Trade agreements, resilient earnings and falling rates: the drivers of the summer stock market rebound

The third quarter of 2025 was driven by widespread optimism, which was reflected in a sustained rise in the main global indices. The period was one of the best performers of the past 50 years for S&P 500. This spectacular movement can be explained by a combination of macroeconomic and geopolitical factors. Firstly, the signing of trade agreements between Washington and several of its partners has made it possible to rule out the most negative protectionist scenarios. Secondly, the marked resilience of companies resulted in an earnings season that was significantly better than expected, with earnings per share growth reaching 11% in the US (2) , compared to a market consensus of 5% (2). In Europe, earnings growth was neutral, but still exceeded expectations of -7% (2). In China, the tech giants stood out for their strong earnings per share growth, also driven by the robust contribution of AI-related revenues. Finally, the more accommodative tone adopted by the US Federal Reserve at the Jackson Hole symposium, which resulted in a cut in key rates on 17 September, reinforced expectations of prolonged support for the economy.

In this context, buying flows by US retail investors remained steady, accompanied by systemic funds, which continued to redeploy their liquidity. The S&P 500 rose 8.8% (1), once again driven by technology stocks, with the Magnificent 7 (3) rebounding by 17.6% (1). The rebound was also marked in Europe, with the Euro Stoxx 50 posting a performance of 4.5% and significantly exceeding the levels reached before Liberation Day. Advances in artificial intelligence development, domestic investor flows into equities, and better-than-expected export and retail sales data helped the Hang Seng appreciate by 12.4% (1).

