Listed real estate has become one of the most conspicuous laggards in global markets. After four consecutive calendar years of underperformance against the MSCI World, valuations now sit below their historical median relative to broader equities, according to Cohen & Steers.

Regional differences matter in listed real estate. While the global sell-off was broadly similar in 2020, though slightly less severe in Europe, 2022 proved far more damaging for European markets: the Morningstar Developed Market European Real Estate index fell nearly 37 percent, compared with losses of about 21 percent in the US and 11 percent in APAC. Since then, correlations between regions have remained low. In 2025, listed real estate outside the US outperformed. Within the US, dispersion across subsectors was meaningful, with health care outperforming data centers by more than 40 percentage points, despite the massive AI-driven capex.

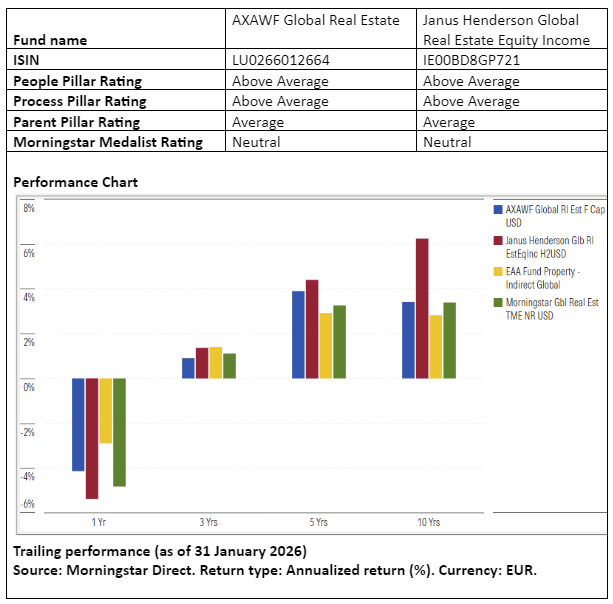

Against this backdrop of compressed valuation and widening regional dispersion, active management has become more consequential. We examine two analyst-rated strategies in the Property – Indirect Global Morningstar Category, comparing the Janus Henderson Global Real Estate Equity Income fund against AXAWF Global Real Estate.

People

Both teams earn Above Average People ratings.

Despite its relatively small size, we believe the managers at Janus Henderson skillfully leverage the firm’s regional structure which allows team members to develop local expertise and facilitates due diligence. Guy Barnard and Tim Gibson have run the fund since June 2017 and sit in London and Singapore, respectively. Their experience running real estate strategies precedes their record here, and they’ve amassed an impressive record steering Janus Henderson Horizon Global Property Equities since 2008 and 2014, respectively. Greg Kuhl joined the management roster in March 2019 and is based in Chicago. The three managers are supported by a six-person analyst team spread across these locations.

Frédéric Tempel has headed AXA IM’s listed real estate team since 2003. Tempel’s people management and strategic responsibilities have increased over the years, prompting him to delegate more investment decisions. In May 2022, Salma Baho was promoted to lead manager here, with Tempel staying on as co-manager. The stable team around Tempel includes four other managers organized by region (Europe, America, and Asia) but unlike Janus Henderson, they are based in Paris. The managers are supported by a team of five analysts, and further inputs are gained from AXA IM’s team dedicated to direct real estate.

Process

Tempel and Baho focus on stock selection and generally favor better-quality stocks, screening out companies that, in their view, have weak corporate governance practices or poor balance sheets. The fundamental analysis then focuses on business durability, valuation, and the identification of catalysts. Net asset value, dividends, and cash flow yield are metrics typically used for the valuation part. This is a proven process and execution has been nifty and consistent, justifying a Process Pillar rating of Above Average.

Janus Henderson’s high-conviction global real estate portfolio also leans on an approach rooted in bottom-up stock selection. With an expansive universe of more than 500 stocks, the team first screens out up to 80 percent of the names based on valuation analysis that emphasizes different metrics across regions. The remaining candidates go through a quality scorecard framework, driven primarily by the team’s qualitative evaluations of a company’s management team, asset quality, and balance sheet, among other considerations.

Portfolio

Barnard, Gibson and Kuhl run a concentrated, high-conviction portfolio that’s meaningfully different from the FTSE EPRA Nareit Global Index. The fund’s active share relative to the benchmark usually sits near or above 70 percent, indicating that more than two-thirds of the portfolio differs from the index. This stands in contrast with AXA’s portfolio that saw its active share decline to 44 percent more recently from nearly 60 percent in 2022. The Janus Henderson portfolio is more concentrated with 44 individual holdings versus 74 for AXA at the end of last year. Before 2012, AXAWF Global Real Estate had more than 100 holdings.

AXA’s risk report shows stock-specific risk dominates overall portfolio risk. This is by design as the team wants to create alpha from stock picking. Country or sector over- and underweightings tend to be modest whereas Janus Henderson’s overweight to the US totaled more than 15 percentage points at the end of 2025. The two share several top holdings, including Welltower, Prologis and Digital Realty, but Janus Henderson’s portfolio contains no German residential names, while stock selection in Japan also differs markedly.

Performance

Since Gibson and Barnard took the reins in June 2017 through January 2026, Janus Henderson Global Real Estate Equity Income returned 5.5 percent annually, outperforming its category peers as well as AXAWF Global Real Estate’s 3.2 percent return. Results have been fairly consistent as well, though periods of underperformance have typically occurred when markets were driven more by top-down elements and less by valuation.

AXA also struggled in the more macro-driven environment of late. However, from the start of Frédéric Tempel and Salma Baho’s tenure in January 2009 through the end of January 2026, the strategy delivered an annualized return of 8.3 percent, outperforming its global property indirect peer group by 1.1 percentage points per annum.

In 2025, the fund posted a loss of nearly 6 percent, placing it in the 74th percentile of its category in one of its weakest relative calendar years. Performance was slightly worse than that of Janus Henderson, which also trailed its peer group.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.