Milleis Banque Privée anticipates a scenario for 2026 similar to 2025: moderate global growth and disinflation. In a still volatile environment, diversification remains the key theme. With this in mind, the bank plans to reduce the share of cash investments in favor of listed and unlisted bonds, and to diversify its equity portfolios.

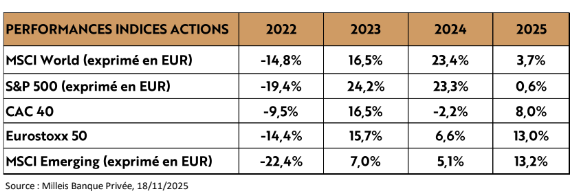

As the new year approaches, Milleis Banque Privée reviews 2025. On the equity side, “markets have recovered since April, even though this rebound came with periods of volatility,” noted Mélanie Cayla, head of associate managers at the private bank. Indices have been supported by strong corporate earnings, massive investments in artificial intelligence, and easing trade tensions.

More specifically, the MSCI World equity index in euro rose by 3.7 percent since the beginning of the year. While the S&P500 index in euro increased by 0.6 percent thanks to AI and expectations of rate cuts, Cayla pointed out that “European and emerging indices have advanced more.” She added that emerging markets stood out this year: “they have outperformed developed markets in local currency, which had not been the case in recent years.” According to her, they benefited from multiple supports, including gross domestic product growth of 4.2 percent, higher than that of developed economies (+1.6 percent), stronger corporate earnings growth, attractive valuations, continued monetary easing by central banks, and a weaker dollar.

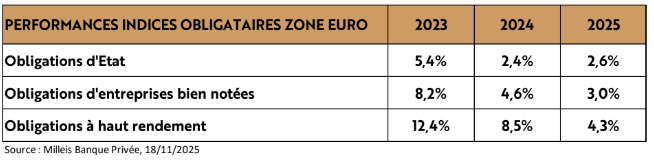

On the bond side, “all indices are up since the beginning of the year,” said Cayla, while noting that volatility dropped significantly after peaking on the day of the announcement of steep tariff increases on April 2, and again on April 9 after these tariffs were suspended for 90 days. High yield corporate bonds are also outperforming those rated investment grade.

A slowdown less pronounced than expected

As for inflation, it stabilized in 2025, around 2 percent in the eurozone and close to 3 percent in the United States. “Disinflation is clearly underway but not yet complete,” said Jean-Patrice Prudhomme, head of products and solutions at Milleis Banque Privée. He noted that, according to central banks, inflation should fall again toward 1.7 percent in the eurozone and 2.6 percent in the US.

Regarding the slowdown of the global economy, “at the beginning of the year, we expected it to be stronger than it actually was,” observed Prudhomme. The IMF raised its global gross domestic product growth forecast twice, from 2.8 percent to 3 percent in July, and from 3 percent to 3.2 percent in October, helped by lower-than-expected tariffs in April and massive investments in artificial intelligence. “These investments inevitably have a positive impact on the economy,” he noted.

Diversifying for the year ahead

“Looking ahead, 2026 is shaping up much like 2025, meaning we expect a slowdown, but a very moderate one,” said Prudhomme. Milleis Banque Privée notes that global gross domestic product growth should, according to the IMF, decelerate only slightly to 3.1 percent, supported by numerous monetary and fiscal stimuli. Many uncertainties remain, however, particularly due to trade and geopolitical tensions. According to him, further policy rate cuts are possible and will depend on inflation and growth data. The Fed could lower rates again if the labor market weakens further. “The consensus among analysts is for three additional rate cuts in 2026,” explained Prudhomme.

In this environment, the private bank led by Nicolas Hubert aims to diversify its equity portfolios across different geographic regions. While European equities are supported by fiscal policy (defense and infrastructure plans) and higher yields than elsewhere, US equities are bolstered by technological leadership (AI, cloud), higher productivity, and deregulation. In emerging markets, economic growth is stronger than in other regions and valuations are lower.

Milleis Banque Privée also wants to reduce the share of cash investments in favor of listed and unlisted bonds. Prudhomme noted that bond yields are attractive, above the money rate and above the inflation rate. He also highlighted that high yield corporate bonds benefit from strong carry and a low default rate. US and emerging market bonds are the most attractive, as they offer higher yields than those in the eurozone.