By Gideon Smith, Europe Chief Investment Officer, AXA IM Rosenberg Equities

The increased engagement of activists keeps the political and public debate on environmental, social and governance issues moving. When it comes to investing money, more and more importance is being attached to the sustainability of investments as well as to the return generated by them. Factor investing is one way to access attractive yet sustainable investment opportunities.

Sustainability opens up economic perspectives

The roles are reversed: At the recent climate summit in New York, the heads of state and government acted like supporting acts. Instead, the eyes of the public were on a 16-year-old Swedish activist who is vehemently calling for the fight against climate change – and Greta Thunberg even received the Alternative Nobel Prize for it.

This reflects a new way of thinking that is gradually finding its way into society, politics and investment strategies. Long-term trends such as scarcity of resources, climate change and global demographic trends on the one hand, and increased regulation and society’s expectations on the other, are having an impact on companies across industries. The more sustainably they position themselves to counter these trends, the more promising their economic prospects appear. This circumstance is reflected in sustainable investment solutions, which are met with growing investor interest.

Inefficiencies in the market offer investment opportunities

The basic principle, which applies to the capital markets, is that fundamentals and changes to fundamentals drive share prices. Successful investors seek to exploit inefficiencies in these historic relationships, and factor investing is one way to identify specific characteristics of a company that are associated with a desirable risk/return outcome. For example, a company could be undervalued relative to its assets and earnings or have above-average earnings quality. Choosing an investment using factors such as these can be cost effective and potentially more effective than passively following an index.

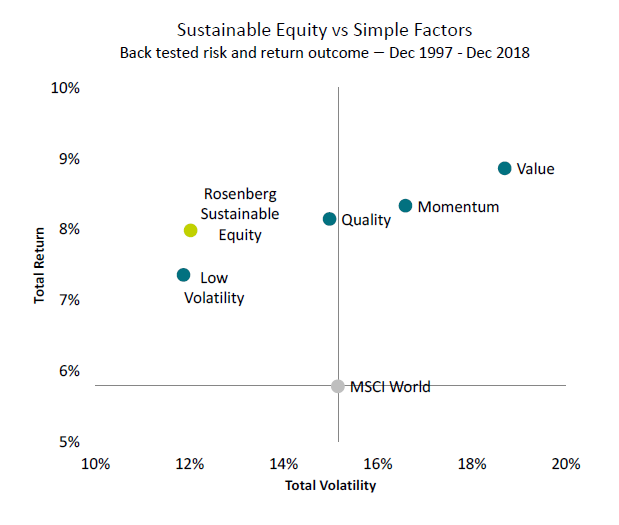

Figure 1: Risk-return profiles of selected equity characteristics (Dec. 1997 to Dec. 2018)

The MSCI World Index serves as a starting point to illustrate the influence of selected characteristics such as quality, low volatility, valuation and momentum on the risks and returns of equities.

Source: AXA IM Rosenberg Equities. As of December 2018, for illustrative purposes only. Past performance is not a guarantee and is not an indicator of future performance.

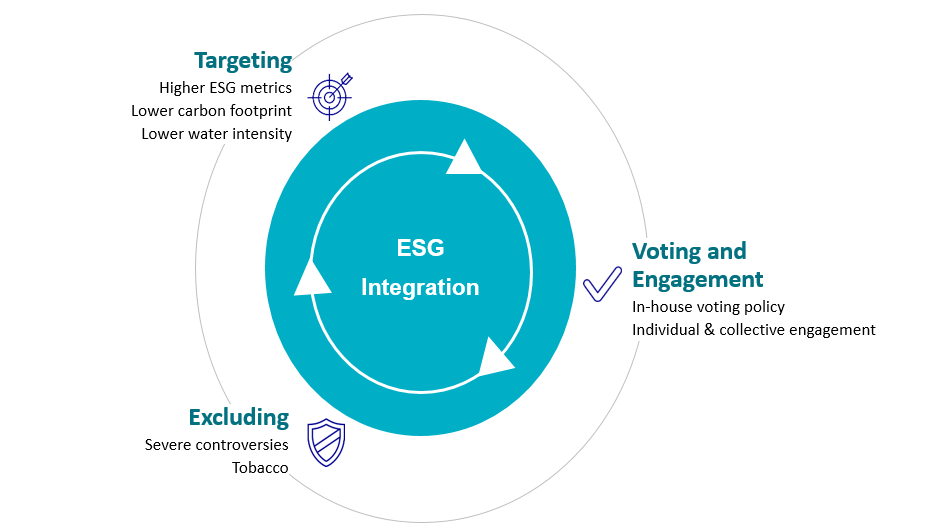

Taking environmental, social and corporate governance into account in a portfolio

Information on how a company deals with the environment, social affairs and corporate management (ESG in short) are also regarded as defining trends in asset management. ESG information data can be incorporated alongside factor insights with the aim of reducing the long-term risks of an investment portfolio and improving results. ESG criteria can be taken into account in investment decisions in a variety of ways: improved ESG ratios, lower CO2 emissions and lower water intensity can serve as targets. Certain investment themes can be completely excluded – such as, for instance, tobacco or weapons. Most importantly, however, an ESG investor can compliment investment decisions with an active and impactful approach to stewardship: active engagement with companies and impactful voting.

Figure 2: The integration of sustainable criteria into an investment portfolio

There are several ways to integrate the ESG criteria into an investment portfolio: Companies must meet targets for sustainable environmental management, have guidelines for their voting policies and social commitment. Industries that are critical from the point of view of sustainability are excluded.

Source: AXA IM Rosenberg Equities. June 2019.

AXA WF Global Factors – Sustainable Equity: long-term returns, low volatility

AXA Investment Managers (AXA IM) has combined sustainable and factor investing in AXA WF Global Factors - Sustainable Equity (ISIN LU0943665348). The fund comprises a well-diversified equity portfolio that aims to deliver sustainable, long-term returns by blending the quality and low-volatility factors. And the performance proves it: At the end of August 2019, the fund had an annualised performance of 13.81 percent over one year – outperforming the MSCI World by 7.86 percentage points. [1] This blend of quality and low volatility offers can help preserve assets in falling markets while ensuring the strategy keeps pace with rising ones.

Designed to deliver performance across the cycle

By investing in low-volatility and high-quality equity, the AXA WF Global Factors - Sustainable Equity fund seeks to deliver performance in both falling and rising markets. This is an attractive combination of features: the defensive attributes of low volatility help investors outperform in falling markets, while focussing on high-quality stocks help capture earnings growth and, therefore, returns when markets rise. The result of blending these two factors is portfolio that is designed to deliver robust performance through the economic cycle

Our active approach adds further value. For example, the recent popularity of low volatility investments caused some stocks to become expensive; we actively avoid the most expensive stocks. This active approach to factors together with thoughtful implementation of ESG considerations makes what we believe is a truly sustainable long-term investment.