The disruptive potential of AI has caused havoc among software companies in recent weeks.

Artificial intelligence has been a major force shaping global equity markets in recent years, driving strong performance in the technology sector—especially semiconductors and hardware infrastructure—as investors priced in rising demand for AI chips and related systems. Semiconductor companies like Nvidia and Broadcom have benefited from robust sales growth and elevated valuations tied to AI deployment. In contrast, sentiment toward software stocks weakened in early 2026 amid concerns that rapid AI advances could disrupt traditional business models and compress future earnings.

High-profile software names such as SAP, Shopify, Intuit, ServiceNow, and Salesforce have experienced sharp selloffs, contributing to broader weakness in the software and services index. While semiconductor stocks gained an average 8.55 percent year-to-date through 9 February, software stocks fell more than 16 percent over the same period.

Against this backdrop, we compare two Morningstar analyst-rated global equity funds that are both significantly overweight technology but differ meaningfully in their exposure to software: Guinness Global Innovators and T. Rowe Price Global Focus Growth.

People

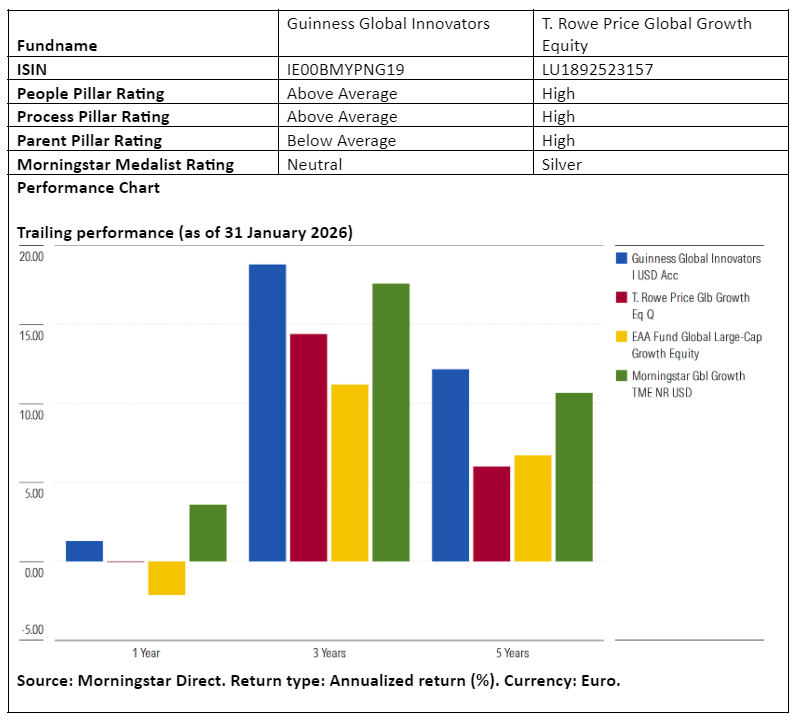

Guinness Global Innovators and T. Rowe Price Global Growth Equity both benefit from stable, experienced leadership, but they follow very different models of portfolio management and research support. Guinness earns an Above Average rating on the People Pillar, while T. Rowe Price receives a High rating.

Guinness is run by a long-tenured duo, Matthew Page and Ian Mortimer, who have effectively led the strategy since 2009 and are credited with a consistent, differentiated mindset that has added value across multiple mandates. Their approach remains boutique in nature: although the analyst team has grown to seven members since 2021, it is still relatively young and continues to build depth, with limited overlap from senior staff who also manage other funds. As a result, the strategy relies heavily on the judgment, discipline, and the continuity of the two lead managers.

By contrast, T. Rowe Price Global Growth Equity is driven by a single, highly regarded portfolio manager, Scott Berg, who has run the fund since 2012 but is embedded within one of the industry’s largest and most sophisticated research platforms. Berg’s strength lies not only in his own experience as a global growth investor but in his ability to leverage T. Rowe Price’s 200-plus analysts across eight global offices, supported directly by an associate portfolio manager and a dedicated team analyst.

Process

Guinness Global Innovators and T. Rowe Price Global Growth Equity both pursue global growth opportunities, but they do so through markedly different investment processes. The two strategies are rated on the Process Pillar with one notch difference, an Above Average rating for Guinness and a High rating for T. Rowe Price.

Guinness follows a deliberately simple, highly disciplined framework built around identifying innovative, capital-light companies that generate economic value, defined by cash flow returns exceeding their cost of capital. From a universe of about 1,000 stocks, the managers narrow ideas to roughly 100 and ultimately construct a tightly focused, equal-weighted portfolio of around 30 holdings. Valuation is integral to the process, with multiple metrics and an in-house discounted cash flow model guiding a strict “one-in, one-out” rebalancing approach, giving the strategy a growth-at-a-reasonable-price character and relatively low turnover. Multi-year holding periods are typical.

By contrast, T. Rowe Price Global Growth Equity is far more expansive and flexible. Berg draws on the firm’s vast global research platform and firsthand company visits to identify stocks with underappreciated long-term growth across both developed and emerging markets. Rather than relying on tight portfolio construction rules, risk is managed primarily through broad diversification across countries, sectors and holdings. The fund is more benchmark-agnostic and actively traded, with turnover often elevated as positions are adjusted in response to changing fundamentals and valuations.

Portfolio

Guinness Global Innovators and T. Rowe Price Global Growth Equity both offer global growth exposure, but their portfolios are built very differently. Guinness runs a highly concentrated, conviction-driven strategy with roughly 30 holdings and a persistent US bias, typically allocating 60 percent to 80 percent of assets to American stocks. The managers also take large active bets at the sector and industry level, particularly in technology, in large part through a significant overweight in software companies, like Salesforce, Adobe and Intuit, totaling around 17 percent of the portfolio.

T. Rowe Price Global Growth Equity, by contrast, is broadly diversified, holding 150 to 200 stocks with small individual weights. Sector exposures are kept close to the MSCI ACWI strategy benchmark, and therefore the software industry only makes up about 8 percent of assets, including companies like Microsoft (which represents half of the software exposure), Shopify and Intuit. Risk is managed through diversification and position sizing rather than concentration, giving the fund a smoother but more benchmark-aware profile than Guinness.

Performance

Guinness Global Innovators and T. Rowe Price Global Growth Equity have both delivered solid long-term results. Guinness has outperformed global growth benchmarks since 2010, albeit with higher volatility, driven mainly by its heavy overweight to US large-cap technology rather than superior stock selection. While T. Rowe Price lagged its category index since 2008, it remains ahead of its average category peer. Underweights to megacap tech and exposure to emerging markets have held it back in recent years.

T. Rowe Price’s more benchmark-like exposure to software is evident in its 2026 year-to-date results through 9 February, with the strategy posting only a modest loss of 0.13 percent. By contrast, Guinness’ software overweight translated into a steeper decline of 2.39 percent.

Ronald van Genderen is a senior manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. The firm is a member of Investment Officer’s expert panel.