A narrow victory for Kamala Harris in the U.S. election could stir up significant market turbulence. Trump appears unwilling to concede, and his resistance might disrupt the current rally. It wouldn’t be the first time.

Asset managers seem prepared for all possible scenarios but one: What if Donald Trump challenges the result? Some investors see a growing risk of market corrections, especially if the outcome is as tight as polls suggest. Given Trump’s 2020 efforts to contest his loss to President Joe Biden, a close result this year could once again lead to controversy.

“This is one of the most overlooked scenarios, and it will create more turmoil than last time,” says Corné van Zeijl, strategist at Cardano. He expects that a modest Democratic victory will make investors more nervous than a Trump win.

“This is one of the most overlooked scenarios, and it will create more turmoil than last time,” says Corné van Zeijl, strategist at Cardano. He expects that a modest Democratic victory will make investors more nervous than a Trump win.

Trump seems determined to prevent Kamala Harris from reaching the necessary 270 electoral votes at all costs. This could push the decision to the House of Representatives, where a Republican majority might declare him the winner. “They’re gearing up to cheat!” he wrote on Truth Social, his own social media platform, in late September.

Markets bet on a red sweep

Since early October, financial markets have increasingly anticipated that Donald Trump will not only win the November 5 presidential election but that his Republican Party will also take control of both chambers of Congress. This scenario, known as the “Red Sweep,” is driving market sentiment.

Expectations that a new Trump administration would have a free hand to implement inflation-boosting, growth-oriented policies—such as tax cuts, increased government spending, and deregulation—have led to a rise in U.S. equities, a stronger dollar, and higher yields on U.S. Treasuries.

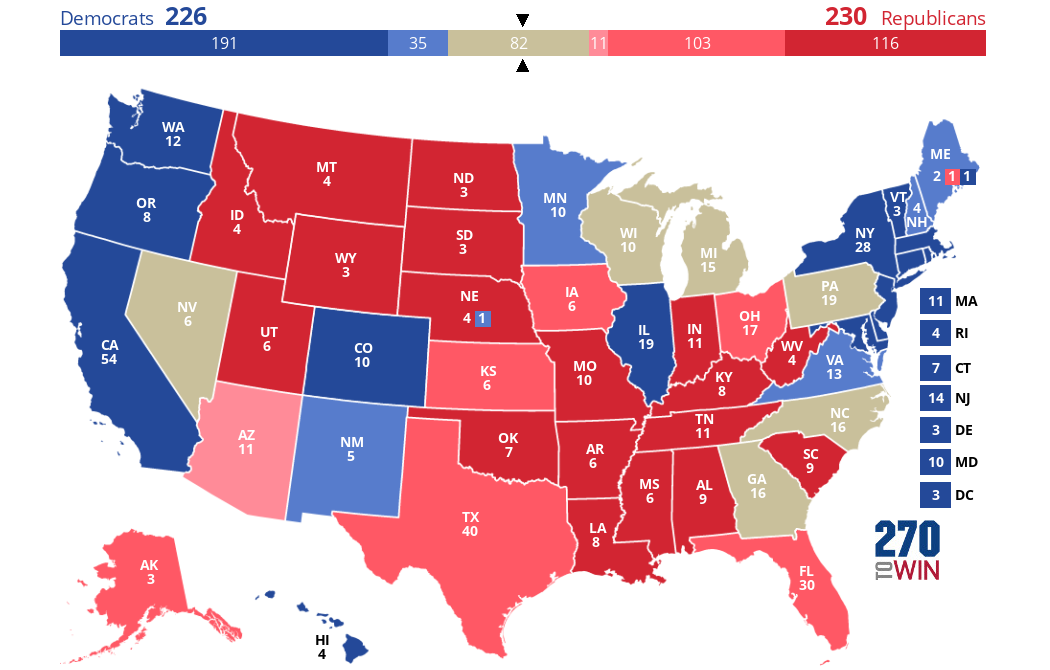

270 electoral votes needed to secure victory

Source: 270towin.com, based on consensus prognosis.

However, markets could react more sharply if the result ultimately does not lead to a Republican victory—a scenario polls consider more likely than investors seem to believe.

“Any news that Trump dislikes will lead to recounts,” warns Michael Purves, CEO of Tallbacken Capital Advisors. He fears a wave of legal actions if uncertainty persists. “If it’s as close as expected, we should be prepared for a margin of just tens of thousands of votes.”

“Any news that Trump dislikes will lead to recounts,” warns Michael Purves, CEO of Tallbacken Capital Advisors. He fears a wave of legal actions if uncertainty persists. “If it’s as close as expected, we should be prepared for a margin of just tens of thousands of votes.”

At the moment, polls from Fivethirtyeight.com give Vice President Kamala Harris a lead of about one percentage point in the popular vote. However, the betting website ElectionBettingOdds.com, which aggregates odds for U.S. political races, estimates a 63 percent chance of a Trump victory.

Safe havens amid election uncertainty

“For investors, it’s not so much about the election outcome itself but the risk the day after, when a large portion of the population may not view the result as legitimate,” says Purves. A particularly tight result will lead to intense scrutiny of the vote count, with late-arriving or manually counted ballots likely to face close examination.

“For investors, it’s not so much about the election outcome itself but the risk the day after the election.”

