Prudent risk management is vital in high-yield-bond investing. As this week’s Morningstar fund comparison shows, even strategies operating in the same corner of the market can diverge sharply when stress hits.

Global investors tensed up as several banks struggled in 2023, with flashbacks to 2008. In 2007 and 2008, warning signs started with the bankruptcy of subprime mortgage lender New Century Financial in April, and a Bear Stearns hedge fund that collapsed in June, followed by a bank run on British lender Northern Rock in September. By the end of 2008, Lehman Brothers, with more than 30 dollar of liabilities for each 1 dollar of capital, had sunk, and remains perhaps the most well-known failure of that time. 2023 played out quite differently though, partly because regulators were quick to intervene.

In March 2023, Silicon Valley Bank in the US collapsed, due to a textbook run on the bank. Smaller Signature Bank followed, a lender to the cryptocurrency industry. Then in May, First Republic failed, and across the ocean Switzerland’s UBS had to rescue its struggling rival Credit Suisse.

Over the longer term, many high-yield funds with exposure to these issuers have largely recovered, thanks in part to diversified holdings and sensible position sizing.

Over the longer term, many high-yield funds with exposure to these issuers have largely recovered, thanks in part to diversified holdings and sensible position sizing. We now take a closer look at two global high-yield bond funds, which have both held exposure to Lehman Brothers and Credit Suisse: Pimco GIS Global High Yield Bond and AB Global High Yield.

People

While both firms boast ample resources, leadership transitions and above-average analyst turnover have limited these funds People Pillar ratings to Average.

Pimco’s David Forgash took over this strategy, and the leadership of Pimco’s high-yield bond team, from his predecessor Andrew Jessop in 2023. He is supported by seasoned global credit specialist Sonali Pier, who oversees several high-yield mandates and the best-in-class multisector credit strategies, as well as European high-yield expert Charles Watford. The experienced trio are backed by extensive credit resources, including 65 corporate credit analysts and 13 distressed debt specialists, but a side-effect of the firm’s meritocracy is often above-average turnover.

AllianceBernstein’s (AB) quintet of managers specialize in different asset classes. Gershon Distenfeld, head of income strategies, and Matthew Sheridan, head of US multisector strategies, have been on the roster since 2005 and provide high-level input on the credit and asset-allocation side. Christian DiClementi, head of emerging-markets debt, and Fahd Malik, who manages several income-focused portfolios, joined the roster in 2021. William Smith, head of US high-yield, joined in 2022. They are backed by a 15-member quant team and 27-member analyst team. AB has replaced most of its departures by promoting internal talent, but many members of the new guard are still settling into their roles.

Process

Pimco’s rigorous fundamental research process, well supported by its expansive credit resources, earns an Above Average Process Pillar rating. Unlike other Pimco funds that express the firm’s macroeconomic themes with out-of-benchmark positions, this strategy mainly focuses on high-yield corporates, particularly the higher-rated end of that spectrum which offers some protection in credit selloffs. Its success depends largely on uncovering mispriced bonds with underappreciated fundamentals.

AB’s high-octane, multi-sector approach results in increased volatility that has not always paid off, thus earning an Average Process Pillar rating. It follows the same combination of quantitative and fundamental analysis as many of AB’s other fixed-income offerings. The process relies on the quant team to narrow the investment universe of securities, countries, and currencies before credit analysts analyze each issue from a fundamental perspective. The team employs derivatives (typically 5 percent to 20 percent nominal exposure) to manage the portfolios’ risk levels.

Portfolio

While the Pimco approach is tilted towards higher quality fare, the strategy doesn’t avoid the lowest-quality debt bucket entirely. The portfolio’s stake in bonds rated CCC or below has typically stayed below 6 percent since 2020, but the category’s average exposure can climb as high as 15 percent. The team is also sensitive to liquidity risk and can hold a sizable cash stake (historically between 3 percent and 12 percent of the portfolio), often paired with high-yield index credit derivatives (typically less than 10 percent of portfolio assets) to help offset the cash drag.