R-co Valor

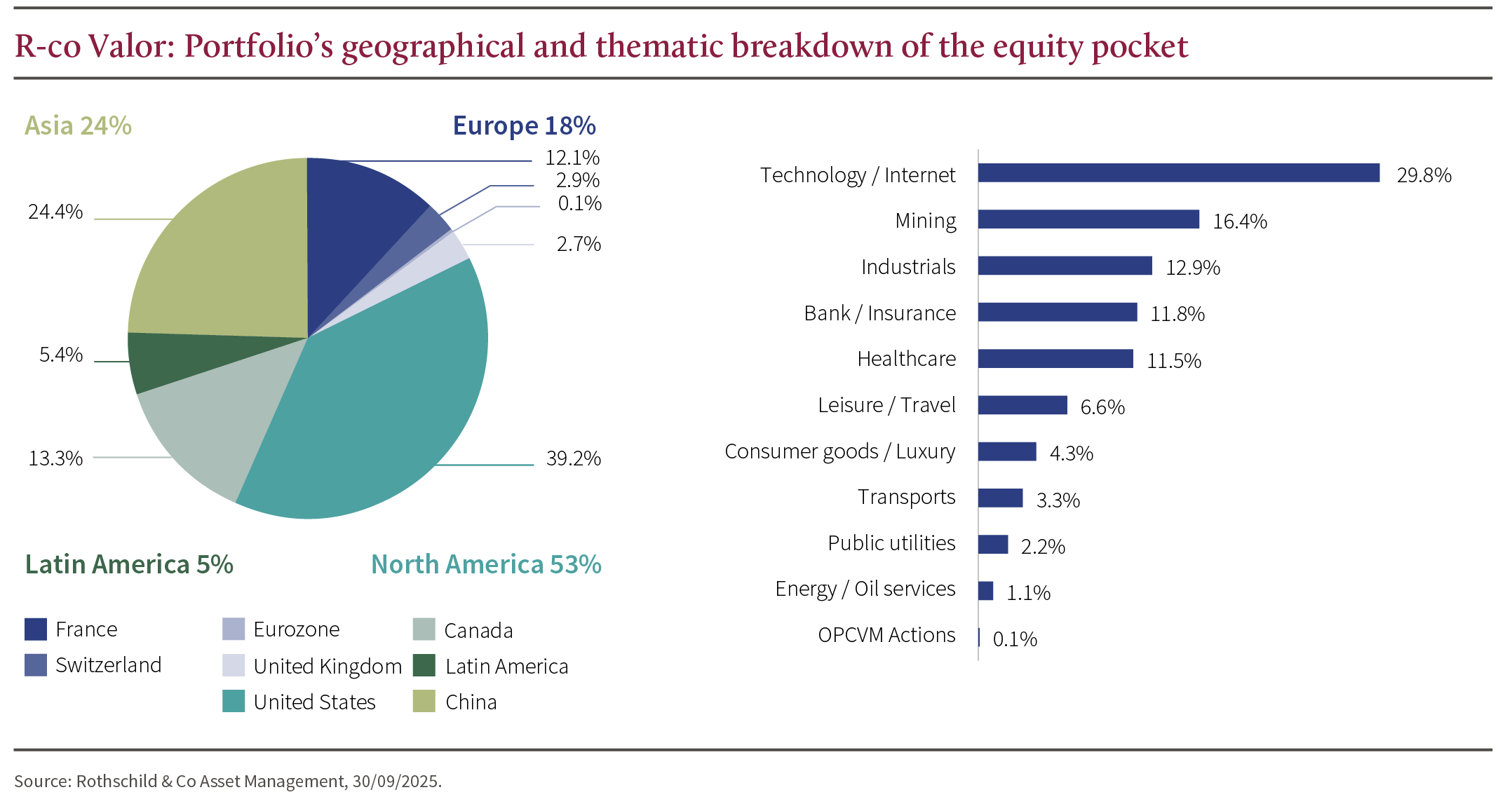

R-co Valor ended the third quarter up 12.0% (4). Exposure to North American equities stood out as the main contributor to performance, accompanied to a lesser extent by China and Europe. From a sector perspective, mining, technology and industrial stocks stand out among the main contributors to performance, driven by gold mines, Alibaba, CATL and Bombardier. No sector contributed negatively to the fund's performance in the quarter.

US markets have reached high valuation levels, opening a window for IPOs and private equity deals. As a symbol of this effervescence, the acquisition of the video game studio Electronic Arts for $55 billion set a new record in the private equity segment, surpassing that of TXU in 2007 (48 billion) (1). However, this upward momentum seems to ignore the prevailing risks and leaves little room for error for market participants. Firstly, the markets' anticipation of a return to the Federal Reserve's neutral rate by the end of 2026, equivalent to four rate cuts, should be approached with caution. This assumption is strong given the strength of the U.S. economy, with GDP growth of 3.8% in the second quarter (2), but also the uncertainty of the effects of tariffs on inflation. The latest statistics on non-farm payrolls in the United States point to a sharp slowdown in activity, with only 52,000 jobs created in September, after 22,000 in August (2), well below expectations. These figures fuel expectations of monetary easing, but potentially obscure structural factors beyond the Federal Reserve's sphere of influence, such as changes in migration policies or productivity gains linked to the rise of artificial intelligence in certain sectors. In conclusion, the market seems to be ruling out any recessionary scenario and is basing its outlook on optimistic assumptions about the trajectory of inflation and the extent of the Federal Reserve's rate cuts.

Europe is benefiting from a renewed climate of confidence, boosted by expectations surrounding the new German Chancellor's fiscal stimulus plan, whose multiplier effects could spread throughout the eurozone. In this context, the European Central Bank raised its growth forecast for 2025 to 1.2%, from 0.9% previously (5) . However, it anticipates a slight slowdown to 1.0% in 2026, before a rebound to 1.3% in 2027, reflecting a gradual but resilient recovery trajectory (5).

China reported growth of 5.2% in the second quarter , in line with expectations, driven by rising retail sales and exports. In view of the good economic performance, and the uncertainty related to the trade negotiations with Washington, the government maintained a wait-and-see stance towards greater fiscal support at the July Politburo meeting. With the Communist Party's fourth plenary session scheduled for 20-23 October approaching, the central government is preparing to review the 15th five-year plan, which will set the economic direction for 2026-2030. During the third quarter, the euro-dollar exchange rate stabilised at around 1.16 (USD at -11% over the year) (1). The price of gold reached a new high in September, around $3,900 per ounce (+47% since January) (1), driven by a massive influx of financial institutions and central banks, as well as individuals into physical gold-backed ETFs.

