By Alexandra Morris Director of Investments SKAGEN Funds

Value and growth stocks started to diverge after the financial crisis, and with COVID-19 this has evolved into an extreme price differential. Have value stocks been written off for good, or could this be a unique opportunity for those of the current generation who have the courage to go against the grain?

In theory, the market crash caused by COVID-19 should have given some respite to value investors after a decade of underperformance. Before the crisis, the valuation gap was very high and many believed that a serious correction would give a boost to cheaper, less popular stocks at the expense of overvalued technology stocks.

The reality proved painfully different. March was the third worst month for value stocks versus growth stocks in 45 years, as during the lockdown we suddenly found ourselves all dependent on technology, healthcare and basic consumer goods companies. And conversely, traditional value stocks such as financial services and energy suffered from record low interest rates and oil prices, and the downgrading of higher-leveraged companies.

History shows that ‘value’ often underperforms in a falling market. Since 1975, 38% of markets in which the MSCI World Index has been negative have been negative, and as many as 48% when there has been a decline of more than 5% (the index fell 13% in March 2020). Going back further in time, to 1963, an analysis by Research Affiliates that examined six previous crashes found that value only outperformed when the crisis was preceded by an asset bubble, whereas today we can speak of an economic shock caused by the corona virus.

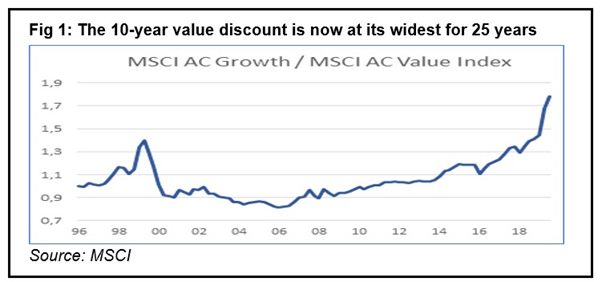

It has led to a huge reversal of the long-established ‘extra premium for value’ (see Figure 1), which has left some investors wondering whether ‘value’ still has a future. Yet there are signs that a cautious recovery is in the making. When value stocks are compared to the performance of their respective Russell 1000 US large-cap indices, they have significantly outperformed growth stocks in line with the majority of our funds, which recorded strong relative gains in the last 9 months of 2020.

Is the tide turning?

While countries around the world tackled COVID-19 in different ways, and with a vaccine available, attention is now beginning to shift from the health crisis to economic recovery.

Historically, value stocks do well during a recovery because companies that are considered riskier become more popular with investors. At the same time, growth stocks appear more vulnerable. Current valuations are still very high, based on continued future earnings growth, which is far from certain. Even if we can avoid another spike in contagion, there are still the high government debts and huge unemployment,

History also teaches us that when the difference between growth and value has increased to such extremes, - (the MSCI World Growth index P/B is more than double its value equivalent, and P/E more than three times higher) that value stocks will start to do considerably better. The exception to this would mean that growth stocks would have to continue their earnings growth, or interest rates used to discount future earnings would have to fall even further, but both of these scenarios are highly unlikely at present.

Keeping up with the wave

The ultimate argument for investors is always the price; how much are you willing to pay for the cash you will receive in the future? According to Exane BNP Paribas, in June 2020, the lowest valued quartile of European equities was trading at a 73% discount to the highest quartile (on a P/E basis). This is well below 2012 and 2016 (when it was 56%), and even below the 65% in 2009, immediately after the financial crisis. Value has already outperformed by the end of 2020, but there is still a significant opportunity ahead. To take advantage of this, there are 3 things to keep an eye on as far as we are concerned:

- First, be selective. There will inevitably be winners and losers on the road to recovery and a critical approach to stock selection will be rewarded. While a broad allocation to value will pay off in a V-shaped economic recovery, stronger companies with more reliable cash flows will offer better protection if the recovery is slow or if we face a prolonged period of uncertainty.

- Second: Be pragmatic. The whole world is undergoing significant change and past valuation models and techniques may NOT prove to be the best guide to future success.

- Third: Stay alert and flexible. While a long-term investment horizon will continue to deliver the best returns for investors, volatility will remain high. During the recovery, caution is needed, flexibility is needed, to take advantage of opportunities along the way that will help increase returns.

The gap that has existed for a decade between value and growth could be on the brink of a significant rotation. In these times, this would be a unique opportunity for those who dare to go against the grain and are sufficiently skilled to select the right stocks. Similar valuation differences are currently seen in small versus large caps and emerging versus developed markets.

For more articles on SKAGEN Funds and our range of value funds, please visit www.skagenfunds.com or contact me at

e-mail: michel.ommeganck@skagenfunds.com

Mobile phone: +4790598412