Eurozone corporate bonds delivered a return of 4.2 percent over the past twelve months (as measured by the Morningstar Eurozone Corporate Bond Index), while their US counterpart, the Morningstar US Corporate Bond Index, lost 1.8 percent in euro terms. The currency effect was crucial here.

The Morningstar Global Corporate Bond Index (EUR hedged) rose 2.5 percentage points in the twelve months through August 2025, while the unhedged version declined 0.2 percentage points. Market participants remain concerned that the Trump administration’s policies will drive up US budget deficits and, like higher import tariffs, will prove inflationary.

Still, confidence in corporate bonds has recently rebounded. The spread on the riskiest US investment-grade bonds (rated BBB), as measured by the ICE BofA BBB US Corporate Index Option-Adjusted Spread, narrowed from 149 basis points in April 2025 to 102 basis points by the end of August. This recovery was largely fueled by strong demand outstripping limited supply, with investor appetite driven by attractive absolute yields of 5 percent or more in high-quality issuers. September is traditionally a busy month for new issuance, making it interesting to see how the market will absorb the supply.

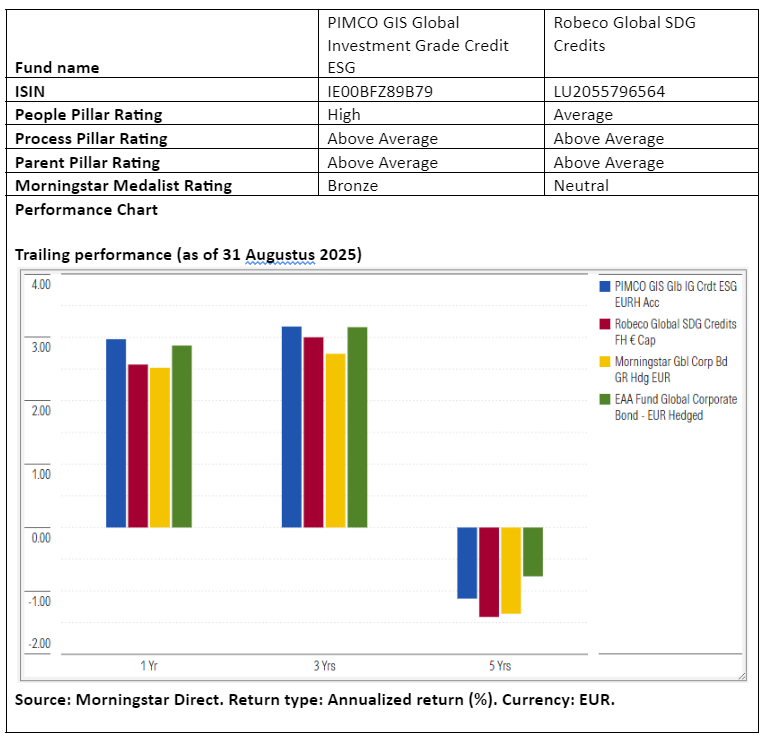

Against this backdrop, we take a closer look at two funds in the Morningstar Global Corporate Bond – EUR Hedged category that are covered qualitatively by Morningstar analysts: PIMCO GIS Global Investment Grade ESG and Robeco Global SDG Credits. We highlight their similarities and differences, including their sustainability approaches.

People

Corporate bond specialist and senior member of PIMCO’s sustainable investing team, Jelle Brons, has led the PIMCO Global Investment Grade Credit ESG strategy since its launch in 2018. The team also includes Mark Kiesel, Mohit Mittal, and Saurabh Sud. This quartet is part of a broader group of 40 portfolio managers and traders in corporate bonds, supported by more than 80 credit analysts and a seven-member sustainable credit team. This impressive depth of talent and resources earns the strategy a High People rating.

At Robeco, however, recent management reshuffling warrants a more cautious view, resulting in an Average People rating. Less than two years after the departure of CIO Fixed Income Victor Verberk in June 2023, his successor, Reinout Schapers—who had co-managed the strategy since its inception in May 2018—also left the firm. The strategy is now overseen by the relatively new Matthew Jackson, who joined Robeco from Western Asset Management in March 2024, along with two co-managers. Morningstar wants to first observe how this team works together before building stronger conviction in the new setup.

Process

Despite the team changes, Robeco’s strategy retains an Above Average Process rating. It follows the proven investment process of its sister strategy, Robeco Global Credits, albeit in a more limited form due to its sustainability overlay. The approach combines top-down positioning in credit markets with bottom-up security selection driven by fundamental analysis. The team’s macro outlook and risk appetite guide regional emphasis and thematic opportunities, while individual bond selection is based on deep credit research. Only issuers deemed to have a neutral or positive impact on the United Nations Sustainable Development Goals (SDGs), according to Robeco’s proprietary framework, are eligible. These criteria narrow the investable universe by about 20–25 percent compared with Robeco Global Credits.

PIMCO’s strategy also holds an Above Average Process rating. Its corporate bond expertise is first-class, characterized by rigorous fundamental research and valuation discipline. The managers develop top-down themes (including long-term ESG trends) that shape interest-rate positioning and sector weights, while PIMCO’s corporate specialists generate bottom-up ideas across the universe. Sustainability screens exclude about 15 percent of the benchmark, while the team also aims to maintain a higher average ESG score than the index.

Portfolio

Within corporate bonds, PIMCO favors issuers whose credit quality is expected to improve in undervalued sectors, with a particular preference for ESG or green bonds. The managers have maintained overweight positions in financial institutions for several years, a sector with significant issuance of ESG-linked bonds. Robeco’s bank exposure—typically around one-quarter of the benchmark—has ranged between 26 and 39 percent of the portfolio over the past five calendar years. Both teams largely avoid issuers in the oil and gas sector.

PIMCO is not shy about expanding the investable universe, often exploring off-benchmark opportunities in high-yield bonds (typically 3–5 percent of the portfolio) and securitized products (up to 10 percent). Like PIMCO, Robeco primarily invests in investment-grade corporate bonds but may allocate up to 20 percent of its portfolio to off-benchmark high-yield corporates, emerging-market corporates (mainly investment-grade), and securitized products, with a combined cap of 33 percent.

Performance

Robeco’s solid performance record has largely been driven by strong credit selection, often delivering results ahead of the market across regions and sectors, thanks to the strategy’s flexibility. However, the weight of this track record is somewhat diminished by the recent changes to the management team.

Under Brons’s leadership, PIMCO’s strategy also stands on solid footing, both in absolute and risk-adjusted terms. That said, the ESG focus can at times cause performance to diverge from that of other global corporate bond funds without an ESG mandate.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.