Within R-co Valor, equity exposure stood at 74% at the end of September (4). Against a backdrop of strong recovery, we took profits on several positions, while repositioning part of the funds into securities offering opportunities for strengthening. Citigroup was sold in its entirety, while profits were also taken on Morgan Stanley and repositioned on Itaù Unibanco, a Brazilian bank newly introduced to the portfolio. Profits were also captured on the Agnico Eagle gold mine and partly repositioned on the Ivanhoe and Freeport McMoRan copper mines, weakened by incidents in some of their operations. We also sold part of our industrial positions that grew strongly in the quarter, Bombardier and CATL. On the buy side, we seized the moment of volatility following Donald Trump's announcements on pricing in the pharmaceutical sector to strengthen Biomarin and Thermo Fisher. Finally, Capgemini and Kingdee were bought on weakness.

In the current environment, we maintain a very selective approach to investment opportunities, with valuations reflecting an optimistic, even complacent, sentiment towards macroeconomic uncertainty. Our historically high monetary exposure, around 26% of the fund (4), allows us to contain some of the market volatility and seize the opportunities it offers.

R-co Valor Balanced

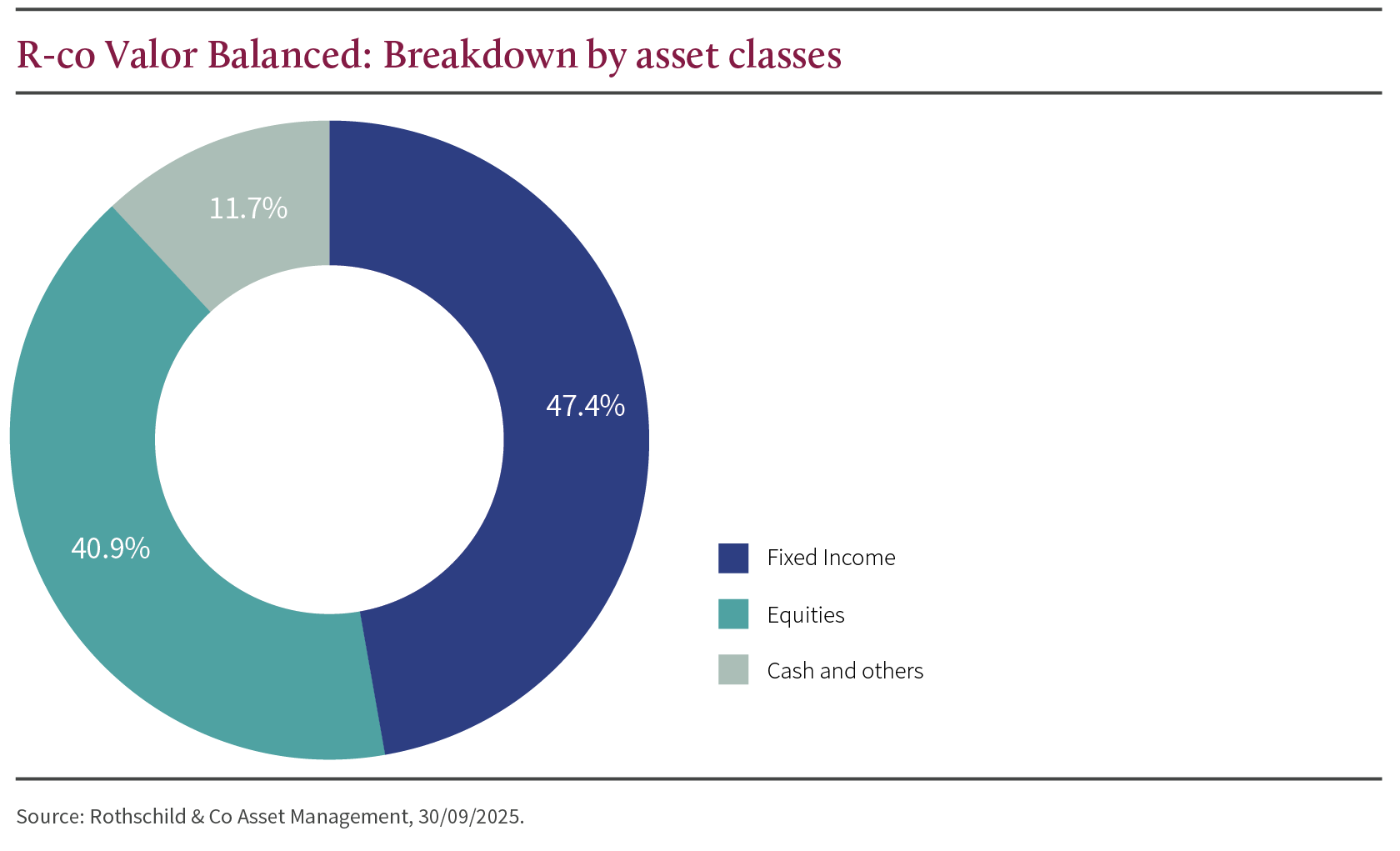

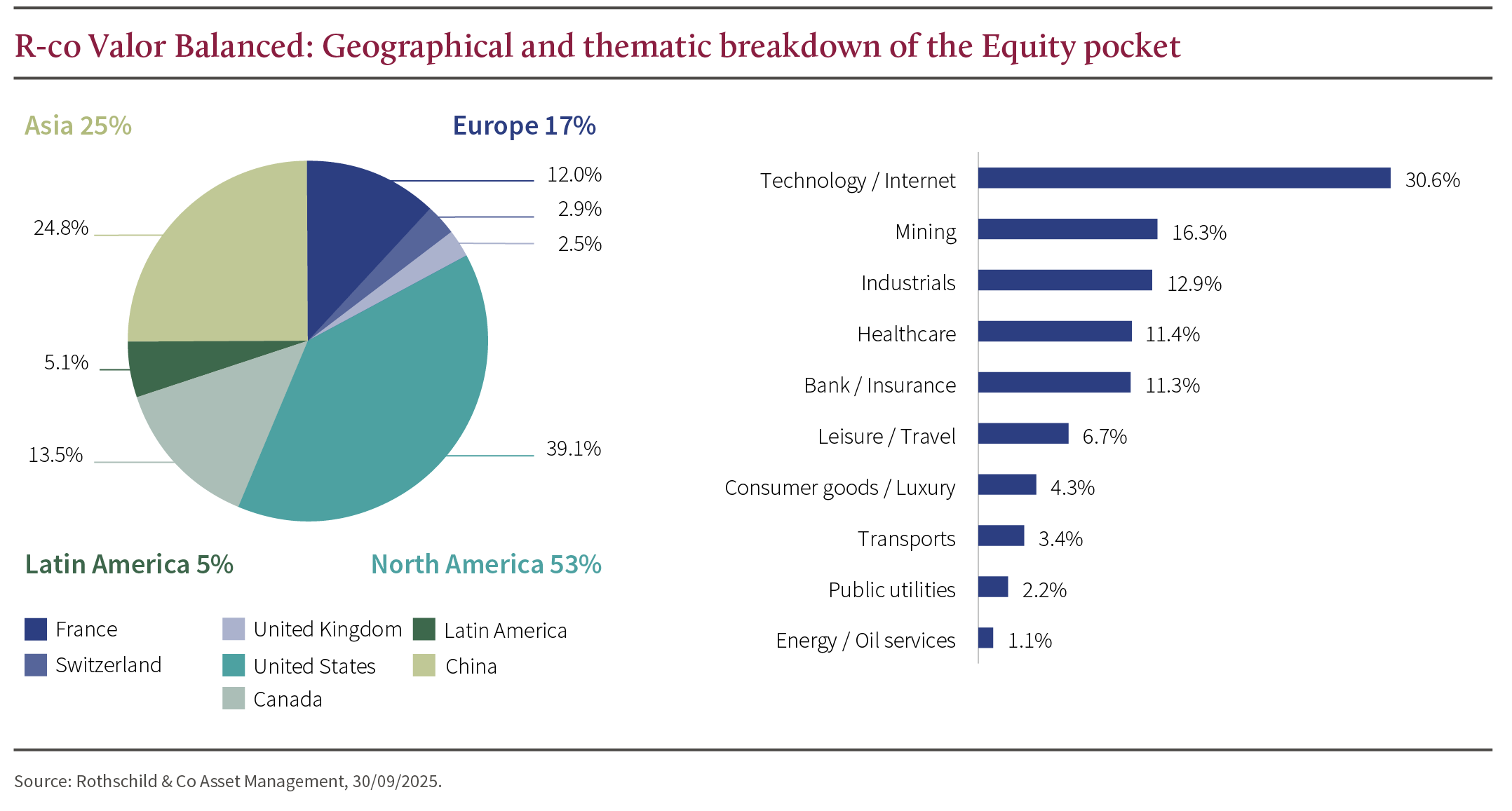

R-co Valor Balanced has 41% exposure to equities and 47% to bonds, with the remainder invested in money market and similar instruments (5). The fund returned 7.1% over the quarter (4).

