2025 had barely begun when the euphoria of the previous year was gone for good. Geopolitical tensions, economic concerns and political conflicts dominate the financial markets—even if the stock markets have calmed down a little (at least for the time being) since the turbulent beginning of April. Super ManCo Universal Investment’s analysis shows how institutional investors are trying to cope with the new environment and which trends are evolving in their portfolios.

While 2024 was characterised by good hopes for AI and soaring US stock markets, the tune sounds completely different in 2025. As the Trump administration has caused uncertainty on the capital markets with drastic cuts and a shift in trade policy through tariffs, stock markets around the world have become more nervous.

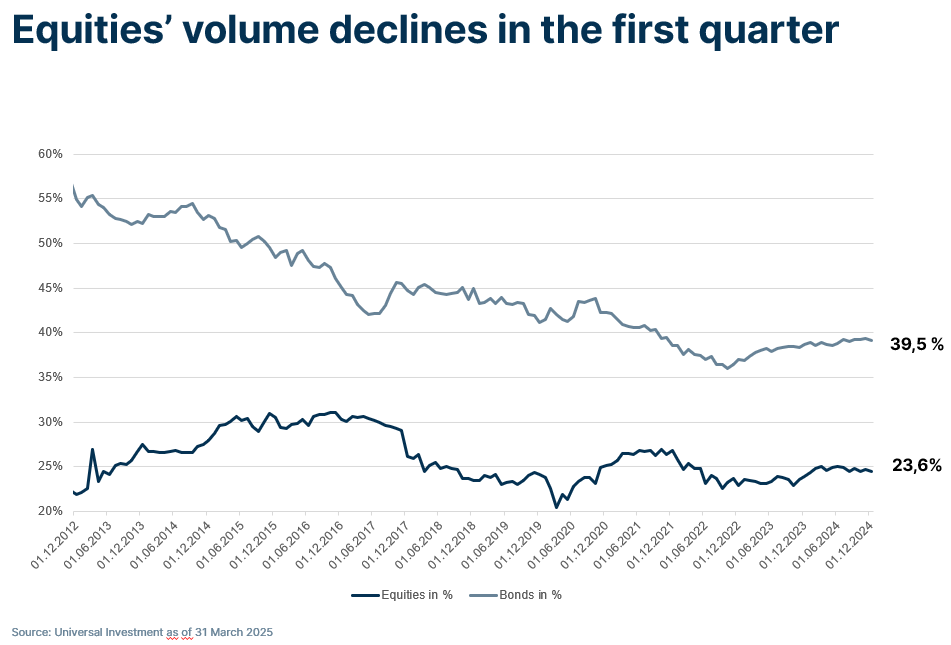

Even before April 2, when the US tariff plans triggered a dramatic escalation, investors were increasingly turning to safe havens such as gold, which rose to over 3,100 dollar per troy ounce by the end of March. They took some of their equity market profits, causing the MSCI World to fall by 1.68 percent in the first quarter. This change in sentiment is clearly reflected on the Universal Investment platform. Equity holdings were reduced or suffered from the price declines, while investors increased their positions in bonds.

New favourites

At the turn of the year, many investors were still betting on the equity-friendly “Trump trade”. However, markets had to deal with a new reality quite soon: Erratic statements about new trade barriers or their suspension, disappointing growth prospects and stubborn inflation led to price losses in the first quarter. US equities in particular went into a tailspin. The news that the Chinese company DeepSeek had been able to develop a powerful AI model at much lower costs than the US giants added to the volatility.

The stars of the past, the so-called “Magnificent 7”, were hit hard. In the portfolios of institutional investors on the Universal Investment platform, the proportion of IT stocks shrank noticeably from 18.9 percent to 16.8 percent, while financial stocks rose from 15.8 percent to 17.7 percent and are now top of the table, followed by industrial stocks (12.9 percent), consumer staples (12.9 percent) and healthcare names (9.8 percent) with hardly any change in weighting.

Looking back, the first quarter seems comparatively calm. However, the extent of the stock market crash in response to Donald Trump’s tariff threats at the beginning of April is one in a series of historic crashes: from the “Black Monday” in October 1987 to the bursting of the internet bubble in 2000 and the slump at the start of the coronavirus pandemic in 2020. By May, however, the indices had not only largely recovered but, like the DAX, even reached record highs at times.

However, uncertainty remains, and market experts are indecisive as to whether the bull market could revive once again or whether a sustained downward phase is imminent. The institutional portfolio analysis at the end of the first half of this year will show which way it was. Nevertheless, demand for risk management strategies such as overlay management and currency hedging is already on the rise.

Back to bonds

The flight to safety put bonds back on investors’ agendas. In the first quarter, their share of investor portfolios at Universal Investment rose slightly to 39.5 percent. Corporate bonds remained dominant at around 29 percent, closely followed by government bonds at around 28 percent. Overall, the weightings within the bond portfolio remained stable.

Until the end of March, the yield on ten-year US treasuries fell to 4.2 percent. At the same time, German government bonds experienced a turbulent period of time, after the new German government had announced its spending plans for defence and infrastructure. The yield on the ten-year Bund rose to just under 3 percent in March, its highest level since autumn 2023.

Since then, the picture has reversed again: Trump’s policies, with their high barriers to free trade, pressure on the Fed and enormous national debt, appear to be causing investors to increasingly doubt whether the USA and its government bonds are still a safe investment. As a result, the yield on ten-year treasuries went up in April and May, while German government bonds became more sought after, causing yields to fall to a “normal level” at around 2.5 percent.

Subdued earnings

The recent analysis by Universal Investment reflects the uncertainty of the markets in the first quarter, when portfolios recorded an overall loss of 0.4 percent. While equity funds lost 2.02 percent, bond funds were able to cushion at least some of the losses with a slight gain of 0.22 percent. Hedge funds, on the other hand, performed much better and ended the quarter 5.29 percent higher—yet they are allocated as satellite investments only.

The long-term picture also shows signs of a slowdown: the performance over twelve months fell from 6.93 percent to 3.64 percent. The average annual returns over ten years fell from 3.75 percent at the end of 2024 to 2.95 percent right now.

Jeremy Albrecht is country head and CEO of Universal Investment in Luxembourg, a member of Investment Officer’s expert panel.