By Mark Hargraves, Head of Framlington Global Equities

Valuations are the most attractive they have been in many years

With the recent pull back, valuations have come back quite a lot and we now see very attractive entry points in the digital economy and robotics sectors, notably given the long-term growth profile. The companies in this sector we invest in are indeed trading at PE (Price to Earnings), of 22x to 26X, which is very cheap. This remains more expensive than the broader international equity market, but we would expect them to normally trade at a premium to the market due to the fact that they feature higher growth, nicely profitable companies with strong balance sheets.

The Long-Term EPS (Earnings per share) growth forecast of these companies has seen some impact from the supply chain constraints and weakening consumer outlook, however, these metrics continue to suggest healthy growth of 17 to 18% over the next three-to-five years, greater than that of the broader global equity market represented by the MSCI ACWI (12% EPS growth forecast).

High-quality companies are more resilient during turbulent market conditions

The quality of the companies we invest in remains steady despite the weakening of macro environment. In times of economic slowdown, scarcity of growth should support valuations of companies maintaining higher EPS growth and stable margins; this is where our selection of high-quality companies focussing on structural growth opportunities, burdened with lower debt levels than the broader market, is important.

Growth investment style typically exhibits stronger rebound feature

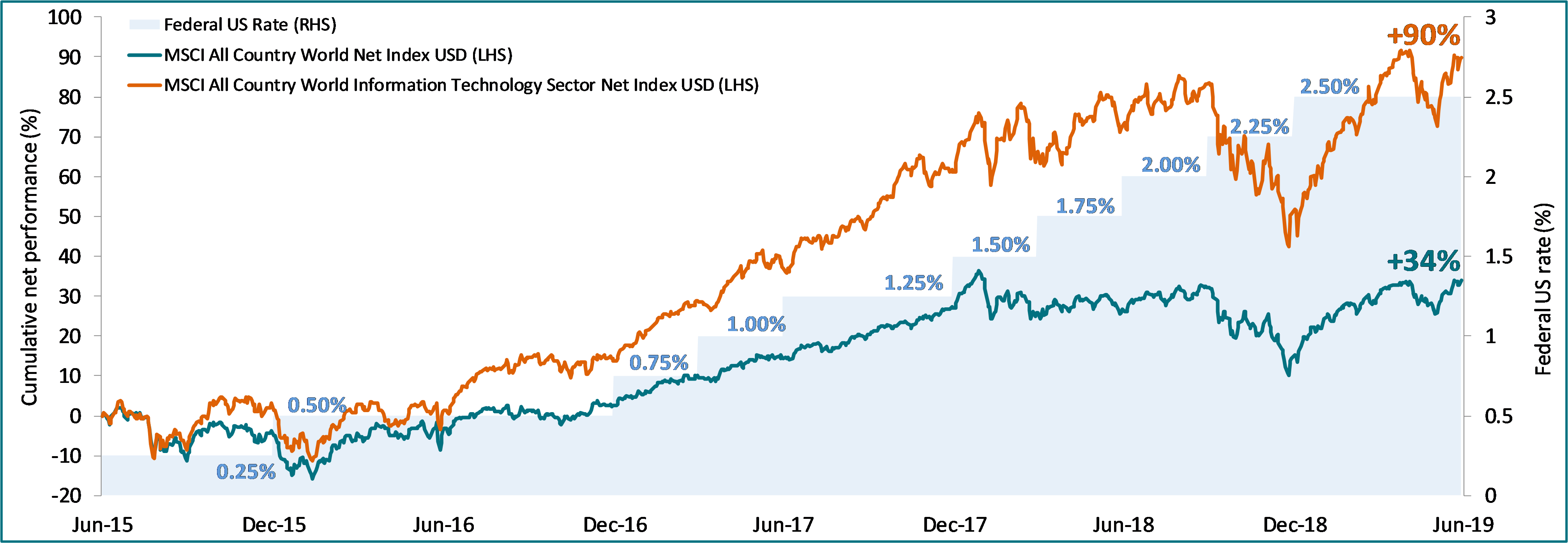

Whilst interest rate hikes are highly scrutinized and a source of nervousness for investors, it does not necessarily mean that the normalisation path will be correlated to weak market performance over time. Looking at the broader equity and technology markets in the course of an entire tightening cycle (June 2015 to June 2019), we can see that the technology sector performed positively and much stronger.

