Multi-asset benchmarks assume costless and frictionless implementation, setting a high bar for allocation funds to outperform after fees. Even so, these “one-stop-shop” solutions remain appealing for many investors.

Allocation funds offer a readily diversified portfolio without the need to further select and combine equity, bond, alternatives or money market funds. Morningstar studies show that multi-asset funds tend to promote more disciplined investor behavior. This is partly because allocation funds limit volatility, so investors are less tempted to move in and out of them. Over time, consistent market exposure tends to outperform attempts at market timing.

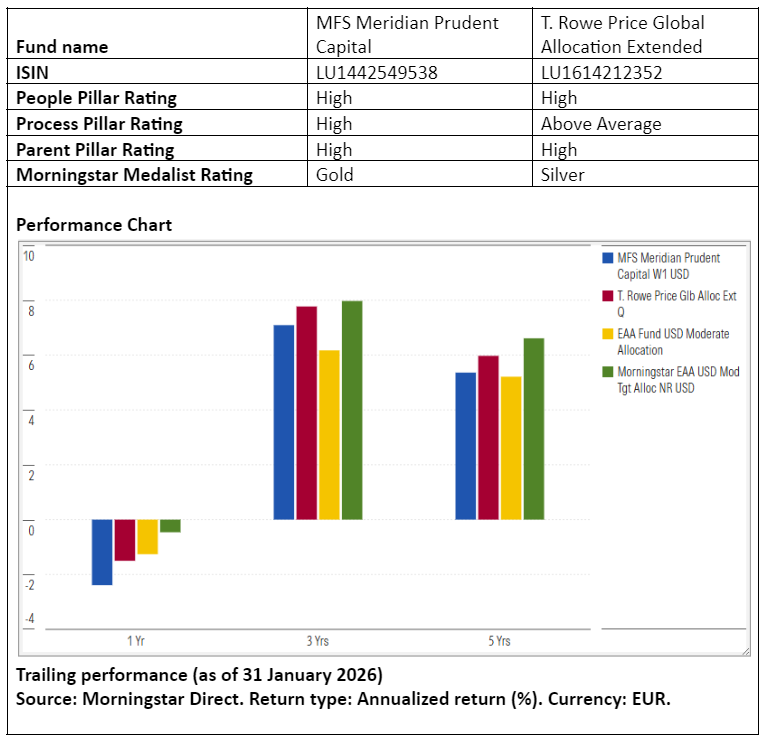

Against this backdrop, we examine two highly rated strategies in the USD moderate allocation Morningstar Category that reflect contrasting construction styles. Both rank among our analysts’ highest-conviction picks in the space.

People

We view both strategies as well managed and assign them High People Pillar ratings. Their setup is very different, however.

T. Rowe Price’s asset-allocation effort is impressive. Portfolio managers Charles Shriver, Toby Thompson, and Christina Noonan are backed by a 70-plus member multi-asset team (larger than most rivals) that boasts proven veterans among its manager and research ranks.

At MFS, the asset-allocation work is done by the three named managers on the strategy: Edward Dearing, Shanti Das-Wermes, and David Cole. We believe that’s adequate given the managers’ bottom-up approach and the fact they rely on the firm’s large, globally scattered 60-plus strong equity analyst team to generate investment ideas and provide in-depth fundamental analysis. By contrast, at T. Rowe Price security selection is outsourced to in-house specialist teams, which allows the managers to concentrate on top-down allocation.

We hold both management teams in high regard. Despite the retirement of its original architect and lead manager Barnaby Wiener in April 2024 and their shorter average track records, the MFS portfolio managers boast strong credentials and team dynamics are solid. Charles Shriver is an experienced asset allocator at T. Rowe Price. He joined the asset-allocation team in 1999 and has run allocation funds since 2011. Toby Thompson, a 17-year veteran of the team, joined as comanager in March 2020, and in January 2025, Christina Noonan was promoted to comanager.

Process

MFS adopts an all-weather, patient, unconstrained approach and has the leeway to adjust market exposure depending on the scarcity of compelling investment opportunities, though asset weightings are not moved tactically based on short-term forecasts. To protect against permanent capital losses, the managers build the portfolio from the bottom up, selecting stocks and credit issuers on individual merits. The stock-picking process is focused on quality and valuation, and stringent investment criteria help narrow the vast opportunity set. Downside risk is also mitigated through index put options. It earns a High Process Pillar rating.

The T. Rowe Price fund by contrast is built from the top down. It offers substantial diversification and a set of well-run underlying strategies, supporting an Above Average Process rating. The managers make allocation calls but rarely deviate substantially from the neutral weights of 60 percent in equities and 40 percent in fixed income (and alternatives). The strategy diversifies broadly and sensibly by investing in a wide range of underlying mandates that span various asset classes, styles, and regions.

Portfolio

Many of the underlying managers steer impressive strategies at T. Rowe Price. While the portfolio includes 15-plus strategies, the niche ones like those in high yield and small caps provide diversification and add potential alpha. Of note, T. Rowe Price decided to liquidate its Multi-Strategy Total Return strategy which up until recently was considered a diversifying building block in this portfolio. It upped the exposure to T. Rowe Price Dynamic Global Bond instead.

While security selection is outsourced by T. Rowe Price’s allocation managers, the MFS team builds a concentrated portfolio of 20-40 stocks and a similar number of corporate bonds themselves. Large deviations from the market benchmark are therefore typical. In line with their cautious view on overall market valuations, the managers have kept a defensive stance since the strategy’s 2016 inception; the fund’s equity market exposure has hovered between 50 percent and 60 percent of assets throughout its history, while high-yield credit represented 10 percent to 15 percent.

Performance

The MFS strategy’s disciplined long-term approach has delivered solid results to investors over time. The style, however, can lead to stretches of underperformance when market conditions turn unfavorable. In 2022, the fund’s German REIT and foreign-currency exposure contributed to the strategy’s largest drawdown on record. In 2025, the fund ranked in the first quartile of its peer group.

T. Rowe Price Global Allocation also underperformed peers in 2022, owing in part to atypically weak stock selection in underlying strategies. Over the long-term, the security selection of the underlying managers has been the primary driver of outperformance for the US-domiciled flagship strategy. The fund landed in the second quartile in 2025.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.