Historically, US smallcaps have outperformed their European peers, with a difference of about 1.5 percent to 2.5 percent over 5-, 10- and 15-year periods, depending on the timeframe. In the first seven months of 2025, however, the situation has been reversed.

As of the end of July, the Morningstar Developed Europe Small Cap TME Index was up more than 12 percent, making European smallcaps one of the strongest performing market segments worldwide. US smallcaps, by contrast, have been among the worst performers this year, with the Morningstar US Small Extended Index down more than 8 percent.

The disappointing results stem from a mix of macroeconomic, monetary, and fundamental factors. The Federal Reserve has kept interest rates relatively high to fight inflation, much to the frustration of President Donald Trump. Trump’s trade policy, which has reintroduced broad import tariffs, has also fueled economic uncertainty. Smaller companies are hit particularly hard since they generate a large share of their revenue in the domestic market. Finally, even after recent losses, US smallcaps remain relatively expensive compared to their European counterparts.

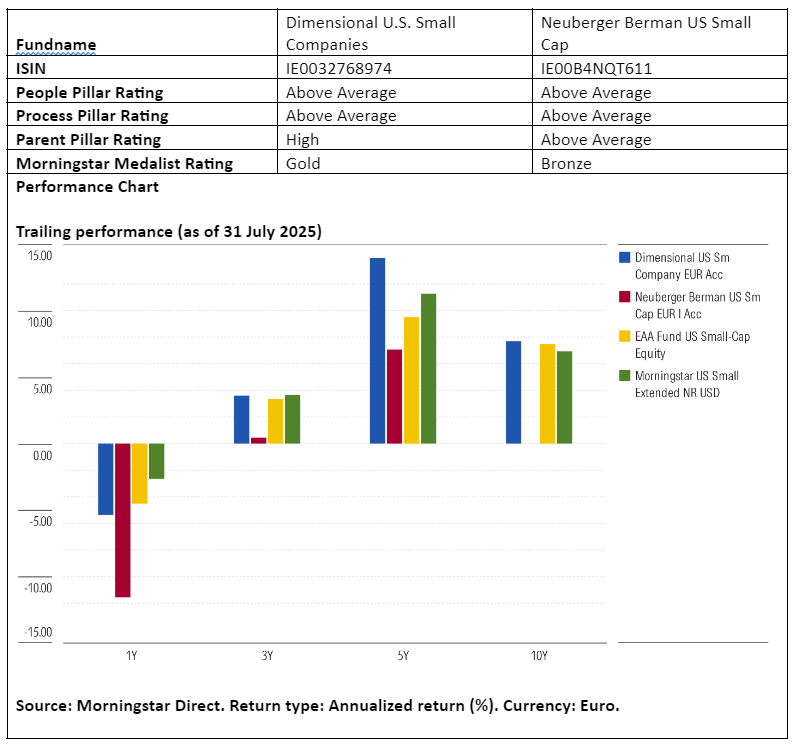

Against this backdrop, we take a closer look at two funds in the Morningstar US Small Cap Equity category. Both have been rated qualitatively by Morningstar analysts and are considered strong options in this space: Dimensional U.S. Small Companies and Neuberger Berman US Small Cap.

People

Both Dimensional U.S. Small Companies and Neuberger Berman US Small Cap carry an Above Average rating on the People Pillar. Both teams are strong and well-resourced, but Dimensional stands out for its structure and collaboration, while Neuberger Berman distinguishes itself through deep expertise and long-term experience.

Dimensional relies on a structured and highly collaborative team of managers and traders, with responsibilities broadly shared. This structure ensures continuity and limits the impact of staff changes. New managers are intensively trained internally under the guidance of experienced colleagues. Flexibility within the team also allows roles to be taken over seamlessly when necessary.

Neuberger Berman emphasizes fundamental research and experience. Judy Vale and Bob D’Alelio have managed the strategy since 1996, although Vale has since stepped back from day-to-day decision-making. Succession was carefully planned, with Brett Reiner and Gregory Spiegel promoted in 2011 and 2012, respectively. This shows a thoughtful approach to long-term continuity. Despite some turnover in the broader team, which includes five analysts, the group remains experienced and well-equipped.

Process

Both funds earn an Above Average rating on the Process Pillar, but their approaches differ markedly. Dimensional employs a systematic, quantitative method, while Neuberger Berman uses a fundamental, bottom-up process.

Dimensional applies a rules-based system rooted in academic research. It targets profitable companies in the smallest segment (the bottom 10 percent) of the US market while excluding stocks with high valuations, low profitability, or excessive balance sheet growth. The result is a broadly diversified portfolio of 1,800 to 2,000 names, market-cap weighted, with traders playing a key role in executing trades efficiently to keep costs low.

Neuberger Berman, by contrast, takes a fundamental, quality-driven, bottom-up approach. Managers select companies with stable cash flows and a durable competitive edge. The team conducts deep research, including management meetings and analysis of 10 years of financial data. Positions are built gradually with a long-term perspective but are adjusted as quarterly results come in.

Portfolio

Dimensional U.S. Small Companies has a highly diversified portfolio that closely resembles the Russell 2000 Index. It has a slight tilt toward value and smaller market caps. Sector weights remain close to the benchmark, with modestly higher exposure to financials and an underweight in real estate.

Neuberger Berman US Small Cap holds a far more concentrated portfolio of 90 to 150 names and balances between small- and midcaps. By holding profitable growth companies over the long term, the fund maintains relatively high exposure to midcaps (25 percent of assets). The portfolio also shows stronger sector tilts, most notably an overweight in industrials.

Performance

Dimensional U.S. Small Companies has a strong long-term track record, with low costs setting a low bar for outperformance. Its tilt toward smaller market caps should be favorable in market rallies, though it also results in higher-than-average risk levels. Even so, its risk-adjusted return profile remains excellent. In 2025, through the end of July, the fund slightly lagged the Morningstar US Small Extended Index, due to its underweight in midcap growth stocks and minor negative stock selection effects.

Neuberger Berman’s strategy has significantly outperformed both peers and benchmarks since the US-domiciled fund’s launch in 1997. It has often excelled in down markets thanks to its focus on quality companies. However, in the first seven months of 2025, the fund lagged, mainly due to negative selection results in financials, industrials, and technology.

Ronald van Genderen is senior manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.