Under control. No, that title isn’t about Iranian airspace—although, with recent developments, an entire column could easily be dedicated to that as well. The title refers to the American consumer, who, despite all the uncertainty surrounding tariffs, has yet to throw in the towel.

“Retail sales plunge due to tariff war.” That’s the standard headline plastered across financial media websites and social feeds following the release of US retail sales figures for May. Sales dropped by 0.9 percent, marking the largest decline since the beginning of the year.

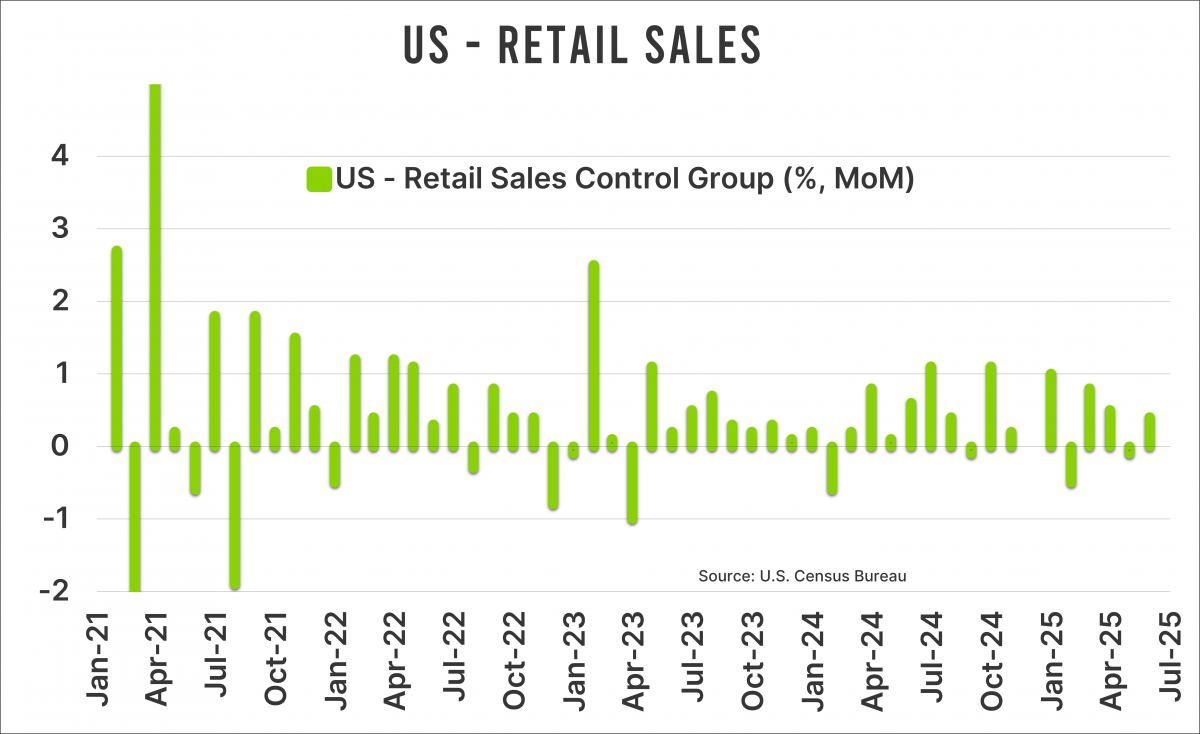

But that’s only half the truth. The so-called “control group” retail sales—which exclude volatile components like restaurants, auto dealerships, building supply stores, and gas stations—increased by a very healthy 0.4 percent in May. This is important, since GDP growth calculations are based on this figure rather than on total retail sales. A crucial nuance, if you ask me, especially when a journalist is crafting a recession narrative.

Healthy pace

The chart below shows the monthly control group retail sales in the US. It looks anything but recessionary. In fact, on a year-over-year basis, these sales rose by nearly 5 percent. That’s roughly 2.5 percent above the current inflation rate, which simply means that US retail sales are still contributing positively to real economic growth—the growth rate that actually matters. The financial world, including when reporting returns, tends to cite numbers without adjusting for inflation, but that doesn’t tell you much.

Labor Market

The best predictor of US GDP growth, the Atlanta Fed Nowcast, projects an annualized economic growth of 3.5 percent for the second quarter. A significant portion of that is a rebound from the previous quarter, when trade dragged growth down, but even so, that figure doesn’t resemble a recession.

For the American consumer, the labor market is key to staying out of a recession. Even though job growth is slowing, the economy is still adding a solid number of jobs each month, and wage growth remains reasonable—though it, too, is leveling off. Nevertheless, wage growth is still outpacing current inflation, meaning consumers’ purchasing power is increasing.

So even though headlines occasionally suggest the US economy is heading off a cliff, the underlying data is far more nuanced. I won’t rule out the possibility that if Trump continues with his volatile policies, caution among businesses and consumers could rise, thereby increasing the risk of a recession. But for now, that risk seems relatively low to me. Trump already provides journalists with plenty of sensational headlines, so there’s really no need to invent new ones for every macroeconomic data point.

Jeroen Blokland analyzes striking, up-to-date charts on financial markets and macroeconomics. He is also the manager of the Blokland Smart Multi-Asset Fund, which invests in equities, gold, and bitcoin.