Developments in public finances are unfolding at such a rapid pace that there’s barely time left to look at asset prices themselves. But if you take a step back, it’s hard not to conclude that we are witnessing a regime shift. So why is hardly anyone talking about it?

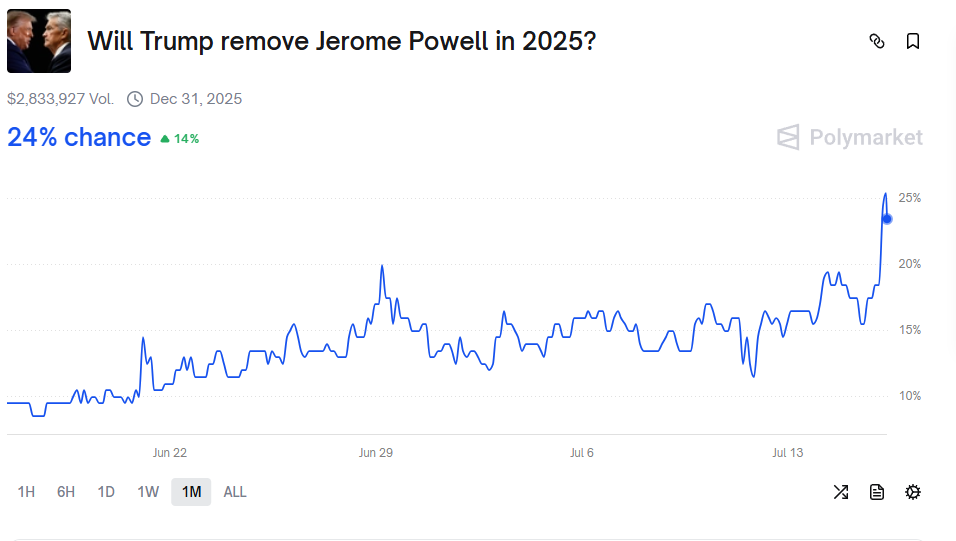

I don’t often use charts from Polymarket, a decentralized betting platform for real-world events. The mere fact that I’m doing so might already signal a change in regime. The chart below shows that the odds of Trump firing Fed Chair Jerome Powell in 2025 have surged to nearly 25 percent.

That spike came after US inflation data largely aligned with expectations. For Trump, it was yet another reason to stress that Powell is unfit for the job and should cut interest rates immediately. He also appears to have found a reason to oust him.

Firing a Fed Chair isn’t easy—not even for a US president. A clear and legally valid justification is required, and even then, there are multiple legal hurdles to overcome. Trump’s latest argument revolves around the renovation of the Federal Reserve’s headquarters, a project whose costs have spiraled wildly out of control. Desperate times, desperate measures.

Spotting doves

Powell’s dismissal may not materialize. His term expires within a year, and pushing through a replacement beforehand would be a hassle. What’s increasingly obvious, however, is that his successor will be a major dove—someone fully indoctrinated by the White House, who will steer US monetary policy accordingly.

Sure, other presidents have clashed with the central bank before, but Trump’s approach is unusually explicit—and telling. In various interviews, he has laid out in exact figures how much the federal government could save on interest payments by cutting rates by 1 or 2 percentage points. Without a hint of caution, Trump argues that monetary policy should bow to fiscal needs. Inflation does come up, but for Trump, a core inflation rate of around 3 percent—combined with the price volatility triggered by his trade war—is more than enough justification to slash rates by 2 percentage points. All in the name of public finances.

Fiscal dominance

Most economists and market experts treat the developments in the United States as an isolated experiment. I see it differently. For months, the United Kingdom has dominated headlines due to its precarious budget situation. The Bank of England has repeatedly warned about the significant risks in British bond markets. We’ve even seen a prime minister reduced to tears, unsure of how to handle the crisis.

This week, France’s prime minister sounded the alarm. The country is teetering on the edge of a fiscal cliff, with annual interest expenses projected to soar to 100 billion euro within five years. That’s not the same as having a total debt of 1,000 billion, as some headlines suggested. France’s actual debt exceeds 3,000 billion euro—about 110 percent of GDP. In an effort to reduce the deficit, the prime minister even proposed eliminating two public holidays to increase working hours.

In the Netherlands, unsettling proposals for tax hikes keep surfacing, including a trial balloon for a 75 percent inheritance tax. Meanwhile, Japan’s long-term interest rates are nearing record highs, with government debt exceeding 200 percent of GDP.

A political choice

In all major economies—either directly or indirectly—central bank leaders are political appointments. Now imagine if all those leaders shared the same objective: keeping interest rates as low as possible. France wants to cut spending by 44 billion euro, but with zero interest rates, it could instead save 100 billion annually.

So why wouldn’t other governments follow Trump’s lead? What’s the easier political message: that you’re going to raise taxes even further, cut vacation days, and eat into people’s pensions—or that you’ll simply lower interest rates and leave people alone for now?

Jeroen Blokland analyzes striking and timely charts on financial markets and the macroeconomy. He also manages the Blokland Smart Multi-Asset Fund, which invests in equities, gold, and bitcoin.