Corporate bonds, particularly high yield bonds, had a strong 2025 but portfolio managers remain cautious going into 2026.

Global corporate bonds delivered broadly positive returns in the fourth quarter of 2025, supported by improving risk sentiment, falling short-term US Treasury yields, and resilient corporate fundamentals. High yield bonds outperformed investment grade bonds overall, although lower-rated CCC debt lagged as investors showed reduced appetite for the riskiest segments. Credit default expectations for 2026 remain moderate, with most forecasts broadly in line with historical norms. Corporate issuers benefited from a resilient economic backdrop, although weakening labor indicators and persistent but not high inflation created uncertainty.

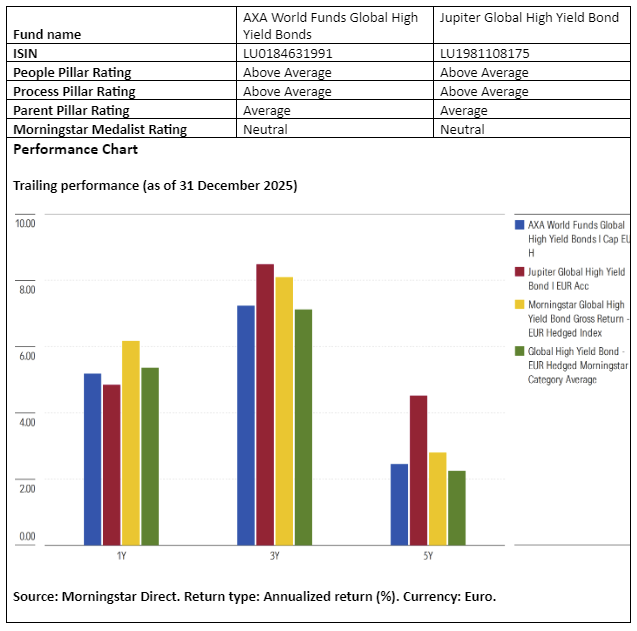

Managers generally maintain a selective approach, favoring resilient balance sheets, cautious positioning toward rich valuations, and close monitoring of refinancing risks. Against this backdrop, we consider two analyst-rated funds in the Morningstar Category global high yield bond: AXA Global High Yield Bond and Jupiter Global High Yield Bond.

People

While both funds earn Above Average People Pillars by demonstrating experienced leadership and robust analyst support, Jupiter relies more heavily on their skilled lead manager, whereas AXA’s team structure is more diversified and collaborative.

Jupiter’s Global High Yield Bond strategy is led by Adam Darling, who has managed the fund since launch in 2019 and brings 24 years’ experience spanning private equity, corporate finance, and project finance. He is supported by senior fixed-income colleagues Ariel Bezalel and Harry Richards and a team of ten sector-dedicated analysts. However, neither Bezalel nor Richards are named managers here, introducing some key-person risk.

In contrast, AXA’s strategy is run by a collaborative team; Michael Graham, Robert Houle, and Yves Berger are all long-standing members of AXA’s US and European high-yield platforms. The trio are very familiar with the investment process as well, having worked with the strategy’s previous managers for over a decade. The group’s fourth manager, Chris Ellis, joined in 2022 to deepen European expertise. The team is further supported by a thirteen-person analyst team across the US and UK.

Process

Both funds receive Above Average Process Pillars ratings but exhibit different strengths. Jupiter’s approach is more flexible and considers macro views, whereas AXA’s approach is more valuation-driven, income-focused, and structured.

Jupiter applies a high-conviction, benchmark-agnostic process built on both top-down macro and bottom-up credit analysis. Target alpha attribution is split roughly 30 percent macro / 70 percent bottom-up. The manager actively adjusts duration and risk appetite based on economic views (growth, inflation, central bank policy). Security selection focuses on bonds with attractive spreads and improving credit trajectories. The fund may deviate significantly from benchmark exposures across rating buckets, sectors, and countries, and uses derivatives for risk positioning.

AXA follows a bottom-up, income-oriented, buy-and-hold process, emphasizing predictable business models, improving credit profiles, and stable cash flows. A defining feature is its barbell approach, combining short-dated bonds (to control volatility) with higher-risk B and CCC exposures that offer higher spreads. Regional allocation generally stays within plus or minus 10 percent of its US-heavy benchmark, though valuation considerations drive relative shifts. The strategy formally integrated Article 8 ESG exclusions since 2021, which had minimal impact given pre-existing ESG considerations from before the formal designation.

Portfolio

Jupiter’s portfolio is often more geographically diversified and can exhibit some contrarian bets, while AXA’s portfolio is more focused on credit risk and tighter duration management, with a preference for shorter-maturity bonds.

Jupiter’s portfolio typically holds 100 to 200 issuers, with meaningful deviations from its ICE BofA Global High Yield Constrained Index. The fund maintains a persistent underweight in BB-rated bonds (seen as expensive and efficiently researched) and a significant overweight in B-rated issuers, where the manager perceives greater mispricing opportunities. It also holds a large underweight in North America (around 30 percent) and a corresponding overweight in Europe (around 20 percent), driven by valuation and bottom-up considerations. Duration has been actively managed: from 2019 to 2021 the fund ran a 1 to 2 year underweight, but by July 2025 duration was around 3.1 years, aligned with the benchmark. In recent years, sector exposures favor energy (not on macro grounds, but due to idiosyncratic opportunities), as well as defensive, cash-generative sectors; underweights include consumer discretionary and real estate.

AXA’s portfolio is more weighted toward lower-rated credits, with 40 to 50 percent in B-rated and 10 to 15 percent in CCC or below. Duration is usually underweight versus the ICE BofA Developed Markets High Yield Index, though more recently credit risk was added selectively. AXA is more US-dominated (with around 70 percent exposure), in line with its benchmark, with some smaller allocations to Europe. In recent years, sector positioning has emphasized services, technology, capital goods, and leisure, while avoiding highly cyclical or structurally challenged areas like telecoms, utilities, retail, and real estate.

Performance

The AXA strategy has delivered consistent outperformance versus its average peer and benchmark over the longer term, with security selection acting as the primary driver. Still, in 2020 it slightly lagged peers owing to underweights in energy during a late-year rally, but outperformed strongly in 2021 and 2022 through defensive duration positioning and effective selection in areas such as real estate, healthcare, and high-yielding segments. More recently, in 2024 and 2025, returns have been mixed, owing to certain sector underweights and cash positions, which dragged.

Jupiter’s fund has produced superior absolute and risk-adjusted returns since its 2019 inception, across diverse market conditions, largely thanks to skilled credit selection. Supportive contributions also came from sector allocations and duration calls from 2020 through 2023. In 2024, sector allocations shone with an overweighting in financials and consumer staples, alongside an underweight duration stance contributing handsomely. 2025’s results were more muted, though, owing to an underweight to US rates in the second quarter, an overweighting in energy, and an underweight allocation in financials.

Jeana Marie Doubell is investment analyst fixed income EMEA at Morningstar. Morningstar is a member of the panel of experts at Investment Officer.