The investment fund Belfius Wealth is dissolving its sub-fund JP Morgan AM Convictions, citing “structurally low performance” and “lack of investor interest” as key reasons. Belfius is offering affected investors the option to transfer to a Blackrock sub-fund.

The five-year-old investment company Belfius Wealth consists of three compartments, each bearing the name Convictions. The term refers to the investment guidelines used by the bank for portfolio management. In addition to Belfius Convictions—managed internally—the range includes JP Morgan AM Convictions and Blackrock Convictions. The American investment giants JP Morgan Asset Management and Blackrock Investment Management, alongside Candriam, are Belfius’ external fund partners.

Because expectations were not met and returns consistently lagged behind benchmarks, Belfius has decided to fully wind down the JP Morgan compartment. The liquidation is scheduled for the upcoming general meeting on May 7.

“The fund’s assets were too limited, and our offering is constantly evolving. Changes like these are part of the natural development of the fund range,” Belfius told Investment Officer.

At the end of 2024, JP Morgan AM Convictions held assets worth 18.2 million euros, representing a sharp 42 percent drop compared to the previous year. In contrast, Blackrock Convictions increased by 5 percent to 217.7 million euros. Belfius Convictions closed the year at 44.5 million euros, down 11 percent.

“Rationalization”

“This operation falls within the scope of a strategic review of Belfius’ fund portfolio and a rationalization of the product offering to investors,” the official announcement states.

It goes on to deliver an unambiguous assessment: “In addition, the long-term viability of the compartment to be liquidated is compromised due to structurally low performance and profitability since its inception, resulting in a lack of investor interest. The compartment has never achieved its growth targets in terms of assets under management.”

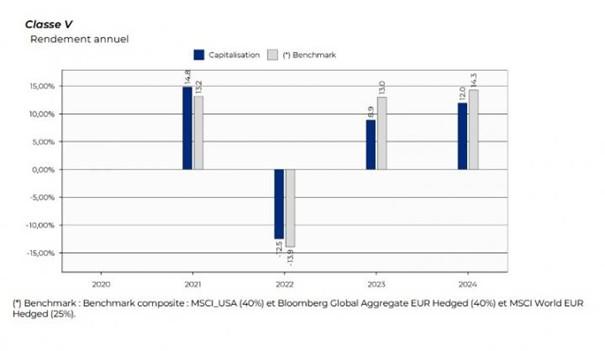

Charts: JP Morgan AM Convictions returns have trailed the benchmark over the past three years, both in the accumulation and distribution versions (source: Belfius)

Returns JP Morgan AM Convictions (accumulation)

Returns JP Morgan AM Convictions (distribution)

Blackrock

The compartment was launched in October 2020 as a multi-asset fund, with Belfius hoping that the global strength of JP Morgan Asset Management as an external manager would make a difference. It followed a flexible investment strategy across equities and bonds (both government and corporate), also allowing investments in emerging markets.

However, from a cost-efficiency perspective, the JP Morgan offering no longer makes sense for Belfius. Chief Investment Officer Maud Reinalter will act as liquidator to close the fund. Affected clients will have one month to transfer to Blackrock Convictions free of charge—an arrangement that clearly strengthens Blackrock’s position as one of Belfius’ preferred partners.

Based on the performance data published by Belfius, Blackrock Convictions has not outperformed its (slightly different) benchmark over the past two years, but it has delivered better returns than JP Morgan.

Chart: Returns of Blackrock Convictions (accumulation version)

Return Blackrock Convictions