With the start of a new year, the professionals making the wheels of Luxembourg’s funds sector spin may be considering changing jobs. Recruitment experts share their perspectives on the state of the industry and the trends shaping it.

For Jean-François Marlière, founding partner of the executive search firm Marlière & Partners, compliance remains a “hot topic” in terms of recruitment. This involves the “full spectrum” of compliance-related jobs, not just roles that involve AML/KYC.

Generally speaking, regulatory profiles—including compliance and legal specialists—remain difficult to recruit, said Marlière. “Those profiles are in limited quantity in Luxembourg, so we are always recruiting people with some experience in that sphere.” That scarcity creates pressure on salaries, making it more expensive as well as challenging to recruit these profiles.

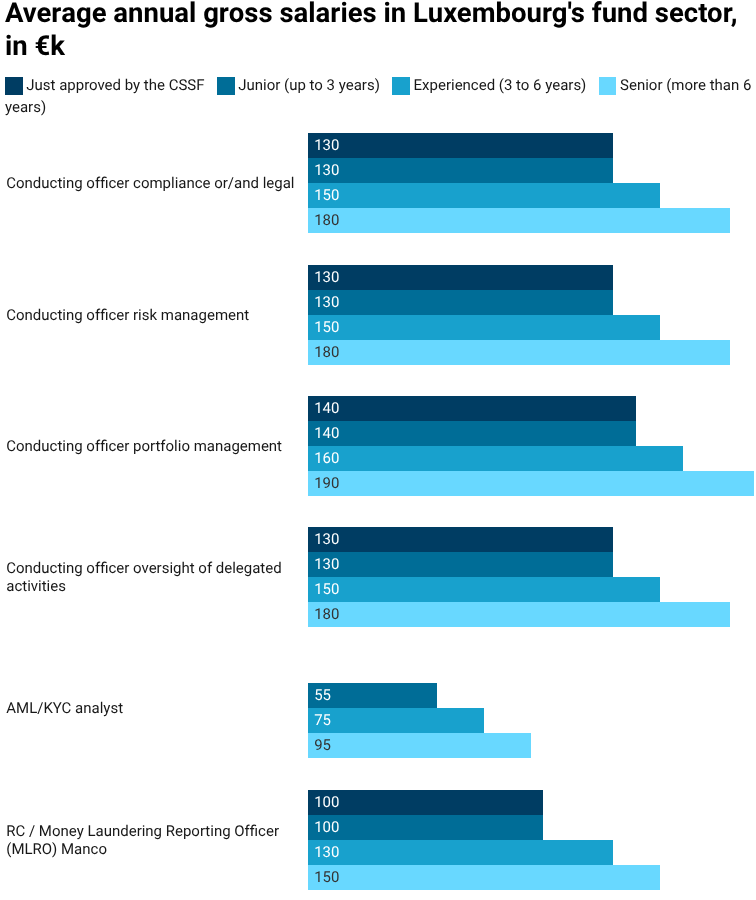

A salary study published by the executive search and talent consulting firm Morgan Philips in December provided an idea of the salaries offered in the sector. For a compliance or legal conducting officer or a risk management conducting officer, average annual gross salaries start at 130,000 euros and go up to 180,000 euros, depending on experience. Average annual gross salaries for AML/KYC analysts range from 55,000 to 95,000 euros, and according to the report, these profiles are in “high” demand. RC or money laundering reporting officers are in “very high” demand, with the study highlighting the role as a “key function.” Their salaries go from 95,000 to 150,000 euros, but can go higher.

Newly arrived law firms with a particular focus on investment funds have added another nuance to the Luxembourg landscape. These recent entrants are challenging the entire Luxembourg market, said Marie Bodson, consultant at Marlière & Partners, making it more difficult for firms to recruit legal talent.

A consolidation crunch

Raphaël Cohen, associate director at Morgan Philips, points to other factors tightening the labor market. “We see the Luxembourg market slowing its activities,” he said. “We have seen consolidation for multiple management companies,” he added, “and we see externalization of key functions.”

Regulatory topics remain important, but these shifts are leading to a surplus of experienced professionals, Cohen said. As a result, conducting officers, risk managers, and compliance officers are facing increased competition and higher selectivity.

Cohen fears that Luxembourg is moving in reverse and returning to back-office functions. “The problem is that we do not have the front-office team here; we do not have the investment team here. So we really see an operational impact because the decisions are not taken in Luxembourg. The decisions are taken outside of Luxembourg—from Paris, London, Switzerland.”

Talent is not the issue

The Luxembourg government this summer introduced a revised carried interest regime that aims to enhance and clarify the tax treatment of carried interest. Its aim is to attract alternative investment fund managers to the Grand Duchy. The scheme could “eventually play a role in attracting and retaining key professionals,” stated the Morgan Philips salary study.

But for the moment, “we do not see any operational impact,” said Cohen. “We do not see any clients, any candidates—internally—talking about this.” “As a recruiter, it’s not seen as an advantage,” he said. People are focused on indexes, productivity and consolidation. “They are not talking about carried interest. I think there is a huge gap between the reality of what people in Luxembourg are looking for and what the government is proposing.”

“We see a lot of communication around the fact that we need to attract talent,” said Cohen. “I’m sorry: we do not have difficulties attracting talent. We have local talent. We have people living here. We have people that are commuting here to Luxembourg. We attract talent.”

Looking for soft skills and adaptability

There has been a lot of discussion around the carried interest regime in recent months, said Andrew Notter, founding partner at the recruitment and executive search firm Anderson Wise. Some new roles have been created, and Notter noted that he had a call planned to discuss that very topic. “We are starting to see some of those roles being created, but we’re not swamped with new positions,” he said. “It’s quite a new focus for some companies as well. It’s something that we’re keeping an eye on to see how that could potentially grow the number of positions in Luxembourg.”

Notter sees a “constant demand” for risk, compliance and conducting officers. But companies are looking for more than just technical expertise. Soft skills and interpersonal skills are “really high on companies’ agendas,” he said. The right leadership skills, gravitas and personality to deal with international stakeholders are key, Notter added, particularly when these profiles have to “build bridges” between Luxembourg and company headquarters.

Finding this “cultural fit” is crucial. But agility is also an important soft skill. “There’s a lot of uncertainty in the world,” said Notter, and companies are looking for people who can adapt to changing environments.

On the flip side, companies also need to make sure they provide candidates with a long-term perspective for career development. “Employees are also looking at how that opportunity for their next move can help their career in the long run.”