While the AB team mainly operate in high-yield corporate bonds, emerging-markets debt, and securitized fare, they will also venture into riskier, less-liquid segments of the market such credit-risk transfer deals, commercial mortgage-backed securities derivatives, and European bank contingent-convertible Additional Tier 1 bonds. As a result, their high-yield strategy can look very different from its more conservative peers. That said, these stakes have come down to single-digit territory over the past five years, as the managers scaled back following significant downside volatility during the coronavirus-driven selloff in 2020.

These funds, like many peers with track records that go beyond 15 years, still held bonds from Lehman Brothers a decade later in 2020, owing to its long liquidation process. This is less concerning than it might seem, as distributions continued to be made to senior noteholders from protected vehicles well into 2025. The funds also held Credit Suisse AT1 debt that was wiped out in 2023, but these exposures were reasonably sized which lessened the impact.

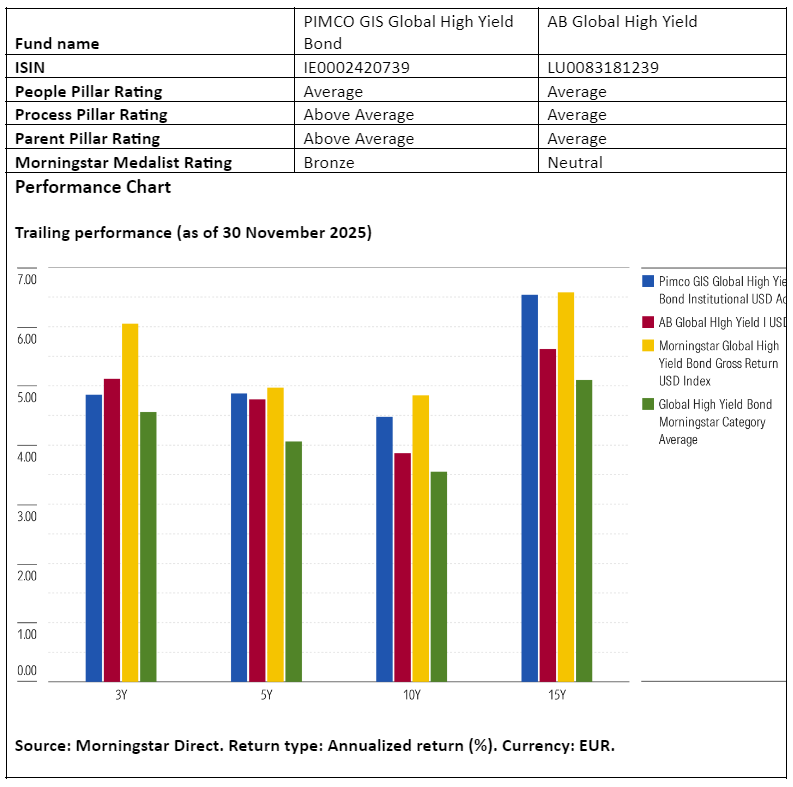

Performance

Pimco’s higher quality tilt typically behaves defensively during credit market selloffs like early 2020, protecting investors from drawdowns, but that can mean it lags during risk-on rallies. However, the team’s bond-picking prowess has helped it capitalize on rising credit markets as well—as was the case in 2017, and 2022’s and 2024’s fourth quarters.

AB’s penchant for risk has left the fund vulnerable in recent stress periods. It stumbled in 2018 as stakes in hard-and local-currency emerging-markets bonds were shaken by spill-over effects from the Argentina crisis, and it struggled again in early 2020 due to stakes in niche asset classes such as credit-risk-transfer deals and European AT1s. In 2024, the strategy fared better, propelled by off-benchmark positions in bank loans and collateralized loan obligations, which continued to recover from the 2023 banking selloff.

Jeana Marie Doubell is investment analyst fixed income EMEA at Morningstar. Morningstar is a member of the panel of experts at Investment Officer.