Global flexible bond strategies cover a wide range of different approaches. Given that complexity, investors should treat them with caution.

The Morningstar Global Flexible Bond Category encompasses a diverse range of strategies that do not share a core set of characteristics as found in more narrowly defined Morningstar categories. Funds in this category often have a distinct objective or utilize a comprehensive toolkit. The latter allows managers considerable flexibility in the use of derivatives, currency and sector exposures, and significant discretion in interest-rate positioning—including the potential for negative positions. As a result, comparisons with peers and category benchmarks can be more nuanced, reflecting the diverse objectives and range of tools that managers may employ. Appropriate comparisons require a deeper understanding of each strategy’s objectives, asset allocation, and risk budget to accurately identify truly similar funds.

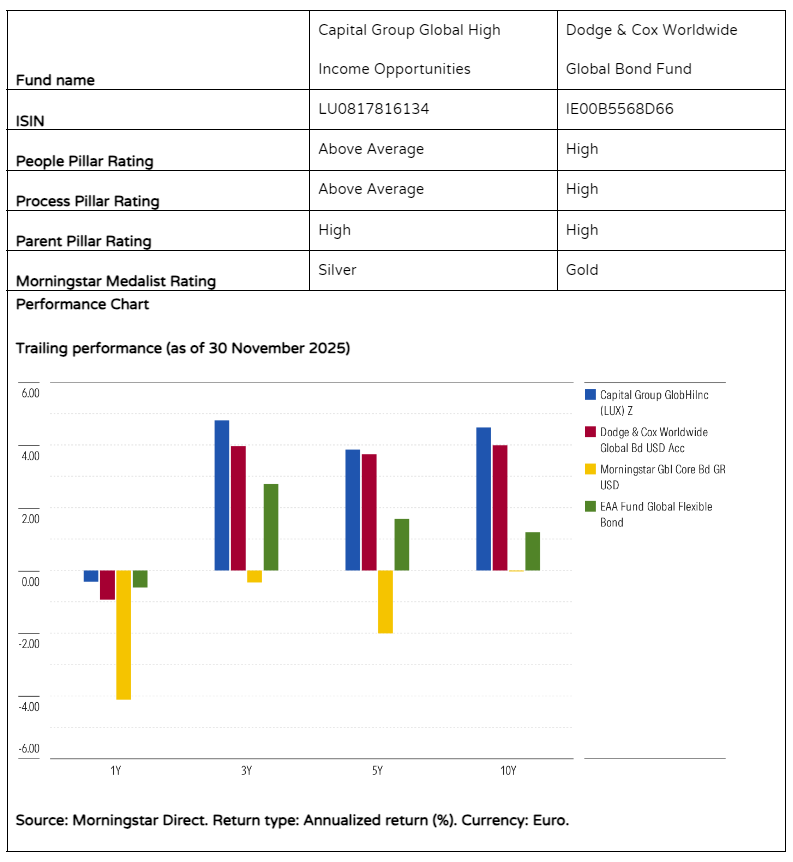

Case in point, Capital Group Global High Income Opportunities and Dodge & Cox Worldwide Global Bond both earn strong Morningstar People and Process Pillar ratings, but they pursue distinctly different objectives: Capital Group emphasizes consistent income generation, whereas Dodge & Cox adopts a broadly diversified approach focused on total return and long-term capital preservation.

A comparison of these two strategies follows, highlighting the key differences that set them, and their ratings, apart.

People

These funds are managed by highly experienced teams, but their structures differ. Capital Group employs a multimanager approach, with four seasoned portfolio managers each running a sleeve of the portfolio. Kirstie Spence and Luis Freitas de Oliveira oversee emerging-markets debt sleeves, and David Daigle and portfolio investment officer (PIO) Shannon Ward take care of the high-yield debt sleeves. As PIO, Ward ensures that the combined result of the sleeves stays within the guardrails of the fund’s mandate. Each manager has nearly three decades of experience. The managers are supported by robust analyst resources, with 10 analysts in high-yield and 11 in emerging-markets—averaging 16 years of experience. This deep and collaborative environment supports Capital Group’s Above Average People Pillar rating, especially given the strategy’s reliance on bottom-up analysis.