—Michael Purves, Tallbacken Capital Advisors

In such a scenario, investors will turn to safe-haven assets, according to Purves. Gold, he argues, offers the best protection against prolonged uncertainty, especially as the U.S. “increasingly starts to resemble an emerging market.”

“This is one of the strongest arguments for holding gold,” he asserts, anticipating that uncertainty over the election outcome could trigger a sell-off in equity markets.

U.S. Treasuries also remain the go-to safe haven for many investors, though the current interest rate level poses its own risks. However, Van Zeijl expects Treasuries to retain their safe-haven status, particularly if the situation “really gets out of hand.”

Déjà vu on the stock market

The current situation evokes memories of the 2000 election. Back then, prolonged uncertainty over the outcome between George W. Bush and Al Gore led to sharp declines in the stock market. Gore’s campaign contested the Florida results, resulting in a drawn-out legal battle and the most controversial election in recent U.S. history.

From election day until Gore eventually conceded, the S&P 500 lost 5 percent, with a total drop of 7.6 percent over November and December 2000.

Purves expects investors’ patience to wear thin this time as well. “After a few days, they get nervous, and if the situation looks ominous, they won’t want to hold onto risky assets,” he says.

For investors who have already seen returns of 30 percent or more this year, the temptation to lock in gains might be strong if election uncertainty drags on, Purves adds.

Tensions in the fixed income market

Fixed income investors also face a volatile period. The Move Index, the bond market’s equivalent of the VIX, stands at 128 points, with options pricing in an expected swing of about 18 basis points in U.S. Treasury yields across various maturities immediately after the election. For the remainder of the month, an average daily movement of 6 basis points is anticipated.

Move Index shows new peak in bond market volatility

Trump’s unexpected victory over Hillary Clinton in November 2016 triggered a 37-basis-point swing in the yield on the 10-year U.S. Treasury—a record move not seen in over a decade. Ahead of the 2016 and 2020 elections, the Move Index hovered around 60 points, whereas it now stands at 128.

Pressure on Trading Systems

Banks, asset managers, and market makers have ramped up staffing to handle the anticipated surge in trading volumes around election day. Markets are expected to respond with volatility as results begin to come in.

“From a market perspective, we’re preparing for at least a week of uncertainty, with no assurance of who the new president will be.”

—Grant Johnsey, Northern Trust

Unexpected fluctuations may force investors to rapidly unwind positions, posing risks to liquidity and market infrastructure, and putting significant pressure on trading systems.

“From a market perspective, we’re preparing for at least a week of uncertainty, with no assurance of who the new president will be,” Grant Johnsey, regional head of client solutions for capital markets at Northern Trust, told Reuters.

“From a market perspective, we’re preparing for at least a week of uncertainty, with no assurance of who the new president will be,” Grant Johnsey, regional head of client solutions for capital markets at Northern Trust, told Reuters.

“This simply means ensuring we have sufficient capacity to handle higher volumes and volatility, adjusting holiday schedules accordingly, and being prepared for intraday peaks and dips as election news unfolds,” Johnsey added.

Rally unaffected by political turmoil

For now, political uncertainty appears to have little impact on stock market optimism. Buoyed by strong economic growth in the U.S., the S&P 500 continues to reach new record highs. The index has already risen by 21 percent this year and seems poised for a second consecutive year of double-digit gains.

“A much more severe scenario would be needed to have a truly significant impact on markets and economic growth.”

—Rogier Quaedvlieg, ABN Amro

Dutch institutional investors also remain relatively calm. Markets barely reacted to Trump’s attempt to contest the outcome. U.S. stocks rose in the remaining trading days of that week, even though Biden was only officially declared the winner over the weekend.

“A much more severe scenario would be needed to have a truly significant impact on markets and economic growth,” says Rogier Quaedvlieg, U.S. economist at ABN Amro. “While we consider the possibility that Trump might not accept a loss, we don’t see this as likely enough to adjust our overall expectations.”

“A much more severe scenario would be needed to have a truly significant impact on markets and economic growth,” says Rogier Quaedvlieg, U.S. economist at ABN Amro. “While we consider the possibility that Trump might not accept a loss, we don’t see this as likely enough to adjust our overall expectations.”

Even on January 6, 2021, the day of the Capitol storming, the impact on the economy and markets was minimal; the S&P 500 continued to rise throughout that week.

Van Lanschot Kempen also does not anticipate major market disruptions.

“We’re not really factoring in that scenario. As long as the election process proceeds institutionally as planned, it will ultimately have little impact on the markets. We saw this in January 2021 as well,” says chief economist Luc Aben.

“We’re not really factoring in that scenario. As long as the election process proceeds institutionally as planned, it will ultimately have little impact on the markets. We saw this in January 2021 as well,” says chief economist Luc Aben.

- November 5: Election Day

- December 11: Deadline for state approval of electors

- December 17: Electors cast votes in each state

- December 20: Temporary U.S. government funding plan expires

- December 25: Washington D.C. receives electoral votes

- January 2: End of the U.S. debt ceiling suspension

- January 3: 119th Congress convenes for the first time

- January 6: Congress counts electoral votes, overseen by the Vice President

- January 20: Inauguration of the 47th President of the United States

Source: U.S. National Archives, UBS.