Euro rally exposes compounding risks in unhedged portfolios

European investors face steep losses as a falling dollar and surging euro squeeze returns on unhedged US assets, raising new questions about strategic currency exposure.

Doubt grows among fund giants, yet US stocks remain core portfolio holding

Billions are evaporating from the US markets. The world’s largest asset managers are divided in their commentary, but it’s clear they are concerned. Larry Fink said he is “terrified” in the short term.

Trump wants Powell out. The supreme court might offer a way

President Donald Trump believes Jerome Powell is standing in his way. He has repeatedly threatened to fire him, but there is no clear legal path to make that happen. Last week, however, the Supreme Court left the door slightly ajar.

Wealth managers revisit small crypto allocations in portfolios

Bitcoin’s persistent popularity is reigniting portfolio debates among European wealth managers.

Trade war triggers rift among Trump loyalists

Even those expected to back Trump’s tariff move are responding with unease. Over the weekend, that unease turned to hostility.

‘Liberation Day’ reignites a classic trade debate

Trump’s tariff push revives an old trade theory — and investors should pay attention to what Samuelson really meant.

Investors await ‘Liberation Day’: Selling US stocks now is ‘unwise’

US equities have calmed after a turbulent start to the year, but the mood is far from euphoric. With President Trump’s so-called “Liberation Day” tariffs set to be announced on Sunday, it remains uncertain whether the recent gains mark the beginning of a recovery or simply a pause before the next downturn.

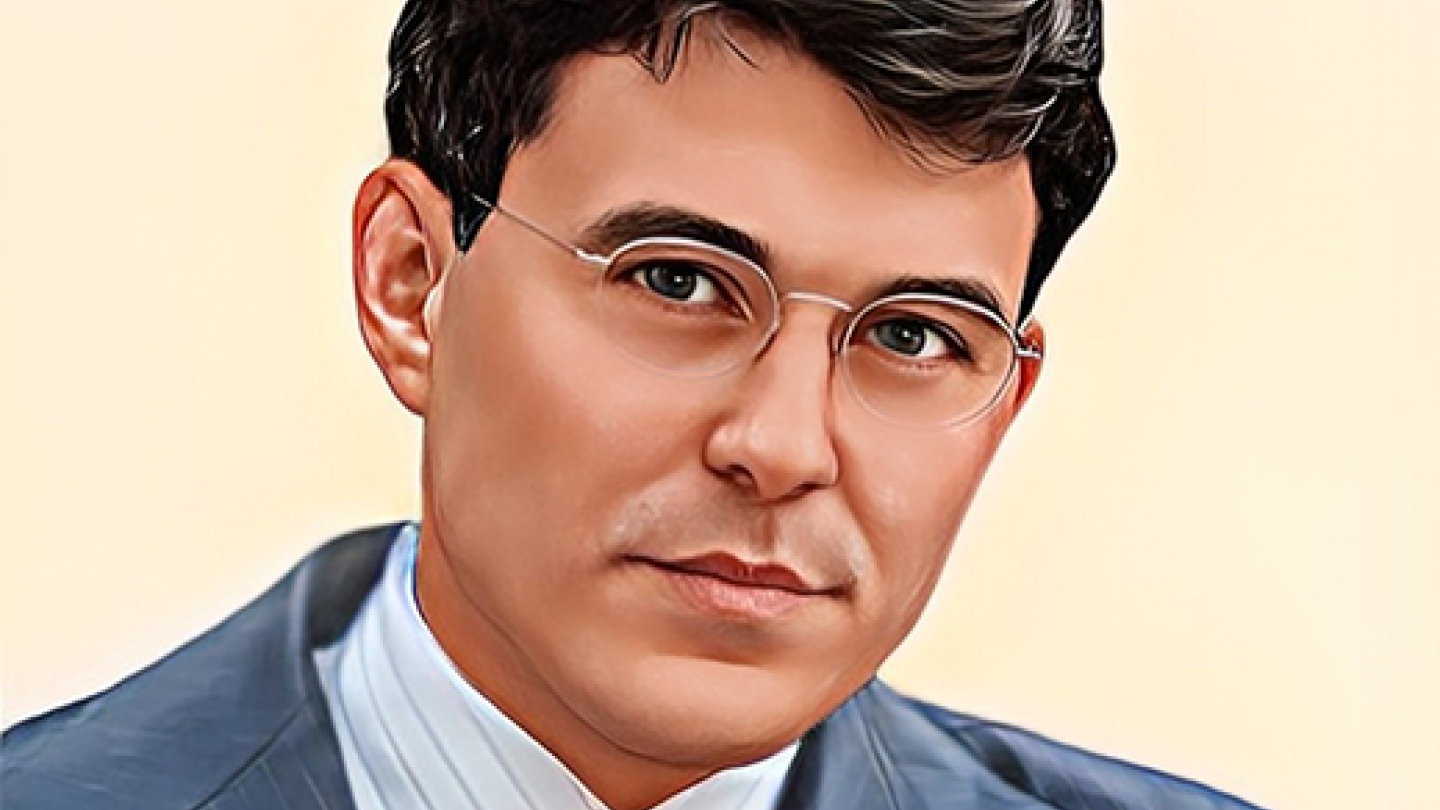

El-Erian: ‘Yields won’t drop further without a recession’

The probability of a U.S. recession is rising, but it is not yet the base case for markets, former Pimco chief executive Mohamed El-Erian told Investment Officer. While the economy is slowing, it has not yet reached “stall speed,” and unless a full-blown downturn materializes, bond yields are unlikely to fall significantly.

Benelux investors keep their cool as Wall Street wobbles

Wall Street wobbles, nerves fray—European investors stay cool, filter the noise, and focus on long-term stability amid market turbulence.

Bund yield rises further as Berlin struggles with budget deal

The German Bund yield continues to rise as Berlin struggles with Friedrich Merz’s planned budget deal. Investors are closely following the impasse between the CDU/CSU and the Greens.