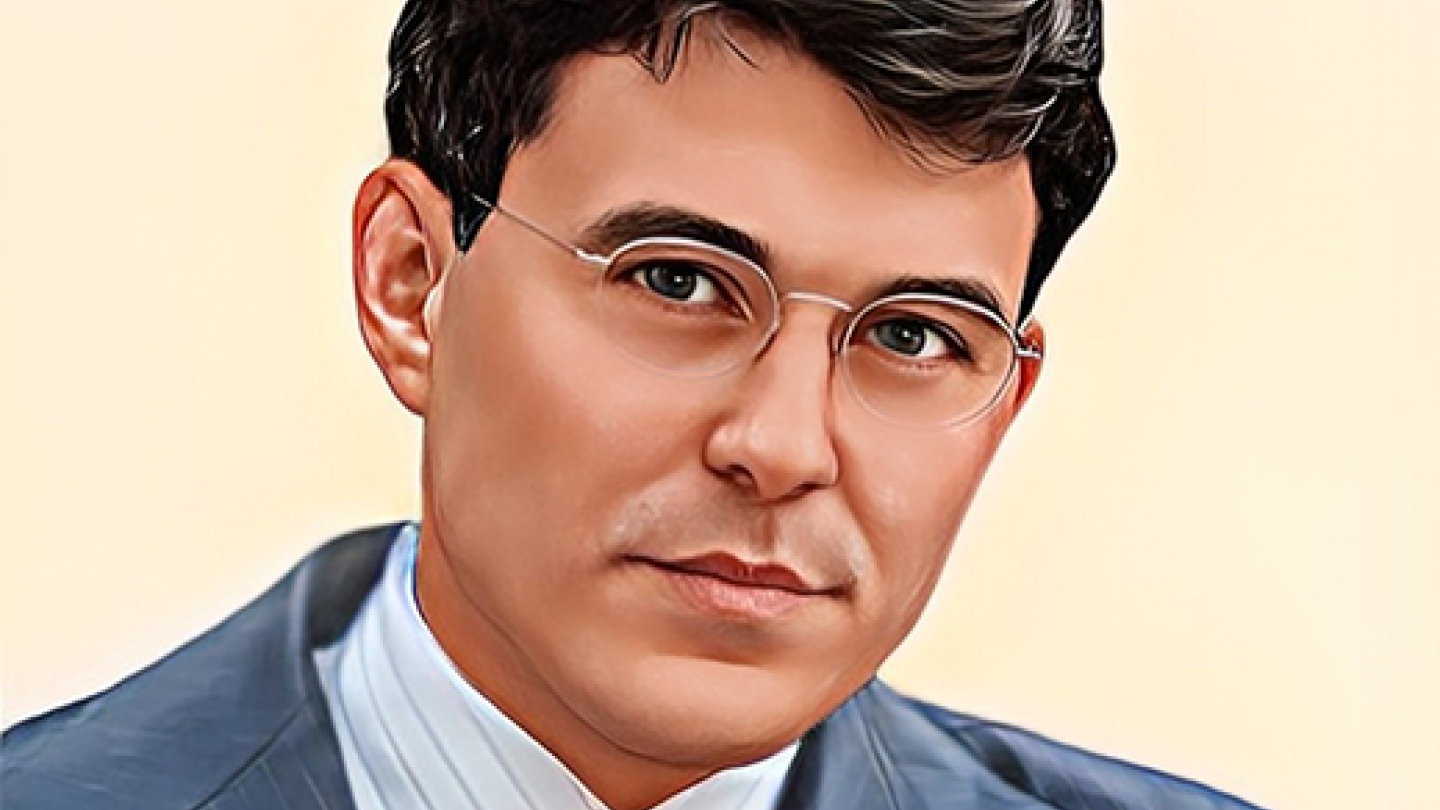

Washington is rewinding the clock on investor protection

Washington is rewinding the clock on investor protection. Under chair Paul Atkins, the U.S. Securities and Exchange Commission has rolled back a series of rules, scaled back enforcement and curtailed shareholder rights. According to former senior counsel Benjamin Schiffrin, who spent nearly two decades at the agency, the regulator is now siding more with Wall Street than with investors.

Private markets boom faces hardening investor scrutiny

Private market fund managers are entering 2026 with record fundraising confidence, and much of that expansion is being engineered out of Luxembourg, according to Carne Group. The Grand Duchy has become the operational nerve centre for European private capital, hosting the majority of Europe’s ELTIFs and an expanding ecosystem of third-party management companies. Yet as assets surge and semi-liquid structures multiply, Carne’s survey finds that institutional investors are sending a firm signal: growth will only be tolerated if governance, valuation discipline and liquidity management meet a significantly higher bar.

Fed is not keen on cutting rates, feeding speculation of a rate hike

The Federal Reserve has little appetite to cut interest rates in the near term. Minutes of the January meeting show policymakers are increasingly concerned that inflation could stay above the 2 percent target for longer than expected. Markets might have to reprice their expectations, economists say.

The growing gap between earnings calls and stock prices in private credit

The already downward-trending stock prices of major US private credit firms took another hit this month amid the markdown of the software sector and concerns about AI. While executives are trying to contain those concerns, analysts say market participants may already be pricing in risks that could affect clients later.

As ASML tops Europe, questions about the ‘Winner’s Curse’ return

ASML shares took a hit last week, after the company had risen in January to become Europe’s largest listed company. That has once again fuelled the question of whether the Dutch chip-equipment maker has become too big, too loved and too expensive. But how convincing are those doubts, really?

Trump’s ‘OK’ with a weaker dollar, European investors less so

An uptick of volatility in the dollar is forcing European investors to confront an awkward choice. With hedging already expensive, some are paying up to protect against further weakness. Others are opting to take the risk, arguing the bulk of the adjustment may already be behind them.

Prediction markets prove accurate enough to help investors, German study finds

Academic researchers in Europe and the United States are finding that prices on Polymarket, a fast-growing online prediction market, can track real-world outcomes with surprising accuracy. The findings suggest such platforms could become a useful tool for professional investors.

To European investors ‘sell America’ is noise

Talk of the need to lower exposure to U.S. assets grew louder this week, but asset managers in Europe are not abandoning the country. Recent market moves, they argue, do not justify a strategic shift away from the U.S., with equities rebounding toward record highs after signs of progress on Greenland at talks in Davos.

This is what’s in store for Jerome Powell

With the subpoena of Jerome Powell, political pressure on the Federal Reserve has taken on a legal dimension. The timing is striking: Powell’s term still has months to run, yet the White House is pressing ahead now. The stakes extend well beyond the fate of the Fed chair himself.

Trump’s credit card rate cap would hurt consumers and banks alike

President Donald Trump’s call to cap U.S. credit card interest rates at 10 percent is weighing on bank stocks and raising broader concerns about consumer credit and confidence.