Equity Pocket

The equity allocation of R-co Valor Balanced mirrors that of R-co Valor. The transactions carried out and the positioning are identical.

Fixed Income pocket

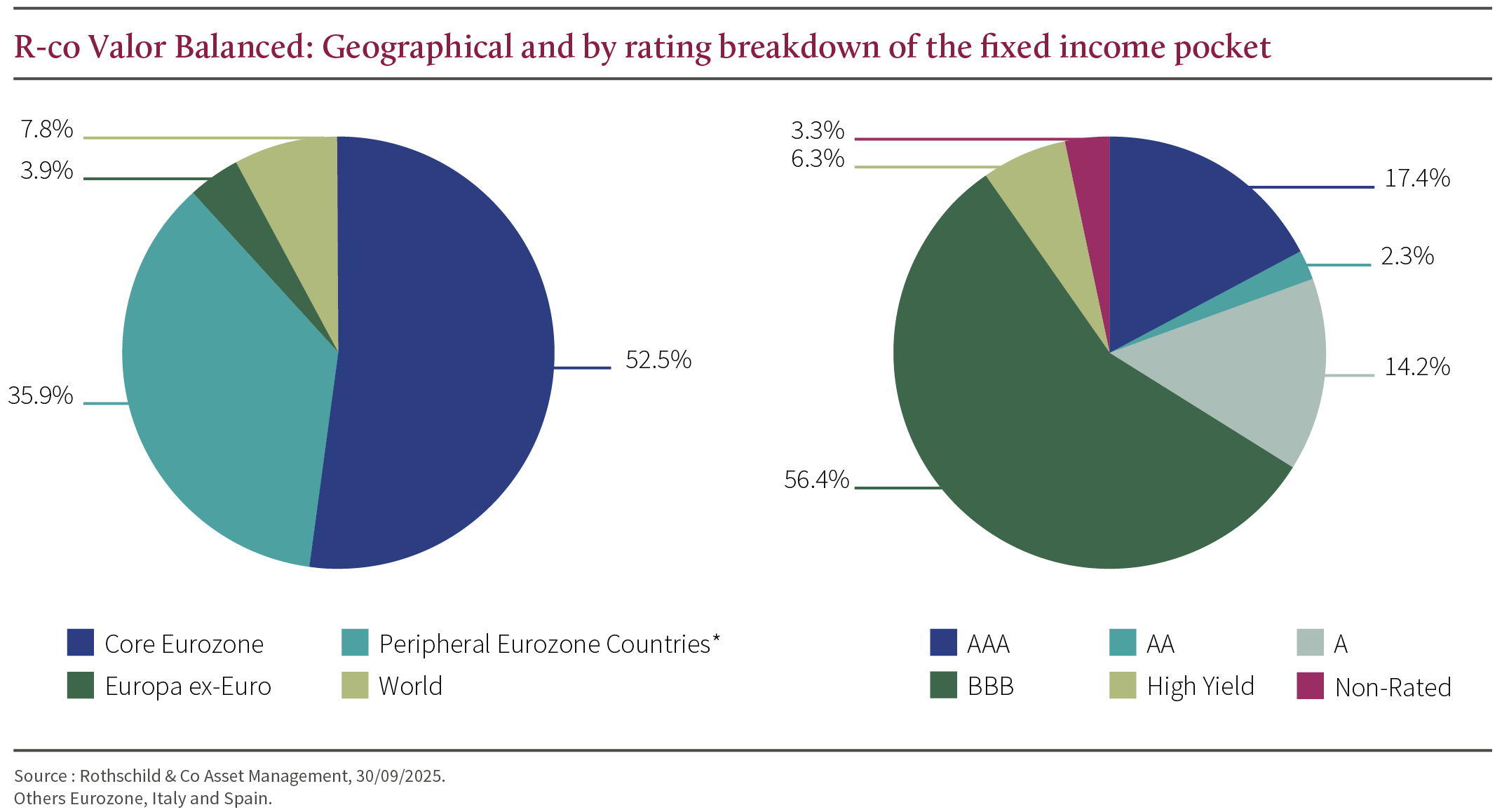

At the Jackson Hole symposium, the U.S. Federal Reserve made a major shift from average inflation targeting to a strict 2% annual target (2) . This change, interpreted as a signal of easing, was accompanied by a warning about the fragility of the labor market, which is now at the heart of the Fed's concerns. The US Federal Reserve cut its key rates by 25 basis points on 17 September (range 4.0%-4.25%), marking a turning point in its monetary policy. However, Jerome Powell stressed that the decision is above all a prudent approach to risk management. As a result, the U.S. yield curve steepened over the quarter, with the two-year yield falling from 3.9% to 3.6% and the 10-year yield falling from 4.3% to 4.2% (1).

The European Central Bank kept rates unchanged during the quarter, with the deposit facility rate set at 2% 5, believing that inflation is now under control. The German two-year yield returned to the 2% threshold, a first since the Liberation Day announcements, while the ten-year stood at 2.7% (1). France has seen its sovereign rating downgraded by Fitch, from AA- to A+, with a stable outlook. This deterioration reflects concerns about persistent political instability, exemplified by the fall of the Bayrou government, and fiscal uncertainties weighing on the fiscal consolidation path. Conversely, Italy benefited from a rating upgrade, with Fitch raising it from BBB to BBB+, also with a stable outlook.

In a context where credit risk premiums continued to narrow slowly throughout the quarter, European companies managed to refinance their debt at comparable or even lower coupon rates, offsetting the effect of rising interest rates and explaining the low default rate over the year. As a result, the primary market experienced a sharp acceleration, recording one of its most active periods since March 2021.

