Unless you’ve been living under a rock for the past twelve months, you can’t have missed witnessing one of the strongest gold rallies in recent decades. The number of parroted stories about gold has exploded, often relying on the same comparison. Yet it’s exactly that comparison which shows that not everyone sees the golden bull in the right perspective.

A frequently cited chart shows that gold has outperformed stocks over the past x years in terms of returns. Leaving aside that the starting point is often decisive—with several serious stock market crises over the past, say, 25 years—comparing stocks and gold is, in my view, not the most logical thing to do. Unless, perhaps, because they share roughly the same volatility.

Inflation protection

Both stocks and gold provide protection against inflation. For gold, this is easy to understand—thanks to its scarcity—and increasingly so for many investors. For stocks, however, it’s often assumed that inflation puts pressure on prices.

There are two key reasons to believe that stocks, too, offer protection against inflation—one old, and one new (for most investors). Let’s start with the old one. Companies, especially those with strong business models and solid competitive positions, have the ability to pass on price increases to their customers. That’s not pleasant when you’re shopping at a supermarket, but it’s great when you’re a shareholder. Even after the post-pandemic inflation spike, many companies were able to translate this into higher prices for their goods and services.

Fiscal dominance

The second, newer reason requires a realistic understanding of the financial system you’re investing in. That system has a name: fiscal dominance. In a debt-driven economy where the traditional source of growth has run dry (just look at the number of babies born in China—see my Linkedin or X timeline), the magical growth ingredient is debt. To keep that mechanism alive, structurally low interest rates and higher inflation are needed. That’s how debt remains affordable and loses value—hopefully in real terms.

If you’re still looking for evidence that we’re living in a regime of fiscal dominance, I wrote an entire book on it. And if you line up central bank policy since the pandemic, you’ll get pretty close to the same conclusion. It means that central banks no longer primarily target inflation, but debt sustainability. Is it strange that the ECB and the Fed started cutting rates when inflation wasn’t even close to 2 percent yet? Is it surprising that the Fed, sitting on a massive balance sheet, has already stopped quantitative tightening?

Fama is wrong

This means traditional theories, like those from guru Eugene Fama, which claim that central banks throttle economic growth when inflation rises—hurting profits and therefore stock prices—no longer hold up. Fama was absolutely right, but in a completely different economic system with entirely different rules of the game. Today, a central bank keeps interest rates relatively low, even when inflation sits at 3 percent and the underlying rate is higher.

Apples to apples

Anyway, stocks and gold sit on the same side of the spectrum when it comes to inflation protection. And while the rule is that you should compare apples to apples, that doesn’t apply when it comes to diversification. In that case, it’s important to compare different asset classes—apples and pears, so to speak.

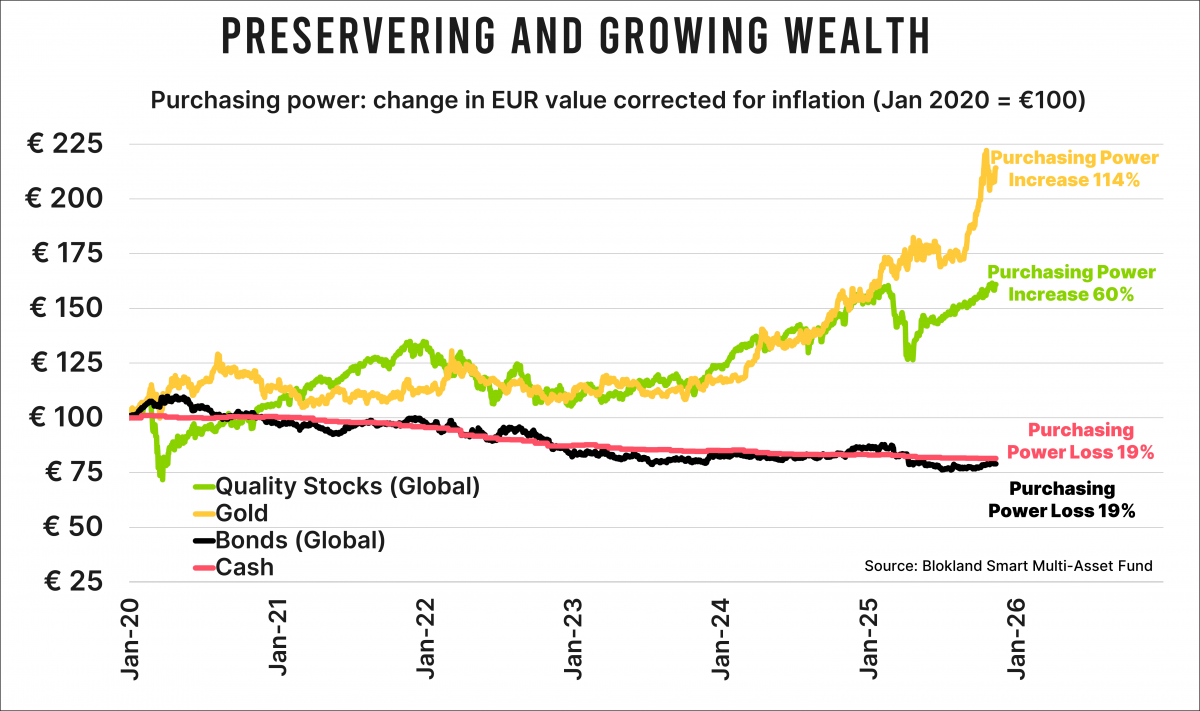

So if I wanted to compare the performance of gold (and stocks) with something, what category should that be? Exactly—the one that’s terrible at protecting against inflation. And indeed it is! Just look at the chart below, which shows the real returns of stocks, gold, and bonds (and cash), adjusted for inflation. I’m guilty of it too: we live in a nominal world, but nominal returns tell you nothing about the reward you’ve received for taking on risk.

The Great Rebalancing

If you, like me, believe that under fiscal dominance central banks must give way—with all the inflation risks that come with it—then the most relevant comparison is with bonds. Especially when you note that the correlation between stocks and bonds is, historically speaking (you really have to go way back), positive, while that between stocks and gold is simply zero.

This column will, at least partly, fall on deaf ears. The fascination and love for bonds is boundless. But that doesn’t mean they are, or will ever again be, great investments.

Jeroen Blokland analyzes striking, timely charts about financial markets and macroeconomics. He also manages the Blokland Smart Multi-Asset Fund, which invests in stocks, gold, and bitcoin.