The second quarter of 2025 provided ample opportunity for tactical trades, as markets whipsawed in every direction. Inflation fears broke out following Liberation-Day tariff announcements from the US, which led to a rapid spike in bond spreads. Spreads then normalized as a 90-day suspension on tariffs kicked in. Even so, global high-yield bond yields stood at 6.9 percent at the end of June, well above the 6.4 percent average over the past five years.

The Fed held interest rates steady over the quarter, while the ECB and Bank of England cut rates. Moves into longer duration US treasury bonds (a measure of interest rate sensitivity) detracted from returns amid inflation uncertainty surrounding global trade negotiations. On the other hand, investors were rewarded for taking on credit risk - particularly in corporate bonds or emerging-markets debt. Within corporate credit, high-yield-bond returns soared ahead of investment-grade bonds. Bank loans, which often exhibit a similar risk profile to high yield fare, also performed well over the quarter.

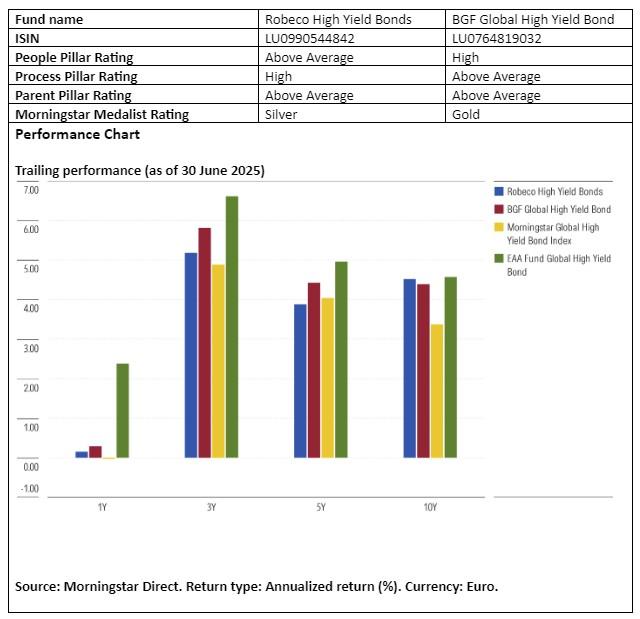

While this has certainly been a challenging quarter for markets, we now take a closer look at two funds in the Morningstar Global High Yield Bond category, that are qualitatively rated by our analysts, and which have historically fared well across a board range of market cycles: Robeco High Yield Bonds and Blackrock Global Funds Global High Yield Bond.

People

Robeco’s strong management team is a key competitive advantage given its depth and continuity. Sander Bus has been part of the team since the strategy’s 1998 inception, taking the helm in March 2001. Comanager Roeland Moraal joined in 2003. More recently in 2023, Christiaan Lever and Daniel de Koning formally joined the lineup as well. The managers are further backed by an experienced credit analyst team, normally composed of 23 analysts, but the historically stable group has experienced significant turnover in the past couple of years which merits some caution given the dependence on fundamental research. The strategy earns an Above Average People Pillar.

Blackrock’s roster also boasts four seasoned lead managers: Mitchell Garfin and David Delbos, Blackrock’s co-heads of US leveraged finance, oversee this strategy’s US high-yield bond sleeve. They are joined by head of European high-yield José Aguilar and head of European leveraged finance James Turner; these two manage the fund’s European sleeve, which accounts for roughly a fourth of the portfolio. The management team has ample resources to support them, stretching across Blackrock’s 44-member leveraged finance analyst team, and earning a High People Pillar.

Process

Robeco’s steadfast execution of a careful, value-aware process and responsible stewardship support a High Process Pillar rating. The strategy combines top-down elements and bottom-up security selection, grounded in thorough fundamental analysis. The team does not make active duration bets but they do modulate the fund’s overall exposure to credit market risk (as measured by its duration times spread) in accordance with their top-down views on the credit cycle. Credit analysts scour the global corporate universe for ideas across the market-cap spectrum, often favoring issuers from the higher-quality BB end of the rating spectrum.

The Blackrock managers follow a flexible approach, emphasizing higher-quality bonds when they think riskier debt offers paltry compensation and leaning into lower-quality market segments when they think risk-taking. The managers set top-down themes based on input from the high-yield team plus insights from across the firm’s broader fundamental fixed-income and equity platforms. The versatile approach, backed by BlackRock’s substantial corporate credit capabilities and risk management resources stand out against the pack, but some caution is warranted over the sizable footprint. The strategy earns an Above Average Process Pillar.

Portfolio

The Robeco portfolio is often characterized by bonds issued by largecap names that are typically held between 6 and 12 months, while smaller issuers are typically held till maturity. The managers have considerable freedom to invest based on their level of conviction and often hold out-of-benchmark exposures, including investment-grade fare (BBB credits typically account for roughly 10 percent of assets). The strategy’s custom benchmark also excludes financials, while the portfolio’s stake has averaged around 5 percent since 2013.

Blackrock’s high yield expertise have led to a sizeable footprint that encompasses USD 60 billion in assets under management as of Q2 2025. As a result, staying nimble can be tricky at times. The team attempts to overcome some of those challenges by broadening its scope to include collateralized loan obligations (up to 3 percent of portfolio assets at times), investment-grade corporates (up to 15 percent), and equities (up to 3 percent). In recent years, the strategy has also held exchange-traded funds, credit default swaps, and total-return swaps, typically totaling between 1 percent and 8 percent of assets collectively.

Performance

Robeco’s solid long-term global high yield track record is partly attributable to the managers’ preference and skill for selecting higher-quality companies and tendency to tread lightly in riskier corners of the market, such as CCC rated debt. This approach typically offers some protection during selloffs, though the strategy may lag more adventurous peers when lower-rated credits outperform. In market downturns, such as 2020’s coronavirus-driven selloff and Russia’s 2022 invasion of Ukraine, these characteristics were distinctly beneficial.

Blackrock’s flexible approach allows this fund to outperform in a wide range of market environments. For instance, the team’s decision to venture beyond high-yield bonds into equities in 2017 and 2021, and into treasuries and CLOs in 2022 and 2023, proved rewarding. The bulk of alpha continues to come from security selection within a wide range of sectors though—testimony to the managers expertise and the deep research resources available to them.

Jeana Marie Doubell is investment analyst fixed income EMEA bij Morningstar. Morningstar is lid van het expertpanel van Investment Officer.