During the third quarter, the fixed income strategy was marked by a series of tactical arbitrages aimed at crystallizing gains and optimizing the portfolio's risk-return profile. In July, the exposure to the Luxembourg real estate company High Yield (7) CPI Property Group was by selling a senior unsecured bond maturing in 2029 and replacing it with a bond of equivalent quality maturing in 2030. In August, profit-taking was made on a bond issued by the French mutual insurance company Macif. We also sold our position in the European credit management specialist Intrum to reinvest the funds in a subordinated bond of Crédit Agricole. In September, activity intensified in the primary market, with targeted participation in the issuances of Sumitomo Mitsui (senior), QNB Finance (senior) and RCI Banque (subordinated), benefiting from attractive issue premiums. The portfolio was also enriched by shares in packaging leader Avery Dennison and real estate company NE Property. In the secondary sector, a position was initiated in a senior Unicredit bond, offering a competitive yield in a context of potential revision of the sovereign rating by Fitch. We are maintaining our CDS (8) coverage on the Main iTraxx Index to protect ourselves against a possible resurgence of systemic risk. The sensitivity of the bond portfolio was 4.2 at the end of September; the yield was 3.2%. (Recommended investment period 3-5 years) (4).

*The actuarial yield is the yield obtained by holding a financial asset until maturity (remaining life) and reinvesting the interest at the same actuarial rate.

(1) Source: Bloomberg, 30/09/2025.

(2) US Bureau of Labour Statistics, September 2025.

(3) Source: The Magnificent Seven comprises seven US technology stocks: Microsoft, Nvidia, Tesla, Meta, Apple, Alphabet and Amazon.

(4) Rothschild & Co Asset Management, 30/09/2025.

(5) Eurostat, September 2025.

(6) Source: National Bureau of Statistics of China, September 2025. (7) Debt securities issued by companies or governments with a rating between AAA and BBB- on the Standard & Poor's scale.

(7) High-yield bonds are issued by companies or governments with high credit risk. Their credit rating is below BBB- on Standard & Poor's scale.

(8) A credit default swap (CDS) is a derivative product that provides insurance against the risk of non-payment of a debt issued by a government or a company. This coverage is applied to the crossover portion of the portfolio, i.e. securities rated between BB and BBB on Standard & Poor's scale.

For more information, visit Rothschild & Co AM website.