, deep expertise, and unique skills placed both the Baillie Gifford fund and the GQG Partners strategy in the hands of highly capable teams. This justified a High People Pillar rating for both funds.

The Baillie Gifford investment team stood out for its close-knit, seasoned group that shared a clear long-term philosophy. Led by partners Mark Urquhart and John MacDougall, with 29 and 25 years of experience respectively, the team combined deep research capacity with a strong collegial culture. It was guided by a thoughtful group that maintained close ties with academics and leading industry “visionaries,” while also cultivating valuable connections with private companies. Each team member was primarily an analyst and was encouraged to research a few companies intensively each year. Their approach demanded discipline and the ability to endure significant share price volatility. That was a strength—but also a potential weakness during periods of structural market change.

GQG Partners relied on the broad expertise of founder Rajiv Jain, who assembled a diverse team of twenty professionals, including forensic accountants and former investigative journalists. This creativity and diversity of perspectives provided a strong informational foundation. However, some recent personnel changes at GQG introduced a degree of uncertainty around the team’s continuity.

Process

An original investment philosophy, a proven approach, and distinctive portfolios earned both funds a High Process Pillar rating.

Baillie Gifford’s investment process focused heavily on identifying companies with extreme growth potential within structurally growing sectors. The approach was deliberately flexible, allowing analysts to cast a wide net for opportunities—supported by an extensive network and original information sources, including private company contacts. The result was a concentrated, high-conviction portfolio where significant volatility and large drawdowns were tolerated. Baillie Gifford also used probabilistic scenarios instead of traditional valuations, aligning with its focus on multi-year growth potential.

GQG, by contrast, employed a quality-driven growth strategy, with attention to solid balance sheets, high returns on equity, and companies capable of withstanding economic downturns. Rajiv Jain adjusted allocations quickly and decisively when needed, as seen in the sharp rotations between energy and technology in recent years. Former journalists leveraged their investigative skills to uncover hidden trends. This combination enhanced the team’s information advantage.

Portfolio

Baillie Gifford’s portfolio typically included thirty to fifty globally selected stocks, chosen without constraints on region or sector. Positions were determined bottom-up based on growth potential, with a clear focus on identifying extreme growth companies. Positions were usually initiated at 1 to 2 percent weights and allowed to grow freely, often resulting in the top ten holdings accounting for a large portion of total assets. The fund showed structural underweights in traditional energy, financials, and defensive consumer goods, while the team identified attractive growth opportunities in emerging markets outside China.

GQG’s portfolio was comparable in size, but Rajiv Jain took a more active approach, frequently shifting sector exposures based on valuations and macroeconomic developments. For example, the fund recently scaled back its technology exposure significantly. The team looked beyond the numbers, also factoring in political and regulatory risks. This dynamic approach created opportunities but could feel unpredictable for investors who prefer consistency.

Performance

Baillie Gifford delivered strong long-term returns with a level of volatility the team consciously accepted. The portfolio could significantly underperform during periods when value-oriented stocks were favored or when investors became more risk-averse. Over the past decade, top holdings like Tesla and Nvidia contributed significantly to the fund’s outperformance. After difficult years in 2021 and 2022, the fund performed strongly in 2023, 2024, and early 2025.

GQG also posted impressive results, with an average annual return of over 13 percent since 2019. The strategy demonstrated resilience during down markets, thanks in part to timely sector rotations. However, during strong growth rallies, GQG sometimes lagged due to its more cautious stance—as seen in 2023, when returns slightly underperformed the benchmark.

Jeffrey Schumacher is Director of Manager Research at Morningstar Benelux. Morningstar evaluates and rates investment funds based on both quantitative and qualitative research. Morningstar is a member of the expert panel of Investment Officer.