The US high yield bond market returned 7.4 percent for 2025 through October (per Morningstar’s US High Yield Bond Total Return USD Index), outpacing the leveraged loans market’s 4.9 percent return (Morningstar LSTA US Leverages Loans Total returns USD Index). This year’s underperformance stands out, due to several high-profile blowups such as Tricolor and First Brands.

The US leveraged loans market has grown rapidly over the last decade, reaching 1.3 trillion dollar in 2025. The US high-yield market, for comparison, has come down from its 2 trillion dollar peak in 2021, to roughly 1.5 trillion dollar in 2025. Given that the bulk of issuers that issue loans will also issue high-yield bonds, some portfolio managers may consider bank loans as a relative value alternative for high-yield issuance, mandate permitting. Ucits funds are typically restricted to no more than 10 percent exposure to bank loans or CLOs though, and exposures exceeding 5 percent are rare.

The year in leveraged loans was partly characterized by some major incidents. Thus far though, these remain stand-alone events and do not signal broader sector issues for subprime auto lenders. Even so, the occurrences have led to increased scrutiny in the sector, leaving some high-yield investors more cautious on loans for now.

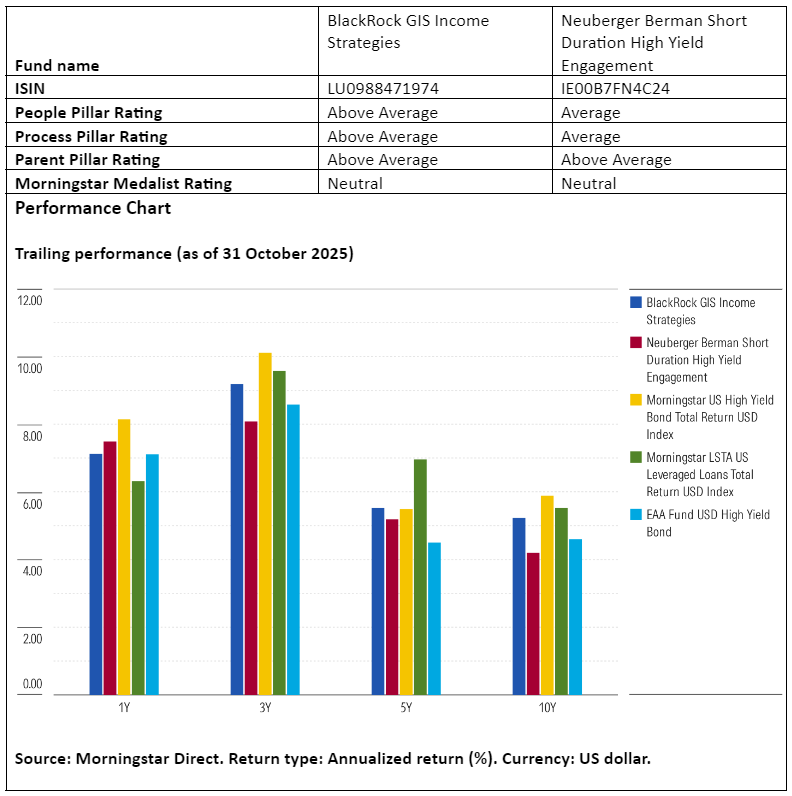

We now take a closer look at two analyst-rated funds with above-average exposure to leveraged loans in the Morningstar USD High Yield Bond Category: BlackRock GIS Income Strategies and Neuberger Berman Short Duration High Yield Engagement.

People

This Blackrock strategy benefits from three experienced portfolio managers with complementary skills and a deep analyst bench, earning an Above Average People Pillar rating. Head of bank loans, Carly Wilson, has led the fund since 2018 and is the day-to-day manager for the strategy’s loan segment. Co-heads of US leveraged finance, David Delbos and Mitchell Garfin, manage the high-yield segment. The trio has worked together since 2009 and collaboratively implement macro themes and asset allocation, supported by more than 15 US leveraged finance analysts and a further four loans specialists.

Neuberger Berman comanagers Joe Lind and Chris Kocinski are no longer new to this strategy, but they still have more to prove—earning an Average People Pillar rating. Lind joined in 2018 from Polen Capital and Kocinski was promoted in 2019 to comanager from the head of below-investment-grade research. Since then, the fund had two experienced co-managers retire. The research-heavy approach they follow requires substantial credit resources, which they get from a stout cast of 28 non-investment-grade analysts and seven traders covering both bonds and loans. While the right pieces are in place here, the current cohort has yet to find their groove.

Process

The Blackrock team follows a robust approach that makes the most of their corporate credit capabilities and risk-management resources, earning an Above Average Process Pillar rating. While Wilson, Garfin, and Delbos collaborate on top-down allocation calls, the emphasis is primarily placed on bottom-up security selection, and the managers leverage Blackrock’s large team of dedicated analysts and traders to populate the portfolio with loans and high-yield bonds from the bottom up. Fundamental research includes qualitative items such as industry assessment, competitive position, and management quality, as well as quantitative components like balance-sheet strength and free cash flow generation.

The Neuberger Berman team follows a value-driven strategy that is built on fundamental, bottom-up credit selection. But it has undergone a few tweaks in recent years that are still coming together, earning an Average Process Pillar rating. The team added flexibility to hold bonds through debt restructurings when they see a clear path to solid recovery value levels, a lever already available to most of their rivals like Blackrock. They also implemented stricter guardrails around single-issuer active weightings to reduce the impact of potential credit stumbles.

Portfolio

The Blackrock team maintains a minimum 80 percent exposure to US-domiciled issuers, while the portfolio’s split between high-yield bonds (typically 50 percent-60 percent of assets) and loans (typically 35 percent to 45 percent) is informed by relative valuations and the desired level of overall market risk. The team usually invests in larger, more liquid high-yield bond issues. Within the loan allocation, they typically prefer issuers which issue both loans and high yield bonds, and have a bias toward seasoned loan issuers with proven trackrecords of paying their debts.

The Neuberger Berman strategy focuses primarily on BB and B rated debt. The managers avoid non-US-dollar debt and credit derivatives but have the flexibility to hold up to 10 percent in senior secured bank loans (often kept around 3 percent to 6 percent). The fund is further constrained to bonds with shorter maturities and the portfolio’s duration (a measure of interest-rate sensitivity) will typically stay below 3 years to help contain risk. Furthermore, the fund excludes roughly 20 percent of issuers via an ESG and sustainability framework.

Neither fund was impacted by the deterioration of auto lenders Tricolor or First Brands.

Performance

The Blackrock strategy’s long-term performance is strong, but its relative ranking for any given period is largely dependent on the performance differential between high-yield bonds and bank loans, given its custom benchmark of 60 percent Bloomberg US High Yield 2 percent Issuer Capped Index and 40 percent Morningstar LSTA Leveraged Loan Index. The fund’s loans allocation is the biggest in the peer group but often acts as a buffer during periods of market turbulence (such as 2022), helping blunt losses amid rates volatility or when high-yield markets sell off (2020). It can also hold the fund back, like in 2025, when loans’ returns have lagged high yield bonds.

Neuberger Berman strategy’s relative performance profile is driven by multiple niches, creating a complex returns profile. Its short-duration bias provided investors with an extra cushion when rates skyrocketed in 2022, but its higher quality bias held it back in 2024 when credit risk was rewarded. The fund does not list an official benchmark in its prospectus.

Jeana Marie Doubell is investment analyst fixed income EMEA bij Morningstar. Morningstar is lid van het expertpanel van Investment Officer.