With the U.S. elections approaching, a tight race between Kamala Harris and Donald Trump is emerging. We took this opportunity to consult with our investment boutiques on their perspectives regarding the potential implications of the election outcome on financial markets and portfolios. Our focus was primarily on insights from our U.S. managers, while also considering the potential impact on emerging markets, particularly China.

Claus Vorm, Sr. PM and Deputy Head of Multi Assets at Nordea Asset Management

Given our bottom-up, risk-premia-based investment philosophy, we do not take a specific view on the outcome of the US elections, nor do we position our portfolio accordingly. Our goal is to construct portfolios robust enough to deliver on their long-term value propositions, regardless of the election results. Therefore, our primary focus is ensuring sufficient risk exposure to strategies that can both protect the portfolio in the event of a tail market scenario and capitalize on potential gains from a relief rally.

While we do not anticipate that a victory by either Harris or Trump will necessarily lead to a market sell-off, our portfolios are designed to be well-balanced and prepared to navigate the uncertainties of geopolitical events, such as US elections. Unlike the 2016 election, when Trump’s win surprised markets, polling is much tighter this time, and both candidates possess governing experience, making their policy impacts more predictable. Trump’s trade and tax policies could potentially be inflationary, reversing the inflation normalization we’ve recently witnessed and exacerbating fiscal imbalances. This might push yields higher for a more extended period as investors demand greater compensation for perceived credit risk in US treasuries. Conversely, a Harris victory would likely maintain the economic trajectory of recent years, with her centrist campaign shift and moderate vice-presidential pick suggesting limited policy shifts to the left. Regardless of the outcome, a divided government seems likely, reducing the probability of significant policy changes in either direction. Even if one party gains full control, recent years have demonstrated how challenging it is for either leadership to push through policies perceived as extreme.

In the coming weeks, we will closely monitor bond markets and their capacity to diversify equity risk in the event of a sell-off. Should investors perceive that the new government threatens the “soft landing” and immaculate disinflation trends we’ve seen recently, yields may rise, and equity-bond correlations could spike again. In this scenario, we believe our alternative risk premia strategies across equities, fixed income, currencies, and cross-asset markets will be well-positioned to provide much-needed diversification for investors. Alternatively, if the election outcome is positively received by the markets and we see a continuation of normalized correlations, we expect mid-to-long-term returns across our portfolios to be very attractive, given their fundamental strength and relatively favorable valuations.

Jim Schaeffer, Manager of NAM’s North American High Yield Bond Strategy along with Kevin Bakker and Ben Miller co-PMs (Aegon Investment Management)

The US presidential election is shaping up to be a very tight race. The outcome could go either direction, and it is considered a toss-up by many political analysts. We anticipate that the results will hinge on a handful of states. While Trump has gained some momentum recently, it is still too close to call at this point, at least with any conviction.

In terms of the candidates’ policies, the one similarity is that Harris or Trump would likely add to the deficit. In Harris’ case, this is due to more domestic spending, and in Trump’s case, more tax cuts and potential tariff impact. The key to how impactful the president’s term could be depends on how the House and Senate races turn out. If Harris wins, we think it is very unlikely that the Democrats win both the House and Senate. The Senate map is very unfriendly for Democrats. They would have to defend multiple seats in Trump territory and the polling doesn’t look good. Thus, Harris is likely to have a divided government which will severely reduce the odds of any transformative policy being passed.

Conversely, if Trump wins, it could be a divided government as well (Democrats win House), but we believe he has a better chance than Harris for his party to win both the House and Senate. If the Republicans have all three chambers, we would anticipate tax cuts to be extended and corporate tax rates reduced further, among other changes. In the event of divided government, look for executive order to remain a key component of president’s arsenal. Key policy topics under this jurisdiction would likely include tariffs and, to a degree, border security.

Overall, the situation remains fluid and it is challenging to predict the outcome. In addition, there is a good chance that we may not have a definitive winner on November 6th, which could add to the uncertainty in the short-term.

