Risk parity investors showed renewed optimism in 2025 after several years of underperformance versus the traditional balanced portfolios.

Risk parity strategies are typically constructed around an equal risk contribution from equities, fixed income and commodities. In practice, this results in a relatively large allocation to less volatile investments like bonds, often supplemented with leverage to maintain the expected return.

The strategy gained prominence in the 2000s with funds such as Bridgewater’s All Weather, which proved relatively resilient during the financial crisis. Over the following decade, risk parity also benefited from a favourable environment of low inflation and declining bond yields. More recently, that reputation has come under pressure. Unlike traditional balanced funds, where equities are the dominant source of returns, risk parity benefited less from the stock market rally. At the same time, these portfolios are more sensitive to interest rate fluctuations so the first quarter of 2020 and 2022 were tough periods. However, in 2025 through the end of November, the S&P Risk Parity 10% Target Volatility Index has outperformed a 60/40 blend of the MSCI ACWI and Bloomberg Global Aggregate Index, although performance varies significantly across individual managers.

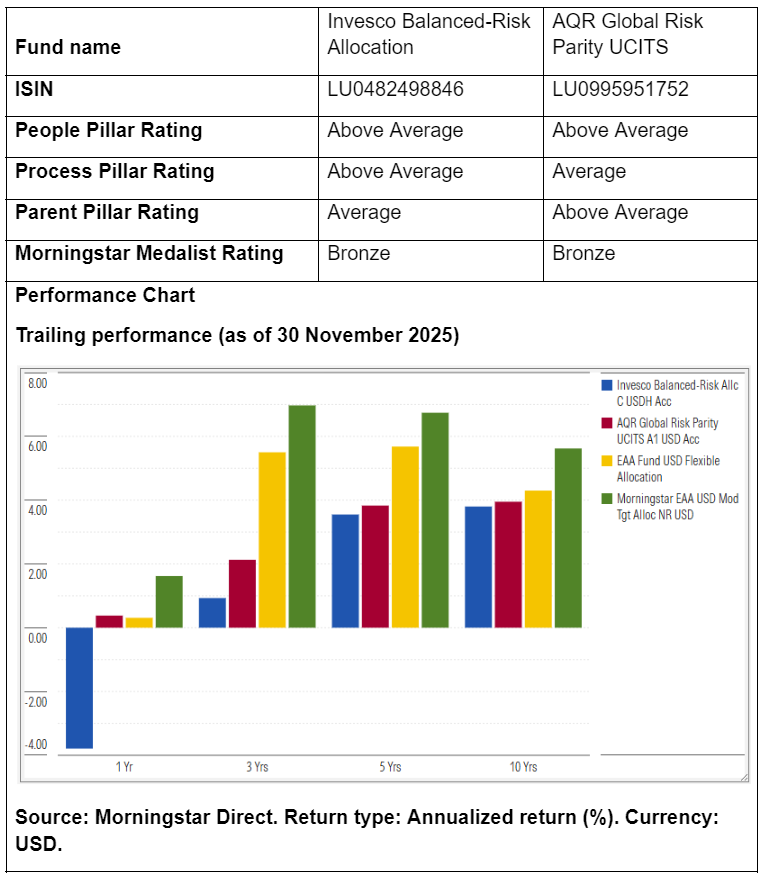

Against this backdrop we take a closer look at two risk parity funds in the USD Flexible Allocation Morningstar Category: Invesco Balanced-Risk Allocation and AQR Global Risk Parity UCITS.

People

These are systematic strategies, so key-person risk is less pronounced than in many discretionary funds. That said, both teams experienced leadership changes that warrant attention, though we maintained our Above Average People rating for both.

At Invesco Balanced-Risk Allocation, two senior portfolio managers transitioned out of the strategy in December 2024. Mark Ahnrud retired on June 30, 2025, and Christian Ulrich is set to retire on March 1, 2026. Alessio de Longis was added as portfolio manager in December 2024. Ahnrud and Ulrich were part of a stable team of four managers that have worked with lead manager Scott Wolle on the strategy since the strategy’s 2009 inception; the others are Chris Devine and Scott Hixon. While these two departures are a clear loss, the team-based approach, the systematic nature of the strategy, and the long transition period dissipate our concerns.

AQR Global Risk Parity also experienced senior-level turnover when long-standing AQR principal Yao Hua Ooi left the firm in the middle of 2024 and earlier with the departure of Ronen Israel, former co-head of portfolio management, research, risk and trading in 2021. The other former co-head Lars Nielsen announced his retirement at the end of 2023. The firm retains much of its high-quality senior leadership, however and this strategy benefits from AQR’s macro strategies, integrated research, and global stock-selection research groups. Following Israel’s departure, two of the firm’s founders, Cliff Asness and John Liew, became more involved with the day-to-day management of the research process.

Process

Invesco’s process starts with roughly equal-weight exposure (on a risk basis) to growth, defensive, and real return assets and then applies measured tactical tilts. In 2021, the team implemented new elements to the defensive sleeve. Replacing part of the nominal bond exposure are equity put options and equity factors, which the team expects to help improve the portfolio’s defensiveness in times of low-bond yields. The team’s track record of incremental changes to the portfolio has been positive. Management has a short-term tactical overlay, which added value since inception but was a detractor in recent years. It merits an Above Average Process Pillar rating.

AQR Global Risk Parity lacks the tactical overlay present in Invesco’s offering (and the firm’s US mutual fund) but it still provides a robust implementation of risk parity with relatively low fees, and AQR’s ongoing efforts to solidify the approach is encouraging. For example, AQR has incorporated “targeted risk reduction” in the portfolio since May 2022. This combination of technical and fundamental signals can improve downside protection by curbing exposures if volatility and drawdown risks are elevated. It earns an Average Process rating.

Portfolio

AQR aims to create equally weighted risk exposures from equities and credit, nominal bonds, and inflation hedges (commodities and inflation-linked bonds) whereas Invesco focuses solely on equities in its growth and commodities in its real return buckets.

To reach the targeted 10 percent volatility and to balance the risk weighting of the sleeves, both funds use leverage, especially within the bond portfolio. In benign market conditions, leverage can be used to take gross exposure up while in periods of high volatility like in the first quarter of 2020, it can cut exposure dramatically. Also, asset-class weights change over time because setting risk weights is largely based on historical volatilities and covariations, which change over time.

Performance

Because of their lower exposure to equity risk, the funds’ returns may deviate strongly from those of its typical flexible-allocation Morningstar Category peer. So, going forward, investors must be prepared for potentially extended periods of underperformance compared with traditional balanced allocation funds.

The divergence between the Invesco and AQR portfolios over the past 12 months has been notable. Invesco’s tactical overlay detracted from returns, with the team citing difficulties in identifying and capturing market trends. On a gross return basis, growth assets (equities) were the primary contributors for both strategies; however, AQR’s models outperformed Invesco’s, supported by the use of non-price signals borrowed from its managed futures program. Over the trailing 10-year period, performance of both funds is more in line but behind that of its category peers.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.