Lovely vacation or not, some things never change. Like the seemingly endless task of filling lunch boxes for school kids. But also, France’s political instability never ends. The simple reason is that the underlying problem—its budget mess—can no longer be cleaned up.

I often get told that I’m a hardcore pessimist or a doomsayer (and worse). As soon as I point out the extreme budget deficits governments run just to keep growth alive—or the big consequences of debt sustainability requirements for savers and bond investors—the reactions are always the same. Hordes of MMT fans (Modern Monetary Theory) tell me that countries can’t go bankrupt (believe me, I know that, and that’s part of the problem). Or traditional investors point to the attractive long-term characteristics of bonds.

More on that later. First, back to France, where investors, economists, and journalists keep hearing the same tune. As soon as someone, however naive, decides to “fix” the deficit, the political chaos begins. To bring the deficit back to 3 percent of GDP, once the holy grail of the Maastricht Treaty, draconian measures are required. The welfare state has to be cut back, the retirement age raised, and taxes increased. In France, even national holidays have to be sacrificed.

All of that is politically unfeasible. The opposing forces are too strong, and with polarization visible everywhere in French society, real austerity today is political suicide. And so, soon the right will be back in power, try again, fail again, and the game starts all over.

Hard facts

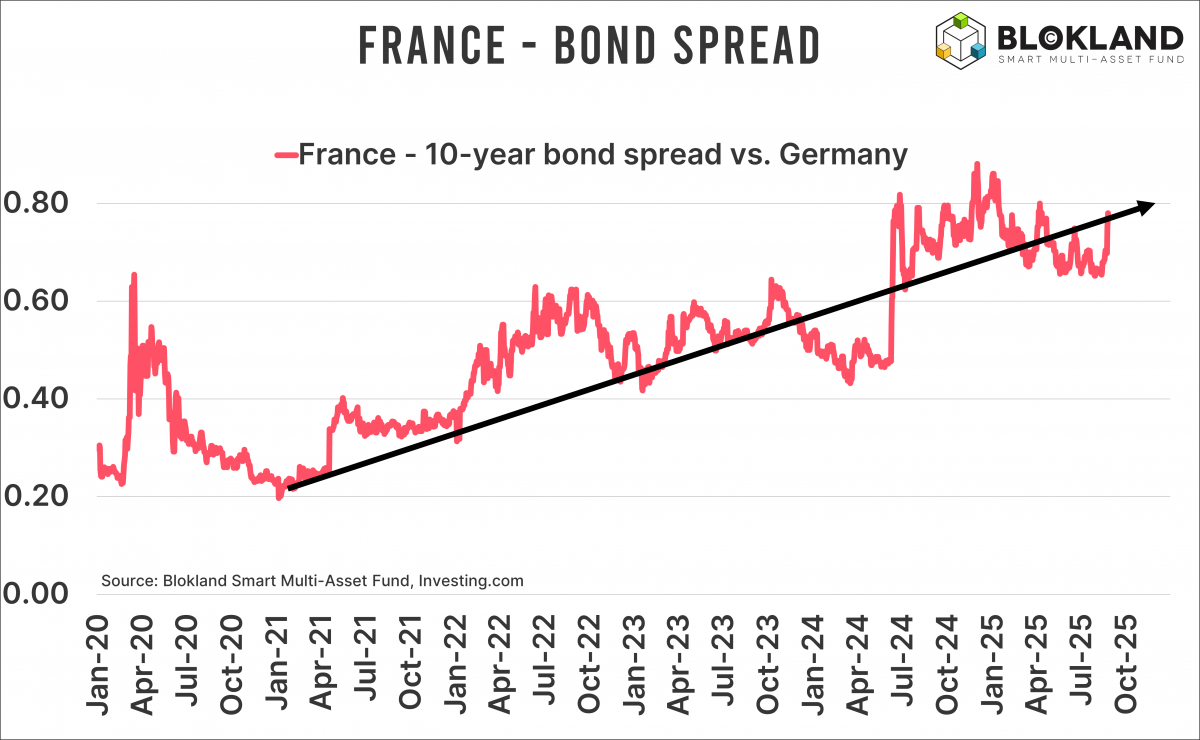

I’m fine if investors want to deny that, but the numbers don’t. The yield spread on French government bonds has steadily risen in recent months and is close to the highest levels since 2012. Yup, that was when we were at the tail end of the European debt crisis. Spreads were still quite a bit higher then, but still.

That’s not the only thing. Volatility in French bonds keeps rising. You can no longer call them low risk—it’s more like average risk now. And that’s not exactly a comforting conclusion for an investment whose main appeal lies in risk reduction. As for returns, I won’t even go there—there haven’t been any for years.

So while I’m occasionally ridiculed for seeking refuge in an investment like gold—which, oh no, doesn’t generate cash flows—that’s fine, but it feels a bit like a classic head-in-the-sand strategy. By the way, have you followed the gold price in recent days? It’s been moving in the same direction as the French bond spread, which is no coincidence.

Pension drama

When I pointed out on X the possible impact of the new Dutch pension system, I was even accused of spreading misinformation. Because, of course, all those charts of mine are just hot air. But imagine you sit on a Dutch pension board and have to reduce the weight of government bonds because you finally accept that lots of people don’t benefit from that category during the accumulation phase. Wouldn’t you also think: “well, we do hold quite a lot of French ones”?

I suspect Ms. Lagarde—who surely understands the rising political instability in her home country—can’t wait for inflation to drop back below 2 percent.

Jeroen Blokland analyzes striking, current charts about financial markets and the macroeconomy. He also manages the Blokland Smart Multi-Asset Fund, a fund that invests in equities, gold, and bitcoin.