Value benefits from AI fatigue and rising Taiwan tensions

U.S. large-cap stocks are extending their rally into the new year, but a growing number of asset managers are entering 2026 with a more cautious view on expensive artificial intelligence bets. Many start to see better opportunities in value stocks.

On Wall Street, one type of colleague remains ‘problematic’: the woman

EEOC interim chair Andrea Lucas has urged white men who feel discriminated against at work to file a federal complaint. “Are you a white man who has been disadvantaged at work because of your race or gender? Then you may be able to get money back,” Lucas said in a video on X. Act quickly, is the message.

White House reins in proxy firms, curbing shareholder power

The US government is moving to scale back the influence of proxy advisers ISS and Glass Lewis, casting the firms as ‘foreign-owned political actors’.

Private market firms sallivate over Americans’ retirement cash

The private markets model is edging into the US retail retirement system, where policymakers are moving to allow 401(k) investors to gain exposure to private assets, potentially opening up a trillion dollar market to alternative managers as early as February.

Democrats are set to win but the timing is awful

The Democrats are on track to win the U.S. House of Representatives in 2026. For investors, that is usually just noise. Now, however, even the most committed progressive has to admit the timing is terrible. Things were going so well.

Private credit’s real risk rests with the managers

In private credit, institutional investors face their biggest risk not in the asset class itself, but in selecting the general partner. Interviews with private market insiders suggest the real danger is a lack of scrutiny of managers.

ESG debate at Natixis IM shows drift between Texas and Paris

While ESG may be politically sensitive, Invesco reports that inflows continue to build. Natixis IM’s US Media Summit in New York showed just how sharply opinions on the theme diverge across the Atlantic.

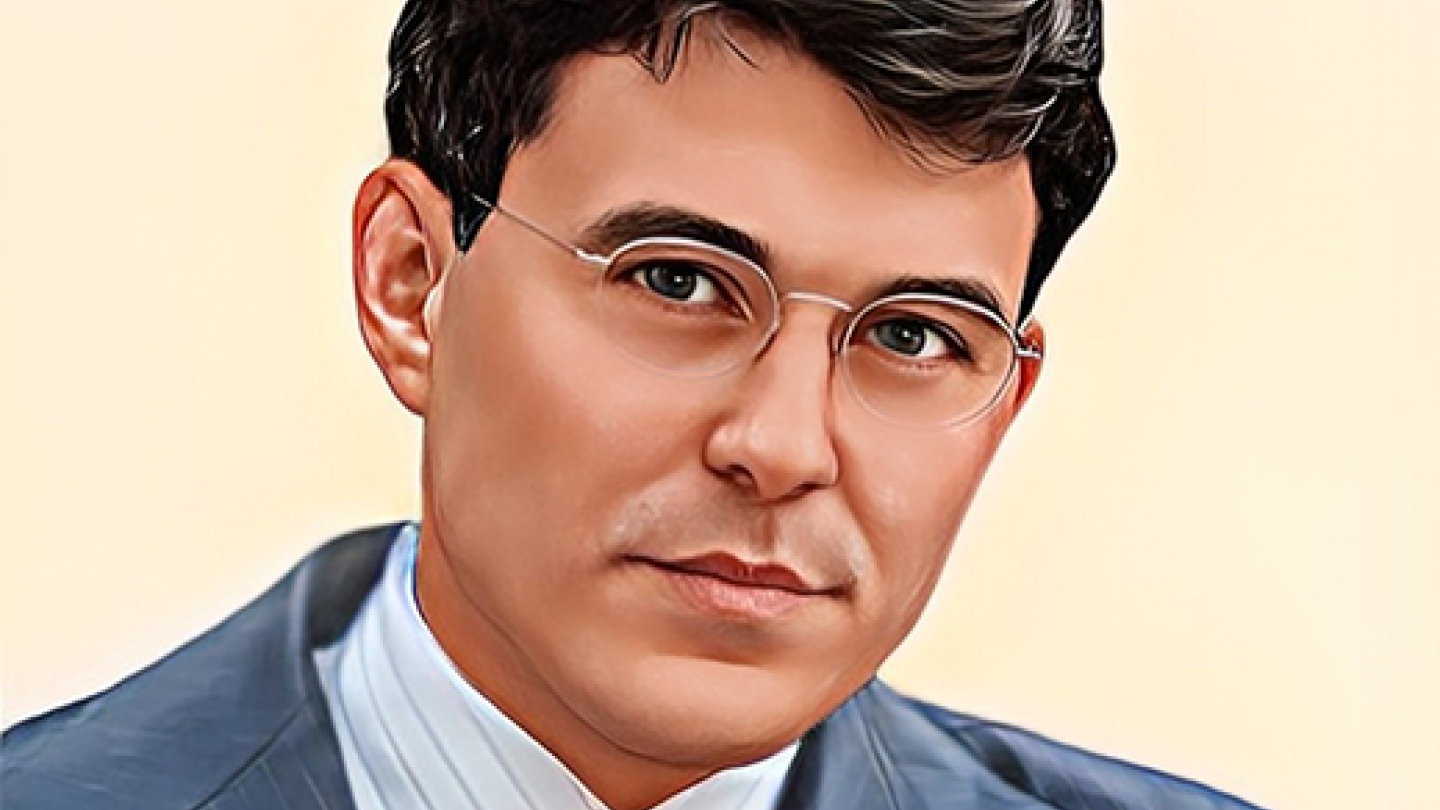

ESG is measured wrong, says Dan Ariely. His fix is beating the S&P500

Dan Ariely has devoted his career to understanding irrational behavior. According to the Duke University professor of psychology and behavioral economics, ESG investors are the perfect test group. They focus, he says, on what is easy to measure rather than on what actually matters for returns.

Art investors puncture own investment case at Deloitte’s New York forum

At the Deloitte Private Art & Finance Conference in New York, art investors did something almost unheard of: they dismantled the investment case for their own asset class.

Blackrock’s latest loss widens rift between private credit yays and nays

New loan failures have reignited debate over the health of private credit. The bankruptcy of Renovo Home Partners last week has drawn warnings about the quality of the underwriting and possible systemic risks. Industry veterans push back, saying media coverage borders on sensationalism.