One in five global dividend funds now integrates ESG criteria. Where sustainable funds in other segments have struggled to maintain their growth momentum, sustainable global dividend funds have seen strong inflows in recent years.

Over the past five years, global dividend equity funds have seen remarkable growth. Since the end of 2020, assets under management in the Morningstar Category Global Equity Income have more than doubled, rising from roughly 91 billion euro to 188 billion euro by the end of October 2025. In the first ten months of 2025 alone, these funds attracted nearly 17 billion euro - marking the second-largest yearly inflow in two decades, with two months still remaining in the year.

This growth comes amid a broader transformation in dividend investing, as sustainability considerations reshape traditional approaches. Historically concentrated in high-yield sectors such as tobacco and energy, dividend funds are increasingly adapting to meet growing investor demand for ESG-aligned income.

Sustainable investing has clearly moved beyond niche status, also within dividend investing. Today, one in five global dividend funds integrates sustainability criteria, up from just 13 percent three years ago. The 34 sustainable global dividend funds now hold nearly 23 billion euro in assets, up from just over 6 billion euro at the end of 2022. Unlike sustainable funds in other segments, which have struggled to maintain growth momentum in recent years, sustainable dividend funds have enjoyed steady and substantial inflows: 1.8 billion euro in 2023, around 2 billion euro in 2024, and 2.5 billion euro in the first ten months of 2025.

Against this backdrop, we compare DWS Invest ESG Equity Income and Kempen Global High Dividend.

People

DWS Invest ESG Equity Income and Kempen Global High Dividend have a lot in common, including recent team turnover. This is an important reason why both strategies earn an Average People Pillar rating.

DWS Invest ESG Equity Income is led by Martin Berberich, a seasoned manager with nearly three decades of experience, but the departure of deputy-manager Bertrand Born in June 2024 has heightened key-person risk. Born was replaced by Michelle Chau, who is new to portfolio management. Berberich and Chau can leverage the broader dividend team, which includes nine additional members. However, this team has also experienced turnover recently.

In contrast, Kempen Global High Dividend has emerged from a period of instability and is now on more stable footing. From April 2021 to April 2022, the team experienced a difficult period following the departure of three highly experienced experts who were considered essential to the long-term success of the strategy. This led to a series of changes in coverage responsibilities when new members joined the team. Joris Franssen, a veteran dividend investor, leads the team. However, four of the six team members have shorter tenures and must still prove their effectiveness.

Process

DWS Invest ESG Equity Income and Kempen Global High Dividend both have a disciplined, income-focused investment philosophy, earning each an Above Average Process Pillar rating.

Both strategies have evolved to increase flexibility in recent years. DWS Invest ESG Equity Income revised its ESG framework in 2023, which is based on a proprietary seven-tier, multivendor ESG scoring system. This broadened its investable universe, though in practice roughly half of potential stocks are still excluded. Kempen Global High Dividend, meanwhile, lowered its dividend yield hurdle and relaxed its sell discipline, allowing for greater exposure to stocks with higher dividend growth potential and adapting its equal-weight and rebalancing principles for more pragmatic portfolio management.

ESG integration is a key differentiator between the two strategies. DWS applies a rigorous, best-in-class ESG screening that significantly constrains its universe. Kempen incorporates ESG factors into valuation models and excludes tobacco stocks, but is less restrictive overall. Both managers balance quantitative models with fundamental analysis, but DWS’s ESG criteria play a more central role in stock selection.

Portfolio

DWS Invest ESG Equity Income and Kempen Global High Dividend both prioritize dividend-paying equities, but their approaches diverge in key areas.

DWS Invest ESG Equity Income favors largecap companies with stable cash flows and robust balance sheets, integrating sustainability screens and exclusions that result in a strong ESG profile, as reflected in its Morningstar ESG Risk Rating of 4 globes. The fund is actively tilted toward highly sustainable firms, with sector overweightings in technology and healthcare, and avoids industries that do not meet its sustainability standards, such as oil majors.

In contrast, Kempen Global High Dividend maintains a value-oriented strategy, consistently trading at a significant valuation discount to its peers and category index, while delivering higher dividend yields. Kempen’s portfolio is distinguished by its tilt toward mid- and smallcap stocks, a notable underweighting in US equities, and a prominent allocation to financials.

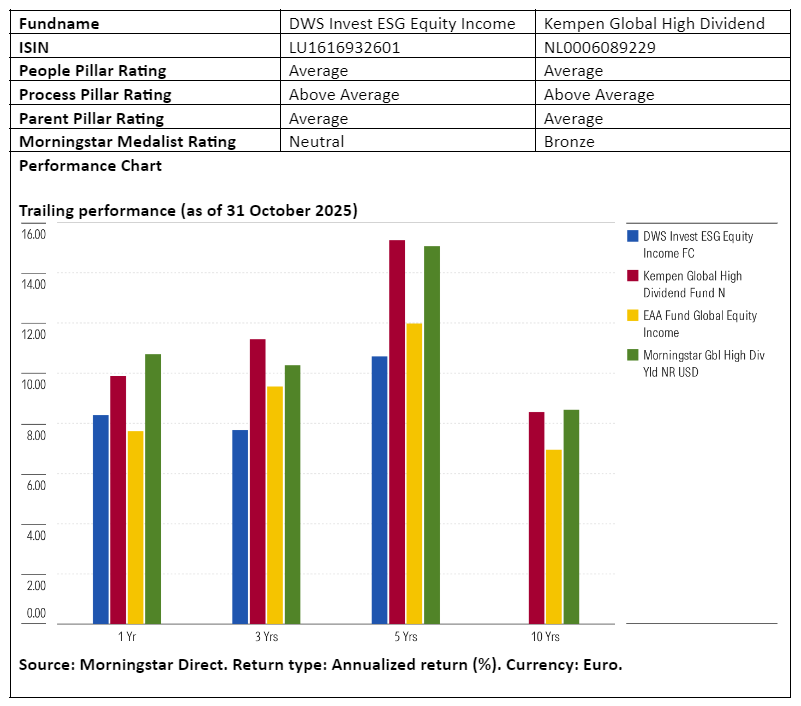

Performance

DWS Invest ESG Equity Income emphasizes sustainable, largecap companies with a quality bias and avoids sectors like tobacco and defense, resulting in lower volatility and strong downside protection. This ESG focus has generally supported performance, with the fund outperforming peers, but slightly trailing the global high dividend index since inception. That said, DWS tends to lag in strong bull markets, particularly when cyclical value stocks and small caps lead, and its cash buffer can drag on returns.

Kempen Global High Dividend adopts a deeper value tilt, higher dividend yield requirement, and greater exposure to mid- and smallcap stocks, as well as emerging markets. This approach has led to higher volatility and more erratic performance, especially during market downturns like 2020, but it has delivered strong returns during value rallies. However, the recent team changes have decreased the relevance of the longer-term trackrecord.

Ronald van Genderen is a senior manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.