For the time being, the overwhelming monetary and fiscal measures appear to be enough to avert a financial crisis. But a breakthrough in the fight against COVID-19 is needed to get the economy back on track, says Evan Brown, Head Asset Allocation at UBS Asset Management in the ‘Macro Monthly – The policy response and its implications’.

In our view the global monetary and fiscal response will be enough to prevent a health and economic crisis from turning into a financial one. Indeed, while we are enduring an unprecedentedly sharp contraction, this may end up being the shortest recession in history assuming economies can come back online over the coming months. Still, as impressive as the monetary and fiscal response to this crisis has been, the only true ‘bazooka’ is a healthcare breakthrough. Progress towards widely available therapeutics and eventually a vaccine seem the most dependable ‘solutions’ to normalize consumer and business behavior and establish a more solid foundation for risk assets. We expect to hear progress on potential anti-viral medications by late April while a broadly available vaccine still appears over a year away.

As such we continue to expect volatile markets as investors grapple with the virus’s evolution, the duration of social distancing policies and the speed at which macro policies announced gain traction. How these factors evolve will help determine whether the ultimate recovery in the economy and markets is V, U, or L shaped. At this point, given the sharp increase in unemployment expected in the US, a true V-shape looks unlikely and we expect finding a durable bottom in risk assets will be a process rather than a distinct event.

Asset allocation

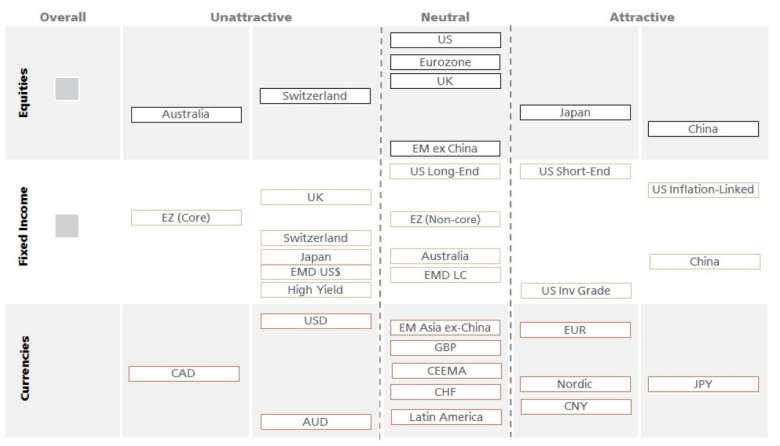

Given the wide range of possibilities in this environment, we are keeping overall risk asset exposure near benchmark. Our focus continues to be on relative value, overweighting equity markets in Asia, which appear to have seen the worst of the virus as compared to developed markets including the US, where the battle is still in early stages. In fixed income, we are long real yields as protection against further deterioration in risk appetite and as central banks do whatever is needed to ease financial conditions. In foreign exchange we are underweight the USD against reserve currencies EUR and JPY as dollar funding stresses ease and underlying vulnerabilities in the US economy become apparent. Indeed, relatively less flexible labor markets in Europe and other regions can be a blessing in disguise during a crisis, ensuring workers and businesses remain tied together and geared for the rebound once the virus is contained.

Inflation

We of course also remain focused on the longer-term risk-return profile for asset classes beyond the current period of elevated volatility. With the recent selloff, valuations for risk assets have broadly improved and may provide opportunities for long-term investors. At the same time, the prospective returns for sovereign bonds have worsened. As discussed in ‘The Next Decade in Asset Allocation,’ investors must recognize that with policy rates near their effective lower bound and fiscal policy becoming a more important driver, that the equity-bond correlation can become less negative. While the first-order effects of the COVID-19 shock as well as the sharp oil price decline are disinflationary, investors should be prepared for a surprise in inflation down the road, as aggressive monetary-fiscal policy meets potential supply side constraints. We reiterate the importance of diversifying portfolios broadly against a variety of macroeconomic outcomes, including exposure to real assets and absolute return.

Herewith you’ll find the full report: ‘Macro Monthly – The policy response and its implications’ from UBS Asset Management.