During the third quarter of 2025, investors who assumed moderate credit and duration risk were rewarded, as the European Central Bank kept interest rates unchanged at its July and September meetings, while the US Federal Reserve cut rates once in September.

Credit markets were buoyed by strong company fundamentals, which helped already tight credit spreads compress further. Solid corporate earnings released over the quarter, backed by attractive yields, helped boost year-to-date returns through September to 5.3 percent, as measured by Morningstar’s Global High Yield Bond – Euro Hedged Index.

While the impacts of US tariffs appear to have been absorbed by a combination of companies and consumers thus far, certain sectors remain more at risk. These include the retail and automotive sectors, as the latter is also facing competition from Chinese electric vehicle makers, which often offer more advanced technology at lower prices. With support for sustainability and climate policies under pressure in the US, oil and gas companies have gained. Together with Europe’s renewed focus on defence spending and access to commodities, this leaves global high-yield managers operating within environmental, social and governance (ESG) frameworks with their work cut out for them this year.

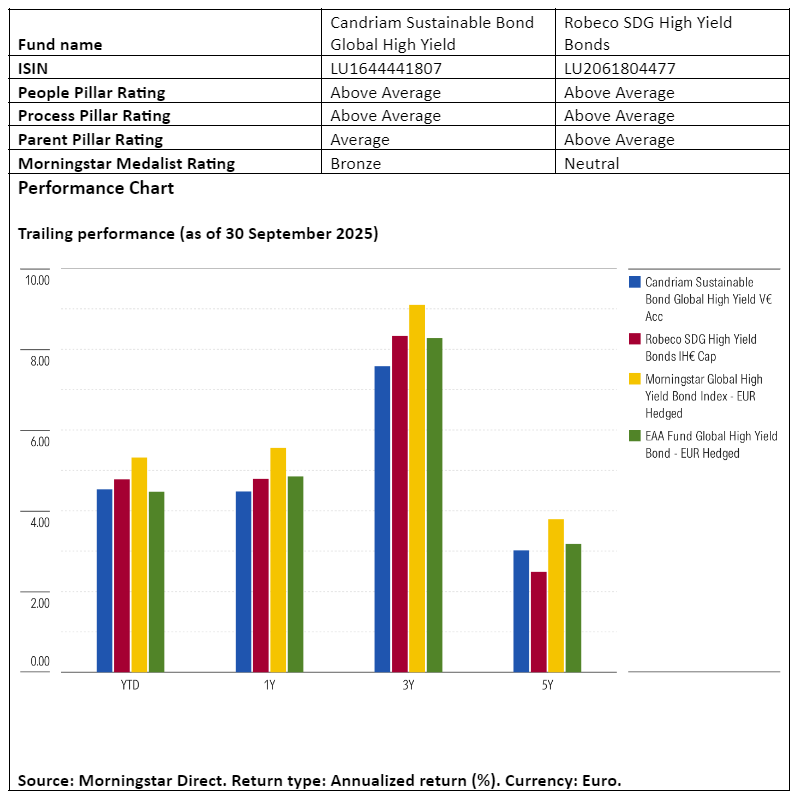

Against this backdrop we take a closer look at two analyst-rated funds with ESG considerations in the Morningstar Global High Yield Bond – Euro Hedged category. Candriam Sustainable Bonds Global High Yield and Robeco SDG High Yield Bonds both receive Above Average People and Process Pillars.

People

Thomas Joret has led the Candriam fund since May 2019, having served as comanager since its inception in 2017. Joret has demonstrated distinct skill in security selection and portfolio construction over that time, with no defaults in the portfolio. He is closely supported by comanager and head of high yield, Nicolas Julien. Comanager Jean-Claude Tamvakis and five experienced high-yield credit analysts complete the tight-knit group, together demonstrating savvy risk management and solid security picks. This strategy also benefits from the support of a 17-member ESG corporate analyst team.

Lead manager Christiaan Lever and comanager Sander Bus have successfully run the Robeco strategy since its October 2019 inception. Roeland Moraal and Daniel de Koning were formally named as additional co-managers in 2023. The full roster has ample support from a typical 23-member credit analyst team across Robeco’s Rotterdam, London, New York, and Singapore offices. However, the team suffered 10 departures from mid-2023 through mid-2025. Although the departures were backfilled, the new cohort may need some time to settle into their roles.

Process

Candriam’s process is mainly focused on bottom-up security selection within a subset of the high-yield investment universe constrained by ESG criteria. The team uses stringent ESG screens and a proprietary assessment model to identify issuers with the best ESG profiles, avoiding the riskiest ESG profiles. That, together with a further avoidance of financial issuers and securities with the lowest credit ratings (CCC and below), results in a fine-tuned and risk conscious approach. The disciplined approach means that the team does not hesitate to take profits when prices rise or to dissolve losing positions if stop-loss limits are reached.

Robeco’s process focuses on solid execution of a careful, value-aware approach, combined with a sustainability overlay. The team often favors issuers from the higher-quality BB-rated end of the spectrum and crossover credits from issuers with good fundamentals. Only issuers that Robeco’s sustainability analysts assess as making a neutral or positive contribution to the UN Sustainable Development Goals (SDGs) under the firm’s proprietary SDG framework and that also meet the Paris-Aligned Benchmark criteria are eligible for investment.

Portfolio

While non-financial benchmarks gained popularity among high-yield funds after the 2008 global financial crisis, many competitors still maintain sizable off-benchmark positions in that sector or tap into CCC-rated fare for a yield pickup. The Candriam team does neither against its ICE BofA BB-B Non-Financials Global High Yield Index. They will however use a 20 percent allowance for off-benchmark allocations to investment-grade debt, as they did in 2022 when they were wary of interest-rate volatility and low market liquidity. In line with its ESG orientation, the portfolio has held no exposure to energy companies for nearly three years, compared with the benchmark’s 15 percent weighting.

The Robeco strategy is benchmarked against the Bloomberg Global High Yield Corporate Index, which includes roughly 25 percent of financials and emerging-markets credits. Like the Candriam portfolio, this fund typically has a large underweighting to energy owing to the poor sustainability scores of issuers in the sector, and roughly 15 percent is generally held in off-benchmark investment-grade debt. The remaining sector positioning is mostly driven by bottom-up selection.

Performance

The managers’ preference for higher-quality companies and their cautious approach toward riskier areas of the market, such as CCC-rated debt, have proven advantageous in times of stress. This discipline helped both strategies weather major downturns, including the coronavirus-driven selloff in 2020 and Russia’s invasion of Ukraine in 2022. However, those same characteristics can hold the funds back when credit markets rally, such as in the second half of 2020 or 2023.

More recently, in 2024, the Candriam portfolio uncharacteristically ranked in the bottom quartile of its peer group. This was largely due to its exclusion of U.S. gas producer Venture Global and oil majors such as Mexico’s Pemex and Brazil’s Petrobras, which benefited from falling inflation and a recovering global economy. For Robeco, despite the positive impact of underweights in troubled French telecom Altice and technology company Atos, the fund was dragged down by overweight stakes in Luxembourg-based packaging company Ardagh, UK utility Thames Water, and Dutch food company Selecta, which faced possible restructurings.

Over the longer term, we expect strong security selection to play a big part in keeping these strategies competitive with non-ESG peers.

Jeana Marie Doubell is investment analyst fixed income EMEA bij Morningstar. Morningstar is lid van het expertpanel van Investment Officer.