Top rated firms come in all shapes and sizes. Colchester Global Investors and MFS Asset Management have different specialties and histories. Both stand out for their commitment to putting investors’ interests first. This earns them both a Morningstar Parent Pillar rating of High.

Colchester Global Investors, based in London and founded in 1999, is a boutique firm specializing in global government bonds and currencies. MFS Asset Management, headquartered in Boston, celebrated its 100th anniversary in 2024 and now offers a wide variety of investment options, including both equity and fixed income strategies. Despite their differences, both firms share a dedication to building strong investment cultures and making thoughtful decisions that benefit their clients.

Talent retention and succession planning

MFS stands out for its transparent and smooth approach to succession planning and portfolio manager transitions. The firm’s research team is mostly made up of analysts who have grown their careers at MFS, resulting in very low turnover. High-potential analysts are often promoted to co-manager roles, helping develop future leaders of strategies. As of August 2025, MFS portfolio managers of funds available for sale in Europe have an average tenure of 9.5 years and nearly 16 years of industry experience.

Colchester’s investment team is also known for its stability, with only three portfolio managers leaving since the firm was founded, that includes founding member Kathryn Elsby, who retired in 2024. The firm has expanded its presence with offices in Dublin and Singapore and has promoted experienced team members to regional investment leadership roles in 2024. Colchester’s co-CIOs, Keith Lloyd and founding member Ian Sims, continue to provide strong guidance, and the firm’s team structure helps reduce reliance on any single individual. All analysts take on portfolio management responsibilities as members of the investment committee.

Alignment of interests

Colchester is 51 percent employee-owned, while the rest is held by Silchester Partners Limited, a private investment management firm and shareholder since inception. While there’s room to improve how bonuses are awarded by formally incorporating long-term performance, most Colchester portfolio managers invest their own money in the funds they manage, showing they have skin in the game and share investors’ interests.

MFS, on the other hand, is owned by Sun Life Financial, a large Canadian-listed company. MFS investment staff’s total pay can include equity-based long-term compensation linked to the success of MFS, and bonuses are based on long-term fund performance (three years and beyond). Like Colchester, MFS managers also invest alongside their clients, further aligning their interests with investors.

Areas of excellence and commercial practices

MFS is known for sticking to its long-term investment approach and avoiding market fads. For example, the firm only launched its first active ETFs in late 2024 after careful research of liquidity risks and daily transparency. It has also chosen not to enter private credit markets citing concerns over the impact on their investment culture. Private markets, which can be very transactional and deal-oriented, would not mesh well with MFS’ long-term investing culture. MFS is focused on growing its fixed income business. Although these assets are still low relative to the firm’s equity offerings, it’s growing.

Colchester, meanwhile, remains focused on global sovereign fixed income and currency markets. While this means the business is less diversified, Colchester’s consistent and focused philosophy and process, which is applied consistently across all products, has helped it stand out from the crowd. The firm continues to launch products within its expertise, such as its Global Green Bond funds, which invest mainly in environmentally friendly government bonds and currencies.

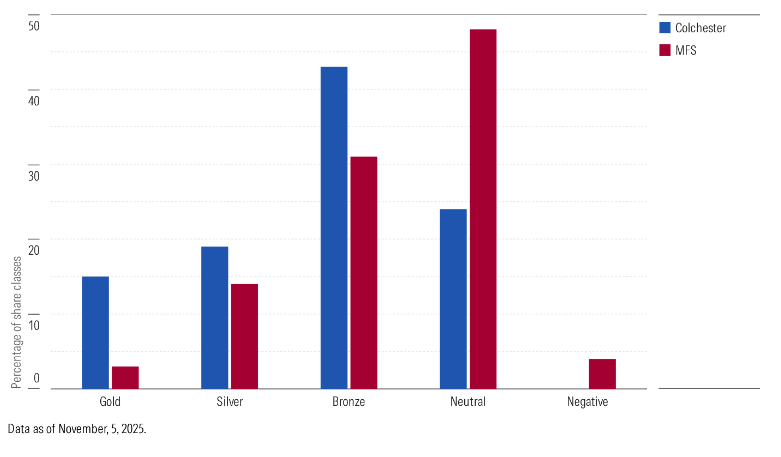

Exhibit 1 Morningstar Medalist Rating for rated share classes domiciled across Europe (analyst- or quantitatively rated)

Elbie Louw CFA CIPM is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.