The implications of the US elections on the markets and economy are yet to be seen. Although the election can cause some uncertainty and pockets of volatility, historically the direct impact to the high yield bond market in the short-term around an election has been relatively muted.

Generally speaking, high yield is a credit-intensive asset class that is driven more company specific developments and bottom-up factors, and is less influenced by broader macro trends and specific election outcomes.

However, the markets could experience volatility in the short-term around the election due to various factors, many of which are challenging to predict. For example, it appears that the market is not pricing in a high probability for increased tariffs. In the event Trump is elected and there is a Republican sweep, this could be disruptive to markets and may result in an equity sell-off. A broader risk-off sentiment could spill over into high yield and lead to spread volatility.

Over the long term, potential changes in fiscal policies could have notable impacts on the economic outlook and the environment in which companies operate, which could more directly impact the high yield bond market.

MacKay Shields LLC, manager of NAM’s US Investment Grade strategies

Heading into the final stretch of this election season, polls and betting markets indicate a neck-and-neck race for the presidency between two populist candidates with starkly different views of the country’s ails, and how to fix them. Vice President Harris has put forward a progressive and expansionary fiscal platform focused on social benefits to address household pain points such as the costs of housing, health care and childcare. If elected, however, likely Republican control of the Senate implies little to no ability to move this agenda forward. Republicans could also use their leverage over the legislative process to force cuts to discretionary spending in budget fights, as they did during the Obama presidency. In fact, one of Harris’ first challenges in office will be to resolve a debt ceiling showdown. Still, there are areas for potential compromise. These include an expanded child tax credit; funding for better border security; and extending many of the expiring provisions of Trump’s signature 2017 tax cuts.

If former President Trump wins the election, Republicans would likely control both chambers of Congress, opening the door to a full extension of expiring provisions of the 2017 tax cuts, and possibly further tax breaks for corporations and small businesses. Trump has also discussed additional support for households, such as an expanded tax credit for families with children and a number of further household tax deductions. Other aspects of his agenda are decidedly negative for growth. Import tariffs would serve as a tax on consumers while also raising input costs for producers, and retaliation by trade partners would hurt the export sector. Restrictions on immigration and measures to deport undocumented immigrants would limit workforce growth and dent overall spending. Hence, the Trump agenda, if fully implemented, could very well turn out to be negative for growth.

The election outcome could have several implications for fixed income portfolios, especially considering the two candidates’ divergent fiscal and trade policies. If Vice President Harris wins, her expansionary fiscal platform, while unlikely to fully materialize due to probable Republican control of the Senate, could still drive targeted fiscal measures like an expanded child tax credit and extensions to some of Trump’s 2017 tax cuts. This could provide moderate support to household spending, benefiting credit markets tied to consumer spending, such as retail and housing-related sectors. However, if her broader fiscal initiatives are blocked, the net impact on deficits and bond markets could be limited, keeping Treasury yields and spreads relatively range-bound.

On the other hand, a Trump victory would likely bring more aggressive fiscal policies, particularly through tax cuts for corporations and households, which could initially spur growth and support corporate credit markets, especially in sectors like energy, telecoms, and banks. However, his proposed tariffs and trade restrictions could increase costs for producers and consumers, driving inflationary pressures that would weigh on long-term bond yields. Increased fiscal expansion under Trump could also widen deficits, which might lead to a steeper yield curve and potentially higher interest rates. In this environment, higher-yielding credit sectors, such as high-yield bonds and certain cyclical sectors, could become more attractive due to their higher income, which helps compensate investors for the increased risks of credit spread widening. Although spread widening typically hurts bond prices, the elevated yields can cushion these losses, and high-yield bonds generally have shorter durations, making them less sensitive to rising interest rates. Additionally, sectors like energy and industrials could benefit from pro-growth fiscal policies, which may improve their creditworthiness over time, further justifying exposure to these sectors despite the near-term volatility.

In both cases, sector-level positioning will be critical. Under Harris, sectors tied to government spending, such as healthcare and utilities, might see more stable performance. Under Trump, cyclical sectors like industrials and energy might benefit from deregulation and tax cuts, though credit risks could increase in sectors exposed to higher tariffs and slower global growth.

