In recent years, global equity markets have been driven by the performance of largecaps, particularly in the technology sector, leaving smallcaps behind. That was the case in 2024, for example, when the Morningstar Global TME Index gained 25 percent while the Morningstar Global Small TME Index managed only a 16 percent increase.

During the first seven months of 2025, smaller companies continued to lag their larger peers, though the gap was far narrower, with smallcaps losing 1 percent and largecaps posting a 1 percent gain.

Regionally, however, there are significant differences this year. Historically, US small caps have outperformed their European counterparts by about 1.5 to 2.5 percent across 5-, 10-, and 15-year periods, depending on the timeframe. But in the first seven months of 2025, the Morningstar US Small Cap Extended Index recorded a loss of more than 8 percent, while the Morningstar Developed Europe Small Cap TME Index rose by more than 12 percent. In Europe, financial services companies stood out with an average return of 30 percent. Communication services, business services, and utilities also performed strongly, although their weight in the index is smaller.

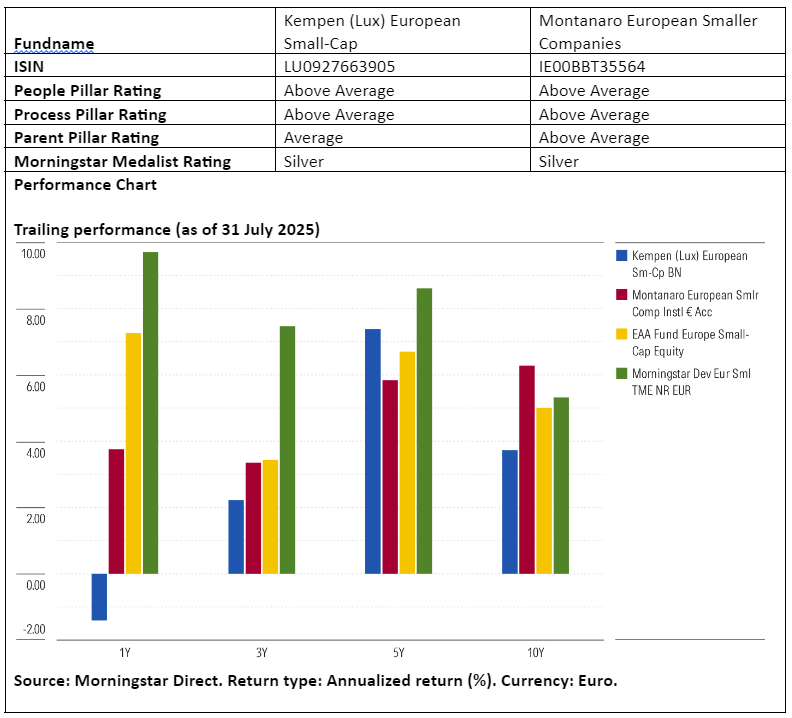

Against this backdrop, we look at two funds in the Morningstar Europe Small-Cap Equity Category. Both have been qualitatively rated by Morningstar analysts and are considered solid choices within the category. We compare Kempen (Lux) European Small-Cap and Montanaro European Smaller Companies, highlighting their similarities and differences.

People

Kempen (Lux) European Small-Cap and Montanaro European Smaller Companies both focus on European smallcaps, but they differ markedly in team size, experience, and approach. Even so, both funds receive an Above Average rating on the People Pillar.

Kempen’s fund is managed by a compact but close-knit team of four portfolio managers who have been responsible for the fund since 2018. Although the team lost an experienced manager in 2023, it has otherwise remained stable over the years. The relatively small group is adequately resourced, in part because it can rely on support from other teams within Van Lanschot Kempen.

Montanaro, by contrast, has a much larger team of more than 15 members, including ESG analysts. The fund is currently managed by Stefan Fischerfeier and Alex Magni, but founder Charles Montanaro remains actively involved. The broader team is organized into three sector teams, ensuring deep research coverage. However, recent years have brought several personnel changes, making stability a point of attention.

Process

Both Kempen (Lux) European Small-Cap and Montanaro European Smaller Companies follow a bottom-up investment approach with a strong emphasis on quality and in-depth company research, earning each an Above Average Process Pillar rating. Still, their methodologies and areas of focus differ.

Kempen applies an efficient quantitative screening process, first selecting companies on return on capital employed (ROCE) and then on valuation (EV/NOPLAT). Roughly 400 companies remain after this screen, followed by detailed fundamental research. Company visits are essential to assess management quality, among other factors. These insights, combined with analysis through Porter’s Five Forces framework, feed into valuation models that incorporate a margin of safety.

Montanaro employs a broader quality framework when screening its universe, with 14 criteria across five categories: growth, profitability, leverage, cash position, and volatility. The analysis then delves deeper into growth prospects, competitive position, and financial health. Direct engagement with management is also central. Montanaro pays particular attention to structural growth trends and sets price targets using DCF models and valuation ratio analysis.

Portfolio

Both Kempen (Lux) European Small-Cap and Montanaro European Smaller Companies run fairly concentrated portfolios with about 30 to 50 holdings and a long-term investment horizon, reflected in their low turnover. Yet their approaches and styles diverge.

Kempen’s portfolio has about 40 percent in its 10 largest holdings but still maintains diversification. Individual positions remain under 5 percent, and sector and country weights rarely deviate more than 5 percent from the benchmark. Still, there are some structural tilts, particularly in consumer defensives and the UK. The team places strong emphasis on valuation, resulting in a blended profile in the Morningstar Style Box.

Montanaro, on the other hand, has clearer sector preferences, typically overweighting healthcare and technology while generally avoiding banks, energy, and materials. On a country basis, the UK is also overweighted. The fund is more focused on growth and quality than on valuation, which structurally places the portfolio in the growth column of the Morningstar Style Box.

Performance

Since its team change in 2018, Kempen has delivered above-average results relative to both category and benchmark. This outperformance stemmed largely from successful stock selection, especially in consumer goods, financial services, healthcare, and technology. In 2025, however, the fund has lagged its benchmark, mainly due to overweighting consumer defensives and weak stock selection in technology.

Montanaro’s focus on quality and growth has produced solid outcomes in defensive or moderately growing markets, with strong downside protection in challenging years such as 2018. But in periods dominated by value stocks or cyclical themes—such as 2013, 2016, and 2021-2022—the fund fell behind. In 2025 so far, Montanaro has again trailed its benchmark, with underweighting banks playing a significant role.

Ronald van Genderen is senior manager research analyst at Morningstar. Morningstar analyzes and rates mutual funds based on quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.