Stocks are extremely expensive, so it’s just a matter of time before the markets collapse. The next mega market crisis already has a name: the bursting of the AI bubble.

Now, it is 100 percent certain that stock prices will at some point crash completely (only to likely recover afterward), but whether valuation will be the actual trigger, I’m not so sure.

A cloudy crystal ball

In general, stock market valuations are often not the cause of a crash. Of course, the bursting of the dotcom bubble is the counterexample here, but more often valuations simply become a convenient stick to beat the dog with once sentiment has already soured due to other factors.

The result is that countless market experts warn for months, often years, that valuations will bring about the next bear market, but in practice those predictions rarely pan out. This time again, plenty of gurus have been predicting for at least a year that these exceptionally expensive stocks must correct sharply.

Perspective

Aside from the fact that stock valuations are not exactly the best predictor of crashes, the current economic landscape makes me wonder whether stocks are really that expensive on average.

Take the dotcom bubble at the start of this millennium. Depending on the yardstick you use, in many cases stocks are not more expensive now than they were back then. What is often forgotten, moreover, is that stocks do not move in a vacuum. Right before the tech bubble burst in 2000, the US 10-year yield was just above 6 percent. We are now at 4 percent, and everyone says that is high. The German 10-year yield was over 5 percent while today we are looking at well below 3 percent. With simple discounted cash flow math, valuations now come out noticeably lower.

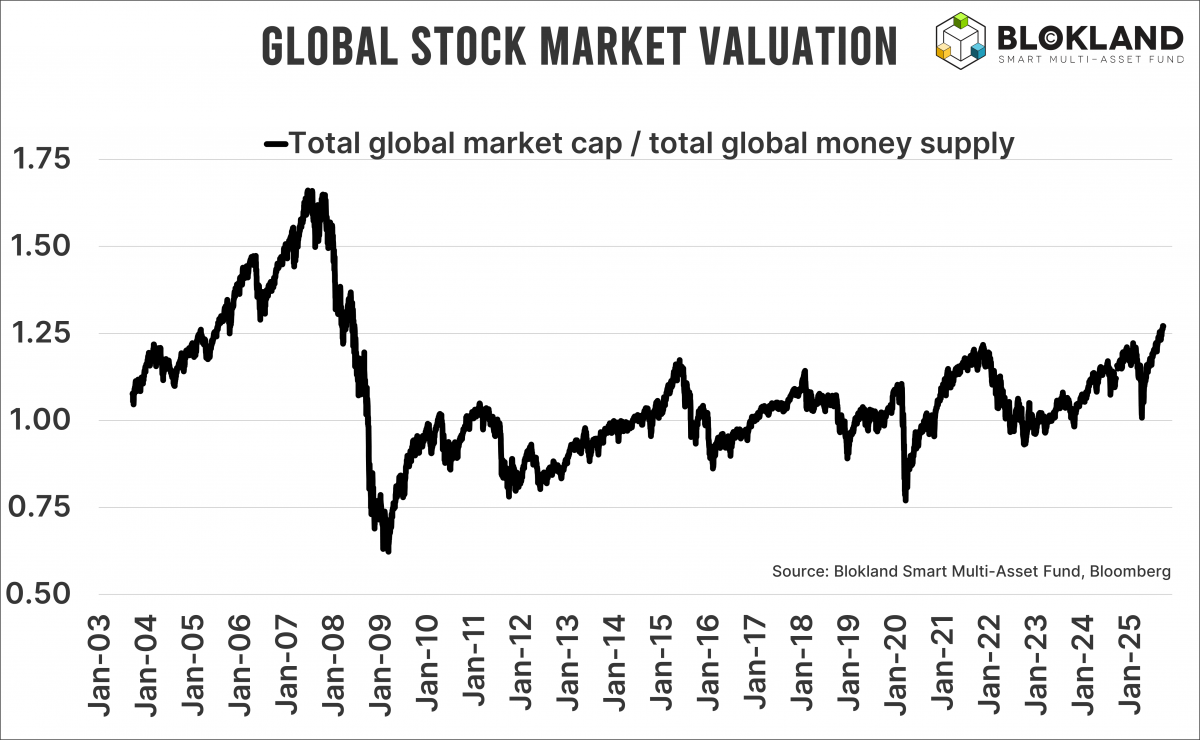

Of course I also take CAPE ratios, book values, and other traditional measures into account, but there is another valuation metric I like to look at that often remains underexposed: total market capitalization compared to the total money supply. The chart shows this ratio for stocks worldwide.

Monetary context

This measure works a bit differently from traditional valuation indicators. With price-earnings ratios or cash flow multiples, you mainly look at what you pay for a company’s profits, revenue, or cash flow. The ratio of market capitalization to money supply, on the other hand, shows at the macro level how value is created, preserved, or destroyed. Publicly listed companies, which ideally generate profits, offer an alternative store of value, while an ever-growing money supply continually dilutes the “value” of that money.

Traditional valuation metrics such as the price-earnings ratio focus exclusively on corporate fundamentals and cannot capture the broader monetary context. That includes situations where central banks relentlessly pump money into the economy, causing monetary inflation, which in turn drives up stock prices and with them the traditional valuation metrics. By factoring in the excessive money supply, you adjust stock valuations for the monetary and price-boosting regime. You get a more accurate ratio of equity as a scarce asset against an infinite amount of liquidity.

The chart shows that by this measure, valuations of listed companies worldwide are certainly not low, but at the same time not nearly as excessive as some market commentators would have us believe. Naturally, it is that same combination of monetary context and abundant money supply that ensures rates are not really that high, and in any case significantly lower than in 2000.

A crash is always possible

Stock markets can collapse almost anytime, even when nothing much is actually going on. How many times have equities already predicted recessions that never materialized? But to link the next crash purely to today’s valuations goes a bit too far for me, especially when you realize that the charts resemble 1998 more than 2000.

Jeroen Blokland analyzes striking, timely charts on financial markets and macroeconomics. He also manages the Blokland Smart Multi-Asset Fund, a fund that invests in stocks, gold, and bitcoin.