In both cases, sector-level positioning will be critical. Under Harris, sectors tied to government spending, such as healthcare and utilities, might see more stable performance. Under Trump, cyclical sectors like industrials and energy might benefit from deregulation and tax cuts, though credit risks could increase in sectors exposed to higher tariffs and slower global growth.

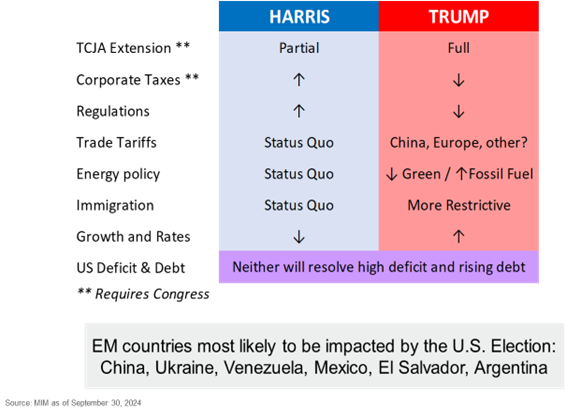

Thomas Smith, Portfolio Manager of NAM’s Emerging Market Bond Strategy (MetLife Investment Management)

We believe that a potential sweep matters: A sweep by either party would have effects on concerns such as more spending/lower taxes, more deficits, potentially higher rates as absorption of debt becomes more of a problem.

Presidential election will likely matter most importantly via the trade route: Under Trump, China and Europe (excluding UK) would expect to see higher tariffs. Trump, some believe, will threaten to let USMCA lapse instead of renegotiate but might renegotiate if Mexico makes efforts to exclude China from the EV supply chain. U.S. inflation effects from tariff increases are likely, but are also likely to be much smaller than what we saw in 2022-23 – also note that tariffs are largely one-time increases for the U.S. (setting aside retaliation and escalating trade wars).

We believe that regulations will matter: Under Trump, we are likely to see fewer regulations than under Harris, and also likely to see less anti-trust action (aside from in the tech sector). This could have material positive economic effects, particularly in specific sectors that have been affected by anti-trust actions and sectors that have been favored/restricted due to energy transition policies under Biden.

Topics including trade, globalization, defense spending, and China will be highly anticipated themes surrounding campaign rhetoric. The ongoing conflict in the Middle East will be a fine line for both candidates to walk given the US’ historical stance with Israel coupled with navigating the localized war and ensuring no further escalation. The war developments further impact the energy sector, where concerns around the conflict and supply disruptions have supported energy prices that were previously pressured by the softening macro outlook.

We expect to see some volatility heading into the election as polls are not pointing to a clear favorite at this time, and even volatility afterwards as markets digest the results and the trickle effect across the globe. Heading into the election, we have reduced some overall risk across EM portfolios, subsequently lowering our tracking error relative to corresponding benchmarks. We want the ability to be a buyer if we experience any disruptive outcomes. In the meantime, we have been focusing on high conviction credits including select sovereign rising star candidates which we believe can benefit from further spread compression.

Ken Shinoda, Manager of NAM’s US Asset-Backed-Securities portfolios (DoubleLine Capital LP)

We generally find market prognosticators may tend to overstate US Election results and their direct impacts on the market, particularly short-term around election season. We are most likely to see changes only on the margin, and many changes would take time. A locked government will limit the ability of either candidate to make sweeping changes. Candidate Trump, if elected, would likely extend corporate tax cuts while Candidate Harris has spoken of stimulus programs for home buyers and new small businesses. Generally, both candidates campaign promises would put more pressure on the exploding deficit. Continued spending would be a headwind for bringing inflation levels to 2%.

We believe the upcoming election may lead to increased market volatility as we near Election Day, no matter who is leading the polls. As always, portfolio returns will largely be driven by interest rate movements and credit spreads. We do not seek to “trade” on US election result projections, rather we invest with our generally 12–24-month economic outlook in mind and where we see the most attractive relative value in markets. Either candidate’s policies, once elected, would of course be a factor to consider in our economic outlook.

