As I’m still reflecting on the Fund Event 2025, where it became objectively clear that Europe needs to take action and learn to look at and approach things differently, the United States just keeps steaming ahead.

Economic growth in particular seems unstoppable, even though the Fed has once again cut interest rates. Or is there secretly a catch?

Q2 was good?

US GDP growth for the second quarter was revised sharply upward in the final estimate to as much as 3.8 percent annualized. This made the US economy grow at its fastest pace since the third quarter of 2023. Equally striking: the American consumer, who was supposed to be the main victim of their president’s trade war, keeps on spending.

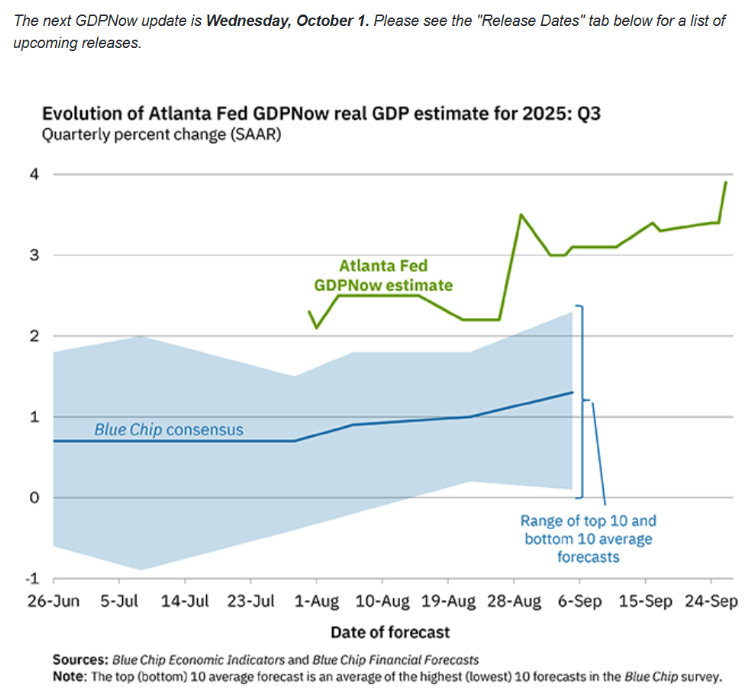

And not just in the second quarter. Personal spending for August came in much higher than expected, as did orders for durable manufactured goods. As a result, the best predictor of US GDP growth, the Atlanta Fed GDP Nowcast, puts growth for the now-finished third quarter at 3.9 percent. Even a bit more than in the second quarter.

So even though US consumer confidence is at rock bottom, job growth is slowing, and the housing market is creaking in some regions, consumers show no signs of stopping.

Raking it in

An economy growing at twice its potential with a central bank cutting rates: what could go wrong? If you can’t generate profit growth as a business in such an environment, when will you ever? And if that profit growth is also strong, it immediately takes the wind out of the sails of the permabears, who have been predicting the end of the rally for a year or two because stocks are so expensive. Feel free to revisit my previous column on those valuation issues.

Corporate (nominal) profits are also being boosted by inflation, which still hasn’t met the Fed’s target and, according to the central bank itself, won’t do so until 2027. When I see actions like these (pushing the inflation target further out while cutting rates at the same time), I wonder if I’m really the only one seeing the obvious pattern. That seems impossible, yet I hear few traditional financial media or experts saying anything resembling fiscal dominance: monetary policy giving way to fiscal policy.

Inflation proof

Still, it’s inflation that worries me. In my view, central banks have long since abandoned their official inflation target. With a booming US economy, sky-high inflation expectations, and a central bank cutting rates, the odds of a new inflation peak increase significantly. Perhaps not immediately—some sectors of the economy are still digesting the inflation spike from the pandemic—but beneath the surface there’s still plenty of inflation in the system. And with growth rates near 4 percent, those inflationary pockets have every chance to expand.

That raises the question of whether the average investment portfolio is inflation proof enough—both in the short term and, especially, the long term. And that brings me back to an important point raised during the Fund Event: in an increasingly fragmented world, with multiple economic powers all targeting each other’s weak spots, it’s only logical that many things will get more expensive.

My answer to that question is crystal clear: “No!”

Jeroen Blokland analyzes striking, current charts on the financial markets and macroeconomy. He is also the manager of the Blokland Smart Multi-Asset Fund, which invests in stocks, gold, and bitcoin.