Pimco and Bluebay take different but equally sophisticated approaches to Euro bond investing, with both managers making active use of derivatives to steer portfolios, manage risk, and seize relative value opportunities. Their strategies highlight how synthetic instruments, often seen as opaque, can serve as powerful tools in fixed income investing.

Derivatives have been a tool in the investment toolkit for several decades. Still, many investors view these synthetic instruments as opaque structures that add risk to portfolios. That view can overlook some of the benefits and nuances when it comes to these synthetic structures. Derivatives also have several helpful uses that can significantly enhance portfolio construction.

When it comes to Euro bond funds, derivatives are often used for risk management, market flexibility, or relative value considerations. Faced with the possibility of sudden or significant interest rate changes, derivatives such as interest rate swaps (exchanging a fixed for a floating rate) can be used to hedge against the anticipated change. Futures contracts (the right to buy or sell government bonds at a predetermined price) can be used to quickly gain exposure to the market when managing inflows or outflows, and, managers may prefer credit default swaps (synthetic bond insurance) when their pricing is more attractive on a relative value basis versus the underlying cash bonds in the market.

Against this backdrop we take a closer look at two analyst-rated funds in the Morningstar Euro Bond category, which employ derivatives to enhance their investment process.

People

Pimco GIS Euro Bond boasts a trio of seasoned managers and ample supporting resources, earning a High People Pillar rating. Industry veteran Lorenzo Pagani took the lead in 2017, when his predecessor Andrew Balls became Pimco’s head of global fixed income and shifted to a backup role in the fund. Head of the European rates desk Konstantin Veit joined the roster in 2021, but has worked at Pimco for 13 years, and serves as the day-to-day co-manager. The trio draw on 40 portfolio managers specializing in European rates, currencies and corporate and securitized credit, along with over 80 credit analysts globally.

Bluebay Investment Grade Euro Aggregate Bond is managed by a team of equally high caliber also earning it a High People Pillar rating. Mark Dowding has led this fund since its 2010 inception and became chief investment officer in 2019. Co-manager Kaspar Hense was added in December 2016, but already contributed to sovereign debt analysis and idea generation since 2014. Sovereign credit specialist Neil Mehta was appointed comanager in 2022, reflecting his prior involvement in the day-to-day management of the fund. This team of 16 macro specialists has shown good stability, coupled with moderate growth, and remains well-supported by the wider 21-member investment-grade desk.

Process

When it comes to setting the portfolio’s top-down positioning, the Pimco managers incorporate insights from the economic and market forecasts produced at Pimco’s yearly secular forum, quarterly cyclical forum, and global investment committee meetings. They actively manage the fund’s duration, interest-rate curve positioning, allocation between private and public-sector bonds, and exposures to specific countries. They also make extensive use of derivatives, usually to manage duration, including countries outside of the eurozone, like the US or UK, and to replicate benchmark exposures by using futures instead of cash bonds to exploit inefficiencies. These additional performance levers add complexity to the approach, but the managers have used them sensibly over the long term, earning a High Process Pillar rating overall.

The Bluebay managers have efficiently employed a fundamental approach driven by proprietary country research, earning an Above Average Process Pillar rating. The team identifies alpha opportunities by assessing sovereign issuers’ fiscal characteristics, growth outlook, debt dynamics, and geopolitical risk. A structured approach to selection in the corporate bonds segment, informed by the team’s credit portfolio managers, complements this well. Moreover, the team employs derivatives such as bond futures, interest-rate swaps and sovereign credit default swaps to make implementation more flexible here and have generally used these tools well.

Portfolio

The Pimco portfolio can at times deviate substantially from that of its benchmark, the FTSE Euro Broad Investment Grade Index. While the managers focus primarily on investment-grade, euro-denominated government and corporate debt, they will often keep up to 25 percent of assets in off-benchmark fare such as US Treasuries or agency mortgages (typically kept below 10 percent), emerging-markets debt (a few percentage points), or currencies (the latter generally making up less than 10 percent of the fund’s risk budget). Investments in high-yield issuers are limited to 10 percent of assets.

Typical of Bluebay’s alpha-seeking philosophy, and different from many peers, this Euro Bond portfolio has the flexibility to step outside the opportunity set offered by its prospectus benchmark, the Bloomberg Euro Aggregate Index. This discretion has been used effectively by the managers, who rely on a variety of return drivers, including duration management, relative value plays, directional positions in sovereign credit, and active currency trades (up to 10 percent of the portfolio), as well as off-benchmark emerging markets hard currency bonds. Interestingly, while the size of their country overweights has been largely stable over time, the team did tactically introduce credit default swap indexes as a hedge in early 2025.

Performance

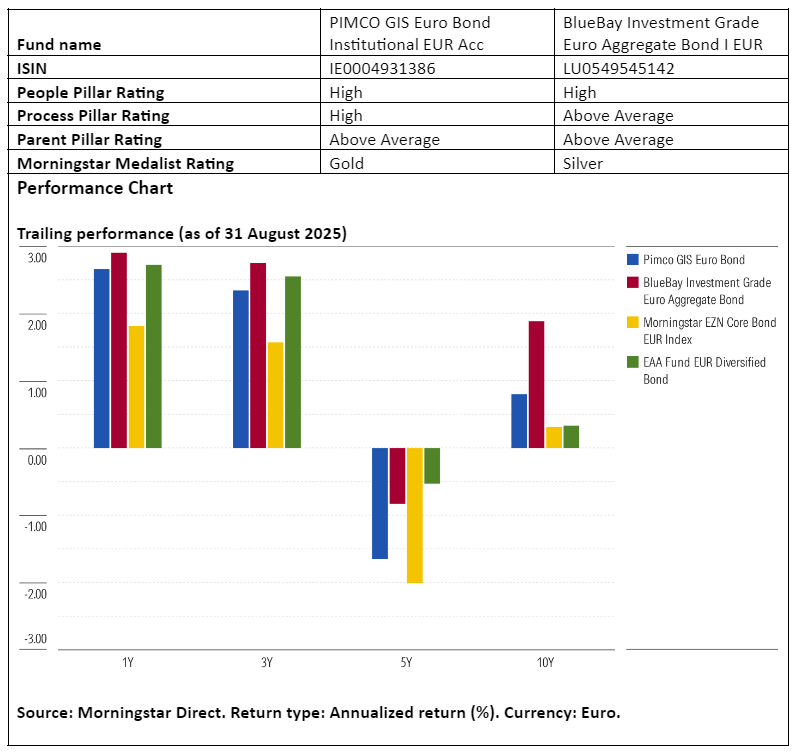

The Pimco fund stumbled uncharacteristically in 2021 and 2022 as overweights in rates-sensitive Danish mortgage bonds and Spanish debt dampened medium-term performance. However, the fund came roaring back in 2023 thanks to an overweight in US duration, which was additive as yields fell. In 2024, the fund nosed ahead of its benchmark thanks to a series of successful plays within G10 and select emerging-markets currencies. Over the longer term, the fund beats the majority of peers in its EUR Diversified Bond Morningstar Category, as well as its benchmark.

On the other hand, the Bluebay managers’ cautious duration positioning proved to be the primary driver of excess returns in 2022 against the backdrop of a historical market selloff, and country selection drove strong returns in 2023. In 2024, tactical duration trading contributing to returns, with long positions in periphery Romania and Greece also additive. Despite its higher-than-average volatility, the fund has outperformed its benchmark since inception and the risk-adjusted profile is certainly strong.

Jeana Marie Doubell is investment analyst fixed income EMEA bij Morningstar. Morningstar is lid van het expertpanel van Investment Officer.