Manulife Investment Management (managing NAM’s Chinese equities portfolio)

Despite the outcome of US election, we expect noises between China-U.S. to stay. If Trump wins, Trump has signaled willingness to introduce a minimum 60% import tariff on China and a 10%-20% universal import tariff on the rest of the world. If Harris wins, the trade and tariff policies are likely to remain status quo.

However, we see limited impact due to the reason that tariff actions are not new and has been implemented by Trump administration since 2018. Note that since then, China’s export to the US has declined while export to the rest of the world has picked up. For example, China’s export to US on EV, solar cells and semiconductors is very small.

Besides, Chinese companies have been building factories globally to localize their operations e.g. Mexico, Europe to mitigate tariffs (i.e. go global strategy). Also, there could be negative impact to US economy (e.g. inflation, high product prices) if more tariffs are imposed, which may cause the new administration to re-think the implications.

GW&K Investment Management LLC (managing NAM’s global small cap portfolios)

In terms of expected results, polling indicates that the presidential election and some congressional races are currently too close to call. This uncertainty coupled with evolving policy platforms for both candidates will likely create bouts of short-term US market volatility. However, investor apprehension is a common election cycle feature and should subside, as it has historically, after the new administration has taken office. It is also important to note that US equities have generally performed well regardless of the political party occupying the White House.

Contrary to popular belief, markets have demonstrated a remarkable ability to climb higher regardless of which party occupies the White House. Over the past century, both Democratic and Republican administrations have presided over periods of robust stock market performance. This bipartisan bull run challenges the notion that one party is inherently ‘better for business’ than the other.

We do not expect the election to have an extended impact on global small caps relative performance. Our objective is to build a portfolio of high quality, well-managed companies that are prudently capitalized and generate consistently strong cash flow. They tend to perform well throughout the business cycle, even during more challenging periods, and should be able to navigate any election related policy changes.

Loomis, Sayles & Company, LP (managing some of NAM’s global equity portfolios)

Elections have been a market-moving factor in 2024. Transitions of power and potential policy reforms will likely remain key considerations for investors, in our view. The US presidential election is essentially a coin toss. We suspect a divided government to be the outcome if Harris wins. Such an outcome makes passing major policy changes difficult, which we believe risk markets would like. But if Trump wins, he will most likely get a clean sweep.

Neither US presidential candidate appears focused on fiscal austerity, which we believe means the US government budget deficit is not likely to improve over the near term. Increased government spending can boost economic growth and to some extent employment. However, it can also widen budget deficits with more debt being issued at higher interest rates.

While tough to time, the market should eventually begin weighing the consequences of the deficit. Until then, we believe the global monetary policy easing cycle should keep interest rates trending lower. Our focus remains on investing in quality companies we believe have the ability to manage the current environment and generate value over the longer-term. Periods of volatility can provide us with the opportunity to build positions in quality companies at more attractive valuations.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A., Nordea Investment Management AB, Nordea Funds Ltd and their branches and subsidiaries. This material is intended to provide the reader with information on Nordea Asset Management, general market activity or industry trends and is not intended to be relied upon as a forecast or research. This material, or any views or opinions expressed herein, does not amount to an investment advice nor does it constitute a recommendation to buy, sell or invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. Unless otherwise stated, all views expressed are those Nordea Asset Management. Views and opinions reflect the current economic market conditions, and are subject to change. While the information herein is considered to be correct, no representation or warranty can be given on the ultimate accuracy or completeness of such information. Published by the relevant Nordea Asset Management entity. Nordea Investment Management AB and Nordea Investment Funds S.A. are licensed and supervised by the Financial Supervisory Authority in Sweden and Luxembourg respectively. Nordea Funds Ltd is a management company authorised by the Finnish Financial Supervisory Authority. This material may not be reproduced or circulated without prior permission. © Nordea Asset Management.