Source: AXA IM, FactSet as at 31/05/2022

We can observe that there was a lot of volatility at the start of the tightening process, but the power of the earnings growth story came through nicely as the years progressed and helped drive performance. Clearly not all cycles are the same and there are certainly significant factors around macro etc. but it’s wrong to suggest that growth can’t perform in a rate rising cycle.

Long-term trends underpinning the robotics and automation sector remain intact

- We believe that automation can be an answer to inflation and labour shortages. When labour costs are going up, it makes automation more attractive. And when there are labour shortages, it is necessary to introduce more machinery in to manufacturing.

- Warehouse automation is increasingly important to help with online deliveries. Consumers are becoming more demanding, insisting on rapid and reliable delivery and this can only be enabled by great amounts of technology to support this.

- Importance of Healthcare. We believe that the review of health care provision post COVID-19 will largely focus on technology and efficiency. Two areas are poised to benefit – Robotic Surgery and Digital Health.

- Semiconductors are increasingly and broadly incorporated into the next generation of automated equipment. Whilst 4G was the technology that individuals really benefited from, it is 5G which is the technology that will start to connect industrial machines and factories.

- Electric vehicles and batteries require CAPEX. What is less well understood by investors is the huge investment that is needed to manufacture the cars and batteries. One of the key features of the COVID economic stimulus programs around the globe is investment in environmental technologies – we see significant opportunity for robotics to manufacture these new technologies in future.

Long-term trends underpinning the digital economy sector remain intact

- E-commerce penetration, currently at around the 20% level, is poised to increase. Online transactions experienced strong growth during the pandemic but growth rates have moderated as economies reopened. However, we believe that once the economy stabilises, online penetration should continue to grow steadily, supported by catalysts such as technological adoption and demographic shifts.

- « Gen Z » purchasing power. The use of digital has become mainstream for the younger generation. They are eager to engage in social commerce and can effortlessly access a large variety of sources for product information. More importantly, this digital-native generation is now reaching adulthood and embraces an increasing ‘digital’ purchasing power as they come of age.

- Digital payment still in its infancy. More people are using digital payments than prior to the crisis, shifting their preferences towards a cashless society. We think the secular growth tailwinds from these companies are unchanged and we see their prospects remaining highly attractive.

- The delivery rush. The increasing online penetration is acting as a tailwind for logistics and warehouse demand with ‘Next-‘ and ‘Same-day’ delivery options being standard customer expectations. We see companies urging to collaborate with logistic and warehouse experts to cope with rapid delivery.

- Towards normalisation. We believe that if a consumer’s online experience has been positive, or once a technology service has proved added value to a company’s business, there is less reason that it should stop. We see recent changes in our global behaviours to remain sticky and we think that there is still a lot of business to be done as companies adopt new ways to support their employees and customers.

We have decided to invest in the Metaverse

The scope of the metaverse is already considerable. It is an area that is developing very rapidly. Studies suggest that the market was worth some USD 500 billion in 2020, could reach USD 685 billion in 2022, and the sector as a whole could reach nearly USD 800 billion by 2024[1] , a compound annual growth rate of about 13%. To encompass the intricacies and scale of the Metaverse, we are focusing on four key sub-themes: Gaming, Socialising, Working and Enabling. The Metaverse is an expanding and tangible investment opportunity, driven by real companies with the potential to deliver double-digit growth year-on-year over the next decade.

[1] Bloomberg Intelligence

EXPLORE AXA IM’S INVESTMENT INSTITUTE >

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

Distributed in Belgium and Luxembourg by AXA IM Benelux, a company incorporated under Belgian law with its registered office at Place du Trône, 1, B-1000 Brussels, registered in the Brussels Trade Register under number 604.173.

© 2022 AXA Investment Managers. All rights reserved