While many economists were once again forecasting a recession and plenty of so-called market experts were calling an end to the rally, equity markets are celebrating summer with new record highs. I’m curious to see how they’ll explain their latest miss.

Japan has signed a trade agreement with the United States. Japanese carmakers will face a 15 percent import tariff, and a fund worth 550 billion dollar will be established to invest directly in the US.

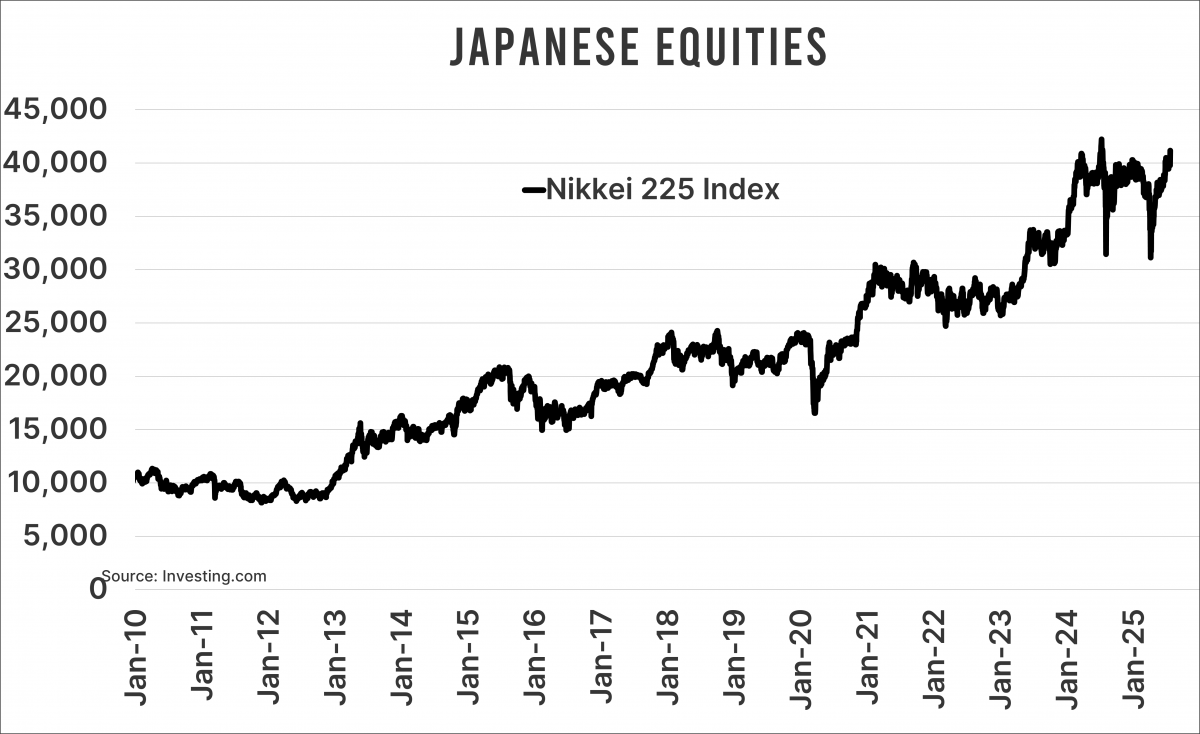

Investors cheered the deal, sending the Japanese Nikkei Index up 3.5 percent in a single day—its highest level this year and just 2 percent below last year’s record. The S&P500 Index had already closed at a record high the day before. Only European stocks—touted by the same experts as the place to be—have yet to surpass their early March highs.

To be fair, the overvaluation of the euro has played a big part in this. It directly impacts the foreign earnings of European companies, and for euro-based investors, record highs are still far off in dollar terms.

Doom and gloom

Even though things aren’t going smoothly for euro investors like myself, it’s hard to argue that the trade war and rising geopolitical tensions have led to negative market sentiment. And yet that’s exactly what the experts widely predicted—earning them headlines across (social) media, which always welcome a good “doom and gloom” story. But let’s be honest: they were completely wrong.

Investors dislike uncertainty, even when it’s mostly latent. The imbalance in trade flows has long been a thorn in Trump’s side—that’s hardly breaking news. He’s been railing against it for nearly a decade. When those risks are suddenly made explicit—trade war 2.0, in this case—it’s understandable that investors get spooked. The initial thought is often: here comes a bully to ruin everything.

Solutions

While that’s partially true (Trump does turn latent risks into headlines), it’s important to keep thinking in terms of potential solutions. Don’t get me wrong—things could’ve played out much worse. But after the umpteenth delay in tariff hikes, it became clear that Trump likes making deals and that the real negotiation space lay there. Just look at the outcome Japan secured—it’s a far cry from the apocalyptic tariffs that were once floated.

When Israel, and later the US, launched airstrikes against Iran to push its nuclear weapons program back by years, we saw a similar pattern. In the heat of the moment, people forgot that if those strikes succeeded—something that’s still far from certain—the risk premium on equities would likely fall.

For investors, a deal with limited damage is often better than lingering uncertainty about how bad things could get. I hope Ursula understands this now too.

Valuation

With markets rising for weeks and the doomsayers once again proven wrong, they’re now scrambling for a new reason why stock prices should fall. And they’ve found it: valuation. Never mind that valuation alone is rarely—if ever—a catalyst for a crash. Especially not when earnings continue to grow.

Take note

As you may have noticed, I’m not fond of perpetual pessimists. If you predict disaster for ten years straight, you’re bound to be right once. But that’s not forecasting—and certainly not skill.

By the way, before you peg me as a blind optimist, there are risks right now. Chief among them is Trump’s relentless push to lower interest rates, which could backfire. Firing Powell is easier said than done, and Treasury Secretary Bessent isn’t on board either. Trump is now trying to rope in stablecoins to help, but they can only offer a partial solution.

Which begs the question: how does Trump plan to lower the interest payments on America’s massive national debt? One option may be to pressure the economy. That, of course, is not without risks. So yes, you could now make a case for a recession—without spinning some dramatic tale of imminent collapse—and you’ll find no one talking about it.

Jeroen Blokland analyzes striking, timely charts related to financial markets and the macroeconomy. He is also the manager of the Blokland Smart Multi-Asset Fund, which invests in stocks, gold, and bitcoin.