Allocation managers overweighing eurozone stocks have done well so far this year while currency management and off-benchmark exposures like gold have also moved the needle for some. After withdrawals over the previous two calendar years, allocation funds in Europe saw modest inflows over the first three quarters of 2025.

Morningstar’s Developed Markets Europe index is up 13.1 percent in the year to date through September 2025 whereas the Morningstar Developed Markets ex-Europe equity index posted a modest 1.9 percent gain. The latter accounts for roughly 30 percent of the Morningstar Euro Moderate Global Target Allocation index, which is made up of 50 percent stocks and 50 percent bonds and serves as a yardstick to evaluate the two strategies in focus. Bond returns are in positive territory so far this year (Morningstar Eurozone Core Bond +1 percent and Morningstar Global ex-Eurozone Core Bond +2.6 percent).

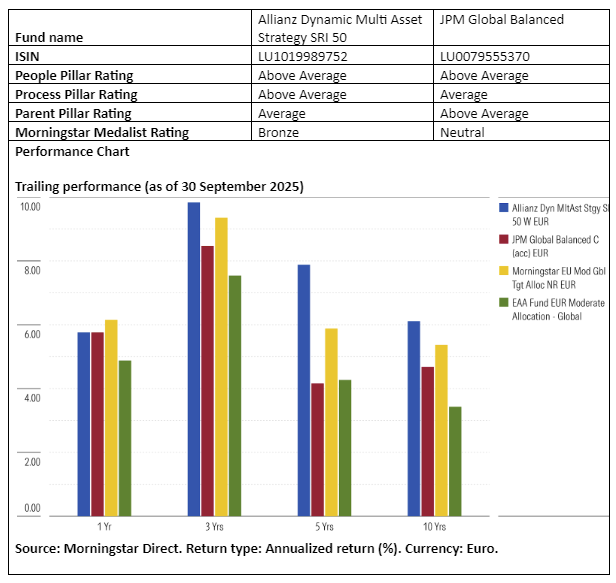

Against this backdrop we take a closer look at two analyst-rated funds in the EUR Moderate Allocation – Global Morningstar Category: Allianz Dynamic Multi Asset Strategy SRI 50 and J.P. Morgan Global Balanced. Allocation funds seek to provide both income and growth by investing in a combination of stocks, bonds, and cash in a single portfolio.

People

Lead manager Marcus Stahlhacke has been at the fund since 2015 but has extensive previous experience from multi-asset investing at AllianzGI, which he joined in 1996. The AllianzGI veteran has multiple other portfolios to tend to as well, but we take comfort that he can lean on two comanagers: Andreas de Maria Campos (since 2015) and Maren Ebert, who took over from Friedrich Kruse on July 1, 2024. Kruse is on extended parental leave but is expected to rejoin the team. In addition, the team can lean on the views of several experienced multi-asset investors who give their input through a fundamental investment council.

The J.P. Morgan fund benefits from an experienced and stable portfolio management team. The three named portfolio managers—Gareth Witcomb since 2010 and Katy Thorneycroft and Jonathan Cummings since February 2018—are in charge of execution, though this is a team approach that benefits from the inputs of J.P. Morgan’s sizable multi-asset team.

Both teams can mostly focus on asset allocation and risk management, since security selection within stocks and bonds is outsourced to well-resourced in-house specialist teams. For example, Allianz’s experienced quantitative equity team fills the equity bucket with its ‘Best Styles’ portfolio with an SRI twist, while J.P. Morgan’s equity sleeve is run by teams within J.P. Morgan’s regional equity groups (US, Europe, Japan, and emerging markets/Asia-Pacific). The two funds earn Above Average People ratings.

Process

The AllianzGI fund has a distinctive asset-allocation process that does not come without risks: The team can push market exposure to 125 percent based on a quantitative analysis of market trends and reversals as well as a fundamental analysis. It has used this leeway regularly, and this has helped to outperform peers. When market sentiment turns negative, a strict risk-control mechanism forces the team to lower its market exposure to as low as 65 percent, such as at the end of March 2022. The fund should have a three- to five-year volatility between 6 percent and 12 percent, which corresponds with a long-term equity weighting of 50 percent on average. It earns an Above Average Process rating.

At J.P. Morgan Global Balanced, active asset-allocation calls are generally more modest and tend to have a short- to medium-term horizon, resulting in tactical tilts of the stock/bond ratio relative to the 50/50 neutral level, as well as regional and sector over- and underweightings via futures within equities. The team’s approach has merits and refinements have been made over the years, but it does not stand out, warranting an Average Process rating.

Portfolio

On top of an SRI best-in-class equity portfolio with factor tilts (above 70 percent of assets at times) and global bonds hedged to euros sleeve, the team at AllianzGI can add “satellite” investments and alternatives. This sleeve typically includes return enhancers like emerging-market equities or high yield, but the team has also added portfolio diversifiers such as catastrophe bonds and gold.

Equity selection at J.P. Morgan’s fund is delegated to several dedicated teams responsible for equities in the US, Europe, Japan, and emerging markets/ Asia-Pacific. Each team runs independently with different investment styles. The global sovereign-bond sleeve is hedged in euro, tends to have a defensive bias and serves mainly as ballast to the portfolio. Relative value currency plays are primarily driven by quant inputs.

Performance

J.P. Morgan Global Balanced has comfortably outperformed its category peers over multiple time periods. Despite the fund’s higher volatility and drawdowns, its risk-adjusted returns ranked in the category’s 17th percentile over the trailing 10-year period through September 2025. Beating the Morningstar Euro Moderate Global Target Allocation index proved more challenging and contributions from active asset-allocation calls have historically been muted.

As is typical for processes leaning on trend analysis, the AllianzGI strategy tends to struggle at inflection points and in whipsawing markets. However, strict risk controls force the team to increase the cash position after losses, with cash going up to around 33 percent for the SRI50 fund in March 2022. Bull markets are longer than down markets, and the team has tended to be quick to move its chips back into the market after downturns, a trait that has supported the fund’s strong long-term performance.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.