Now that several major trade deals—however skewed and ambiguous—have been announced, markets are left searching for the next catalyst to keep the bull market alive. One likely candidate can be found in some rented office space in Washington.

Following a visit from President Donald Trump to the buildings of the Federal Reserve, it now appears that Fed Chair Jay Powell will be allowed to complete his term. That’s not entirely surprising: the procedure Trump would have had to follow to remove Powell could easily have dragged on until May next year, when Powell’s current term ends.

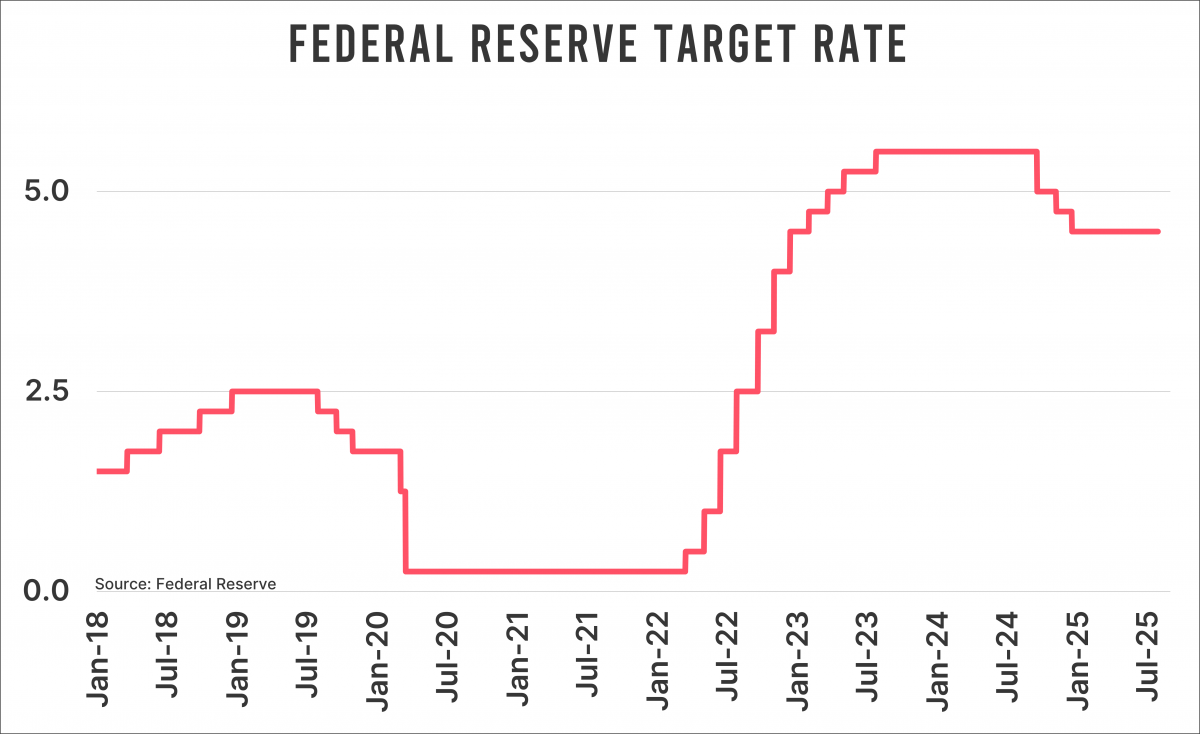

And so, Powell can get back to work from his rented temporary quarters. The renovation of the Fed’s buildings is expected to last until the autumn of 2027. The main reason the Federal Reserve has not cut interest rates further—unlike the ECB and the Bank of England—is, of course, the tariff war. Amid the cacophony of voices, one must not forget that it’s the average American who will ultimately pay the price for these tariffs.

Visibility

Now that final tariff levels seem to be lower than previously expected, their impact on U.S. prices also appears to be more limited. In part, the uncertainty surrounding the effect of tariffs has also diminished. I say “in part” deliberately, as the loose ends that Ursula managed to secure will likely haunt us for years to come. I have trouble with the idea that a single person—who is not exactly known for her brilliant negotiating skills—is brokering deals with someone far more cunning when it comes to these matters. Those who claim this is the least bad outcome, given the circumstances, strike me as incredibly naïve.

Anyway, for Powell and his colleagues, the outlook has shifted—especially if a deal with China is added to the mix. Inflation is still on the high side, but that didn’t stop the Fed from cutting rates rather early in the past. Moreover, the inflation experienced by “Joe Sixpack” is currently lower than the headline figure. On top of that, Powell has acknowledged that the 4.50 percent policy rate is well above neutral—and we may well see a shift in Fed rhetoric in the coming months.

The Next Springboard

As I write this, markets are pricing in fewer than two rate cuts for this year. I don’t expect that to change much and assume a base case of two 25-basis-point cuts.

After that, I see room for more. For 2026, markets are pricing in two to three additional cuts. Assuming we get three, the Fed’s policy rate would land at 3.25 percent by the end of 2026. In my view, that’s still well above the r-star. Unlike many economists, I don’t believe this neutral rate sits above 2 to 2.5 percent. Quite the opposite: I believe it could even be below 2 percent. The difference is that I factor in the clearly observable negative relationship between debt and interest rates. The higher the debt levels, the lower the (equilibrium) interest rate. Trump, who openly calls for the Fed to abandon its inflation target and slash rates, is just one example.

Suppose the Fed brings rates down to 2.5 percent by the end of 2026. That would mean eight quarter-point cuts over the next year and a half. Assuming the economy doesn’t collapse in the meantime—which is always possible—markets would then have the next catalyst for another leg higher. One they can lean on for quite a while.

Jeroen Blokland analyzes striking, timely charts related to financial markets and the macroeconomy. He is also the manager of the Blokland Smart Multi-Asset Fund, which invests in stocks, gold, and bitcoin.