Amundi and BNP Paribas pursue scale and expertise through mergers, but integration challenges create uncertainty over long-term benefits for investors, writes Morningstar’s Elbie Louw in this week’s Expert Panel contribution.

Large-scale mergers and acquisitions among asset managers, such as those involving Amundi and BNP Paribas, are typically driven by strategic goals. These generally include achieving greater economies of scale, expanding into new markets, acquiring specialized investment expertise, or positioning the firm as a comprehensive provider of investment solutions.

While these objectives are ambitious, the practical benefits for investors can vary, and the integration process often presents significant challenges. The process can become complicated by differences in corporate culture, leadership changes, talent retention issues, and the need to rationalize overlapping products. In some cases, increased scale may even hinder performance of strategies rather than improve it.

Parent case studies

Both Amundi and BNP Paribas are themselves the results of mergers. BNP Paribas was formed in 2000 through the combination of BNP and Paribas, while Amundi emerged in 2010 from the merger of Crédit Agricole AM and Société Générale AM. Both firms currently have a Morningstar Parent Pillar rating of Average.

Amundi

Amundi’s notable acquisitions include Pioneer Investments in 2017 and Lyxor Asset Management in 2022. The Pioneer acquisition enabled Amundi to strengthen its presence in European markets and enhance its expertise in European and US equities and multi-asset strategies. The Lyxor acquisition, which was integrated with minimal disruption, expanded Amundi’s passive investment offerings, making it the second-largest provider of exchange-traded funds (ETFs) in Europe.

Following these acquisitions, Amundi undertook several reviews of its fund lineup. The merger with Pioneer coincided with broader efforts to consolidate the product offering; all said, a third of products under the Amundi Funds umbrella were closed or merged. At the time of the Pioneer merger, the firm also opted to restructure its investment teams around platforms, selecting leaders from both Amundi and Pioneer. Staff reductions followed as Amundi reduced its overall workforce by about 10 percent in 2017, though Pioneer’s US teams remained mostly intact due to their complementary strengths. Investment staff turnover was higher, reaching 15 percent, mainly because of overlapping roles in European equities and fixed income, and limited scale in Asia.

The firm also saw several notable voluntary departures. For instance, the European small- and midcap equity team, which runs the European Small Companies strategy, saw multiple changes, departures, as well as team reorganizations.

Before acquiring Pioneer in 2017, Amundi had a Below Average Morningstar Parent Pillar rating, mainly due to short portfolio manager tenures, questions around product oversight, and a lackluster active fund range. The upgrade of the Parent Pillar rating to Average in early 2018 (and where it remains today) was supported by improvements in the firm’s stewardship practices and progress in integrating Pioneer’s investment teams.

Meanwhile, the integration of Lyxor has been a success and Amundi’s passive products are some of the cheapest and most efficient out there. But we believe Amundi could do more to pass on its large economies of scale to investors in the form of cheaper fee classes on its active fund range.

BNP Paribas

BNP Paribas acquired AXA Investment Managers for 5.1 billion euros in July 2025, positioning the combined entity as the second-largest asset manager in Europe. But long-term benefits for investors remain uncertain. The integration process of investment staff and support functions is ongoing but staff turnover has remained within typical levels so far. But retaining top talent may become more challenging as roles are redefined.

Both firms have emphasized sustainable investing and overlap on their listed equity capabilities. However, BNP Paribas has a strong footprint in passive funds, while AXA IM is recognized for its expertise in alternative investments such as real estate and private credit. On the other hand, BNP Paribas has a history of launching several products, with some niche offerings struggling to gain scale.

Although the complete structure of the new leadership team has not been finalized, BNP Paribas AM has revealed that Sandro Pierri, its current CEO, will lead the expanded organization. Meanwhile, Marco Morelli, who presently serves as executive chairman at AXA IM, will chair the group’s asset management operations. Prior to the acquisition, both AXA IM and BNP Paribas had a Parent rating of Average, where it remains post the announced merger.

While mergers and acquisitions can create new opportunities, it also introduces uncertainty. Staying updated on developments during periods of organizational change including changes to fund offerings (closures and mergers), shifts in leadership and investment team structures, retention of key investment team members and the overall impact of fund performance, remain key.

Morningstar medalist ratings

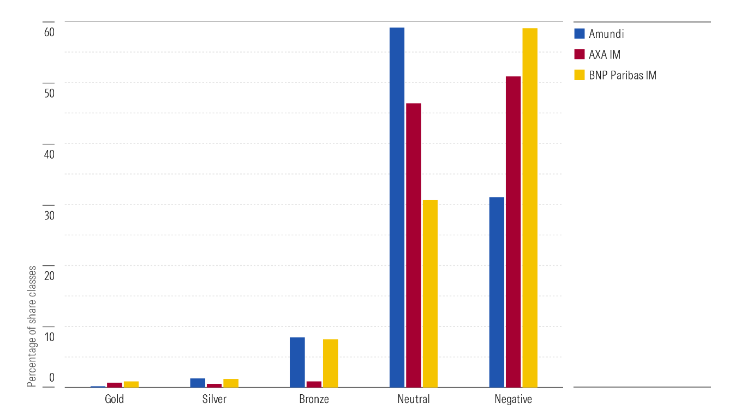

This graph compares the Morningstar Medalist Ratings of Amundi, AXA IM, and BNP Paribas. This universe includes all funds and share classes with a Morningstar Medalist rating (whether they are algorithmically driven or analyst-rated).

Elbie Louw, CFA, CIPM, is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.