It has been an eventful year so far for emerging market debt. Investors have enjoyed strong returns in US dollars, with the JPM GBI-EM Global Diversified index gaining 11.4 percent through July. India’s weighting in the benchmark has increased, but not all fund managers are equally enthusiastic about the country’s prospects.

Additionally, fund flows have also shifted positively, with the Global Emerging Markets Local Currency Morningstar Category recording 1.2 billion euro of inflows through July, reversing substantial outflows seen in previous years.

In April, JP Morgan completed the process of pushing India to its full 10 percent weighting in the JPM GBI-EM Global Diversified index. Additionally, the credit ratings of several emerging-markets countries were upgraded, including index-constituent India, whose rating was raised to BBB from BBB minus. That move reflects rating agency S&P Global’s confidence in the country’s strong economic fundamentals and sound monetary policy.

As of July, the average exposure to India within the Emerging Markets Local Currency Bond category was 5 percent, though managers of Morningstar analyst-rated strategies differ in how they express this exposure.

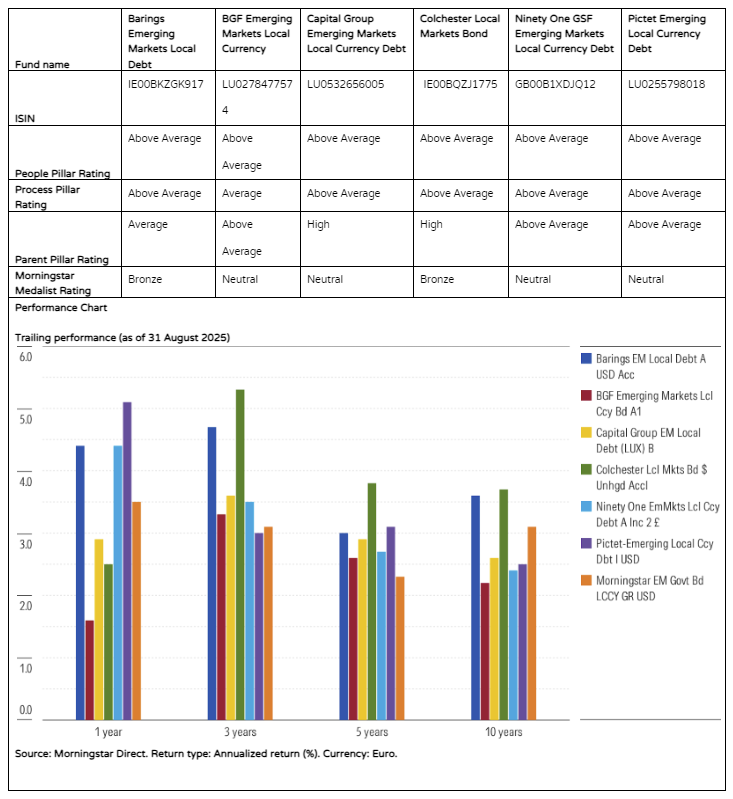

Below we present a range of managers’ perspectives, along with their highest-conviction investment ideas.

India’s economy has evolved as expected amid rate cuts and weaker growth, offering limited appeal according to the managers of Barings Emerging Markets Local Debt. This picture results in underweight positions in both Indian rates and the currency. On the rates side, the team prefers supranationals issued in Indian rupee, citing their higher AAA-rated credit quality and ease of trade. The highest conviction ideas in the Barings portfolio include markets with well-behaved inflation and slow growth with the prospect of interest rate cuts such as Czech Republic, Columbia, South Africa, Mexico and Peru. On the currency side, the team favors those with strong prospects for appreciation including the Brazilian real, Hungarian forint and off-benchmark allocations to Egyptian Pound, South Korean won and Nigerian naira.

In contrast, BGF Emerging Markets Local Currency maintains an overweighting to the Indian rupee, given the managers’ view of a structurally weaker US dollar. But in Indian rates, the fund is underweight the JPM GBI-EM Global Diversified benchmark, with the team citing better relative value elsewhere. The exposure is a combination of local government debt, and supranational bonds issued in Indian rupee and derivatives. The team’s top country positions are tilted towards markets such as Brazil and South Africa which they believe have tight monetary policy, steep yield curves and elevated real yields.

As of July 2025, Capital Group Emerging Markets Local Currency Debt was overweight India (in terms of duration) by 0.8 years and roughly 0.3 percent overweight the Indian rupee compared to its benchmark. The bond exposure included a combination of Indian government bonds, and supranational bonds, issued in Indian rupee. The team appreciates the liquidity and strong domestic demand of the local government bonds while supranationals are not subject to capital gains tax or interest income tax that apply to the Indian government bonds. The team favored Brazilian government bonds and rates because of decent macroeconomic fundamentals, despite political and fiscal concerns.

By comparison, Colchester Local Markets Bond has negligible exposure to Indian government bonds based on the team’s assessment of the country’s weaker financial stability score and unattractive prospective real yield relative to the rest of the opportunity set. The team’s assessment of the investable universe’s real interest differentials led to a small weighting of 0.4 percent in Indian rupee. The team prefers Brazilian, South African, Mexican and Indonesian government bonds and, on the currency side, the Brazilian real, Indonesian rupiah and Korean won.

At Ninety One GSF Emerging Markets Local Currency Debt, the portfolio is neutral Indian government bonds (in duration terms). Most rates exposure is done via swaps, which the team prefers over Indian government bonds due to the tax advantages, supply-demand distortions in the bonds and a belief that markets aren’t fully pricing in further rate cuts.

On the FX side, the portfolio remains neutral the Indian rupee compared to its benchmark. Top picks in the portfolio include an overweight stance in Peruvian rates as the team expects further rate cuts and an off-benchmark long position in the Taiwan dollar as part of a relative trade with the Chinese renminbi.

Pictet Emerging Local Currency Debt is slightly underweight India, a position primarily expressed via swaps, which the team feels are attractively valued with markets not fully pricing in further rate cuts. The team opted for an underweight stance in the Indian rupee at a time when the Reserve Bank of India was reducing its reserves. But more recently, the team has looked for opportunities to decrease that underweight.

The team prefers exposure to countries with high real rates and attractive yields in Central and Eastern Europe, the Middle East and Africa as well as high-yield countries in Asia. Currency exposure includes overweightings in high carry currencies such as the Turkish lira, Chilean peso, Egyptian pound, South African rand and Brazilian real.

Elbie Louw, CFA, CIPM, is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.