Local emerging-markets debt strategies took a beating in the last quarter of 2024 but recovered spectacularly in dollar terms in the first half of 2025 with the widely-used JPM GBI-EM Global Diversified index recording a return of 13 percent for the six-month period.

Where the 4th quarter of 2024 had brought US dollar strength and heightened volatility around the US elections, 2025 through June was characterised by dollar weakness and volatility amid tariff and US-policy uncertainty. But the stability of the euro resulted in negative performance year-to-date of 1 percent for euro-based investors. Meanwhile, JPM completed the process of pushing India to its full 10 percent weighting in the JPM GBI-EM Global Diversified index in April 2025.

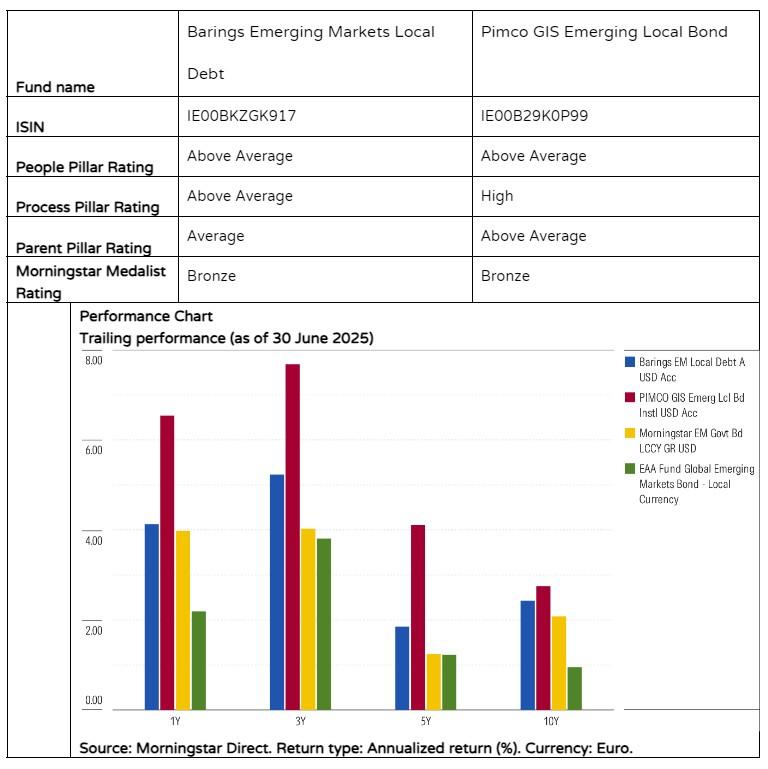

Pimco GIS Emerging Local Bond and Barings Emerging Markets Local Debt are two strategies in the Morningstar Global Emerging Markets Bond – Local Currency category that are analyst-rated. Although both strategies have Morningstar People ratings of Above Average, Pimco’s Process pillar stands out from the crowd, earning it a High rating versus Barings’ Above Average rating.

People

While both strategies boast an Above Average People pillar rating, the driving forces behind these differ.

At Pimco, lead manager Pramol Dhawan and comanager Michael Davidson lead this emerging-markets local currency bond offering. Dhawan, who joined the firm in 2013, took over the strategy and the emerging-markets debt team in 2019. Davidson, a local-rates specialist since 2017, became comanager in 2023. They are supported by a robust 31-member team including 10 global sovereign bond portfolio managers, four economists, and three quant analysts. Despite experiencing 11 departures since 2023 (which were all backfilled), the team’s size and average 17-years of investment experience along with broader firm resources, remain impressive. Although the managers’ tenure here is short, they’ve drawn on multiple sources of return to drive outperformance.

Ricardo Adrogué, head of global sovereign debt and currencies at Barings, and a three-decade veteran, has led that strategy since its 2014 inception. But in April 2025, comanager Cem Karacadag, also with three decades of experience, took over Adrogué’s responsibilities ahead of his August 2025 retirement. At that time, Mi Lu and Vasiliki Everett, who joined Barings in 2014 and 2016, respectively, were added as comanagers. Lu has worked closely with Adrogué on the local currency side in the last couple of years, while Everett brings over three decades of experience. But the team remains leaner than many peers, and the firm’s decision not to replace Adrogué leaves a gap across its four portfolio managers, four sovereign analysts, and one quant analyst.

Process

At Pimco, the disciplined, repeatable, and risk-aware investment process underpins the strategy’s High Process pillar rating. It combines top-down and bottom-up research, with country specialists shaping portfolio themes and credit analysts focusing on credit analysis of corporate and quasi-sovereign issuers. A variety of quantitative tools are used to identify relative value opportunities and reduce trading costs. With a plethora of technological and personnel resources, this strategy is in a league of its own.

The Barings strategy also relies on quantitative models and fundamental macro analysis. The team uses two distinct models to identify the most attractive opportunities in rates and currencies. Both models are subject to rigorous fundamental country-by country analysis which can lead the team to override the results of the models. But this process results in a high-conviction, benchmark-agnostic approach with limited formal risk controls.

Portfolio

The Pimco strategy invests mainly in local-currency sovereign bonds. Historically, it built fairly concentrated country positions, but since 2019, it has limited overweightings to around two-thirds of a year (in duration-weighted terms) to keep a lid on risk. Aggregate currency over- and underweightings have stayed within 16 percent of the benchmark, with individual active currency weightings capped at 4 percent. Since January 2019, local currency corporate debt peaked at 11 percent, while securitized exposure reached 20 percent in November 2019 including some developed market exposure, which has since been significantly reduced.

In contrast, Barings remains fairly concentrated and focused on local-currency emerging-markets bonds and currencies. Most bonds are unhedged and the managers can also take outright currency positions (short or long), despite no rates exposure, based on attractive valuations. High conviction country over-and underweightings can be up to 5 percent compared to the benchmark. The team can also invest up to 15 percent in off-benchmark positions, typically hard-currency bonds linked to IMF-backed debt restructuring, such as the current allocation to Sri Lankan bonds.

Performance

During the trailing 10-year period through June 2025, both strategies rewarded investors on a risk-adjusted basis (Sharpe ratio), but they have been more volatile than their Morningstar Emerging-Markets Government Bond Local Currency category index.

For instance, Pimco suffered a roughly 23 percent loss during the early-2020 coronavirus-driven selloff due to stakes in hard-hit names like Brazil and Ukraine and losses within its collateral sleeve (nonagency mortgages in particular). On the other hand, 2022’s stellar performance was thanks to a cautious stance toward Russian debt, an underweighting in Polish rates, and a short position in the Egyptian pound.

At Barings, the team has been able to add value in periods of swift market selloffs, as well as on the upside. For instance, 2020’s outperformance was thanks to an underweighting in South Africa (rates and currency) during the market crisis in the first quarter and an overweighting during the market recovery phase later in the year.

Elbie Louw, CFA, CIPM, is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.