The Dodge & Cox fund is managed by the global fixed-income investment committee, whose seven members average 20 years in the industry and show strong commitment through significant personal investment in the fund. The committee is backed by over 50 professionals, including fixed income analysts, traders, industry specialists, and global macro analysts. The firm has also handled leadership transitions with careful succession planning, such as CEO Dana Emery’s planned retirement in late 2025. Dodge & Cox’s High People Pillar rating reflects the team’s longevity, deep expertise, and ability to nurture the next generation of investment talent.

Process

Capital Group’s process relies on its established multimanager approach, and the strategy aims for consistent, diversified income by investing across emerging-market and high-yield bonds. The strategy is benchmarked against a custom mix of 50 percent US high-yield bonds, 20 percent each emerging-markets local and hard currency debt, and 10 percent emerging-markets corporate debt. Asset allocation decisions are made jointly by team leaders, with PIO Shannon Ward having the final say in case of deadlock. Once allocation is set, each manager has full discretion within their sleeve, promoting diversification of styles and risk appetites. Alpha is mainly driven by bottom-up credit and country selection though, with asset allocation and currency decisions in supporting roles. The integration of sustainability criteria since 2022 reduced the investable universe by about 10 percent but did not meaningfully affect the portfolio’s risk/reward profile. The process is time-tested, differentiated and team-driven, earning an Above Average Process Pillar rating.

Dodge & Cox, in contrast, is a diversified, “go anywhere” strategy focused on total return and long-term capital preservation. Its process combines deep fundamental research, price discipline, and a long-term focus. The team seeks high-conviction, valuation-based opportunities across fixed income sectors. This can result in a concentrated portfolio that often diverges from peers and its US-dollar-hedged Bloomberg Global Aggregate benchmark. Turnover is typically lower than peers and the process is marked by patience, flexibility, and strong execution, earning a High Process Pillar rating.

Portfolio

Over the past few years, Capital Group’s portfolio has favored emerging-markets debt, reflecting the team’s view of attractive valuations compared to corporate high-yield debt. Local-currency sovereign debt (from countries like Mexico, Brazil, and Colombia) soaked up about 20 percent of portfolio assets, with another 20 percent in hard-currency sovereigns and 10 percent in emerging-market corporates—mainly in the financials and tourism sectors. High-yield exposure ranged from 40 percent to 45 percent, with the team treading lightly in cyclical sectors. As of October 2025, the strategy yielded 6.4 percent, slightly below its 10-year average of 7 percent.

Dodge & Cox’s portfolio is driven by valuations and a willingness to reposition quickly. In March 2025, corporate exposure (typically between 50 percent and 60 percent) was reduced to 31 percent, global government debt increased to an all-time high of 32 percent, and duration extended to 6.3 years, with sovereign rates diversified into developed markets like Australia, Norway, and New Zealand. Securitized assets also rose in keeping with the cautious stance, while emerging-markets-debt exposure was a below-average 20 percent. The portfolio was similarly positioned by September 2025 with only modest adjustments.

Performance

Capital Group has delivered significant outperformance versus its category and benchmark over the past 20 years, with consistent income yields around 7 percent. But the strategy’s focus on emerging-markets and high-yield debt results in higher volatility compared with its more diversified flexible bond category. At this strategy, strong credit selection has driven long-term success.

Dodge & Cox has also posted remarkable returns since its 2014 inception, with both annualized and risk-adjusted returns ranking among the best in this category. The fund’s corporate tilt has led to strong results in credit-friendly environments and rate shocks thanks to its lower interest-rate sensitivity, but this posture also makes it more sensitive to credit selloffs compared to its benchmark.

Elbie Louw CFA CIPM is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.