Equity markets in emerging countries extended their strong performance from the first six months of 2025 into the third quarter. Led by heavyweight China, as well as Colombia, Egypt, Peru, Thailand, and South Africa, the segment delivered a 10 percent return over the past three months. This strengthened emerging markets’ year-to-date outperformance compared with developed markets.

While the Morningstar EM TME Index gained nearly 11 percent over the first nine months, the Morningstar Global TME Index lagged with a rise of just over 4 percent.

This strong performance has not gone unnoticed by investors. After a 5.5 billion euro outflow last year from Europe-available funds in the Morningstar Global Emerging Markets Equity category, this year has seen renewed inflows. Thanks in part to four billion euro of new investor money in July alone, total inflows for 2025 have reached seven billion euro.

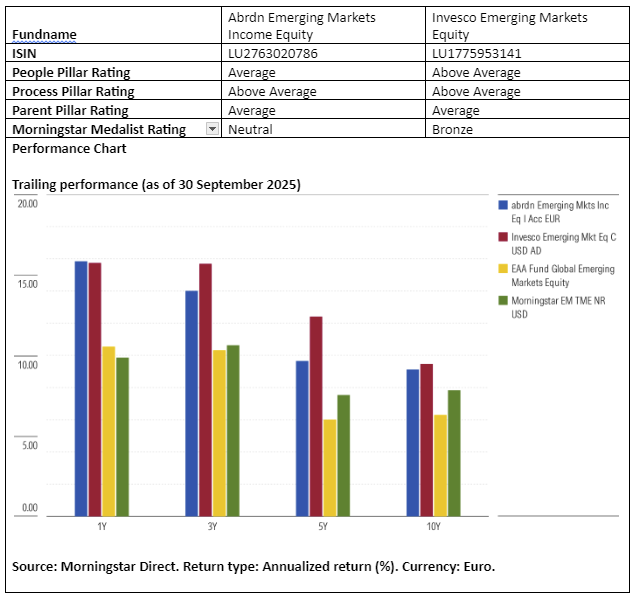

Against this backdrop, we take a closer look at two actively managed funds within the Morningstar Global Emerging Markets Equity category that are qualitatively rated by Morningstar analysts and saw the highest inflows in 2025. These are Invesco Emerging Markets Equity, which attracted an impressive one billion euro, and Abrdn Emerging Markets Income Equity, which followed at some distance with 151 million euro in inflows.

People

Both Abrdn Emerging Markets Income Equity and Invesco Emerging Markets Equity are run by experienced managers supported by larger teams. At Aberdeen Investments, the fund is managed by a four-person group led by Matt Williams, who has been lead manager since 2018 and involved with the fund since 2012. Williams and his team are seasoned investors who can draw on the resources of Aberdeen’s broader Global Emerging Markets team of fifty members. However, this team has been dealing with high staff turnover, undermining stability and expertise. As a result, the fund receives a People Pillar rating of Average.

In contrast, Invesco enjoys a more stable team structure and benefits from strong collaboration within the group. Charles Bond has managed the fund since 2020 and is supported by a cohesive team of ten analysts and managers in the Asia & Emerging Markets division. This group has worked together for many years and shares a common investment philosophy, promoting consistency and knowledge sharing across portfolios managed within this broader framework. Invesco’s team model ensures continuity and a structured approach, resulting in an Above Average People Pillar rating.

Process

Both Abrdn Emerging Markets Income Equity and Invesco Emerging Markets Equity follow a fundamental, bottom-up investment approach, but with different focal points. Both funds receive an Above Average Process Pillar rating.

Aberdeen focuses on quality and income, aiming to achieve a dividend yield of at least 115 percent of the MSCI Emerging Markets Index through a mix of high-dividend and dividend-growth stocks. The typical allocation between these two types of stocks is 50/50. The managers avoid young or financially distressed companies and focus on sustainable income. Williams maintains a risk-aware investment style and targets companies with strong quality traits such as high return on equity and low debt ratios.

Invesco’s strategy is characterized by strict valuation discipline and seeks stocks that trade significantly below their intrinsic value. Although the strategy was launched in 2019, it builds on a well-established approach that had long been used within the firm’s Asian mandates. The approach is style-neutral but tends to lean slightly toward value because of its contrarian philosophy. Stock selection is based on expected total returns over an investment horizon of more than three years. The initial screening focuses on factors such as liquidity and management quality, followed by fundamental research into financial data, key drivers of future earnings growth, competitive advantages, and valuations.

Portfolio

Abrdn Emerging Markets Income Equity is more broadly diversified, with around ninety holdings, compared to about fifty for Invesco Emerging Markets Equity. However, both strategies have a similar concentration in their top ten holdings, at around 40 percent. In both portfolios, the largest positions consist mainly of large, leading companies such as Taiwan Semiconductor, Tencent, and Samsung Electronics.

Aberdeen applies a core/blend strategy, placing the portfolio in the core column of the Morningstar Style Box, roughly in line with the style exposure of the Morningstar Global Emerging Markets Equity category and the Morningstar EM TME Index benchmark. In contrast, Invesco’s portfolio generally falls within the value column.

In terms of sector allocation, Aberdeen has relatively more exposure to industrials and technology than Invesco, while the latter is more tilted toward financial services and consumer sectors.

Performance

Both Abrdn Emerging Markets Income Equity and Invesco Emerging Markets Equity have delivered strong results relative to their benchmarks and peers. Aberdeen has shown consistent outperformance between 2012 and August 2025, the period during which Williams has been actively involved in the strategy. The fund benefited from rising markets but offered mixed downside protection during declines. Strong stock selection in India, Taiwan, Brazil, and Mexico supported the solid performance.

Invesco, under Bond’s leadership, has also achieved notable outperformance between 2020 and August 2025. The strategy provided investors with downside protection thanks in part to its focus on companies with solid balance sheets. The outperformance was largely driven by strong stock selection, particularly in South Korea, India, and Taiwan.

Ronald van Genderen is a senior manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.