Emerging-markets hard currency bonds have delivered positive returns for dollar investors in every quarter of 2025. However, European-based investors faced negative returns in the first half of the year due to a stronger euro.

This changed in the third quarter, when the Morningstar Emerging Markets Sovereign Bond Index returned 4.8 percent in euros. The turnaround was driven by a stable euro-dollar exchange rate, narrowing bond spreads, a resilient global economy, and a more dovish stance from the US Federal Reserve.

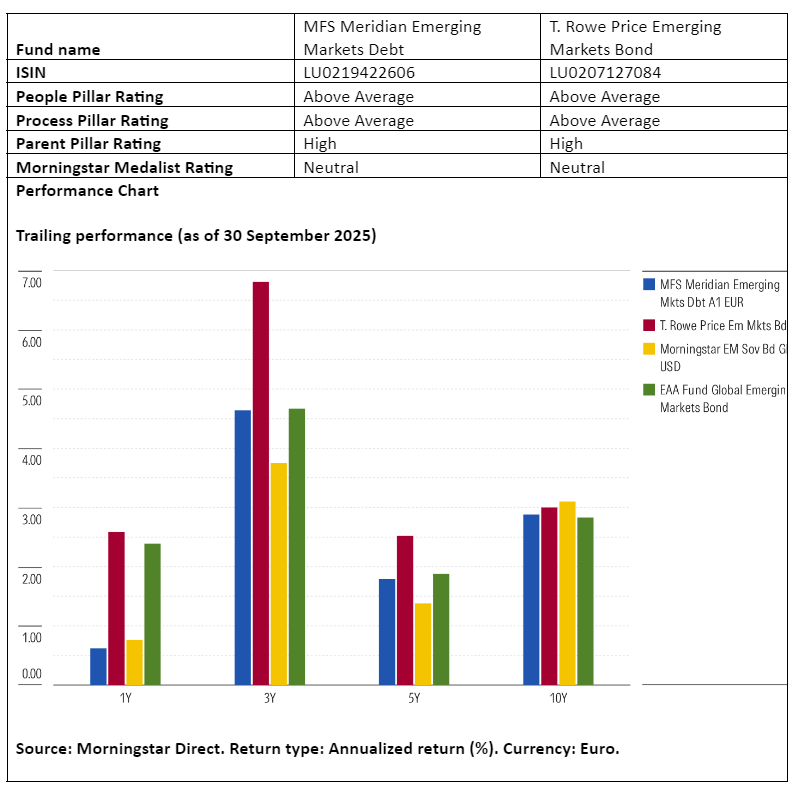

Within the Morningstar Global Emerging Markets Bond category, two standout funds are the T. Rowe Price Emerging Markets Bond and MFS Meridian Emerging Markets Debt strategies. Both have earned Above Average ratings for their People and Process pillars, reflecting strong management teams and robust investment approaches.

People

At T. Rowe Price, leadership transitioned in 2021 when Sammy Muaddi took over from long-tenured manager Michael Cornelius. While Muaddi lacked direct experience running a fund like this, his six-year track record in managing emerging-markets corporate debt was promising. Thoughtful about transitions and key-person risk, the team promoted Richard Hall to co-manager in July, after a two year stint as an associate portfolio manager. While an associate, his analyst duties were gradually handed over to a new hire. T. Rowe Price’s team is larger and deeper than most peers, with a robust lineup of six portfolio managers, 10 sovereign and 12 corporate emerging-markets debt analysts. The team offers depth and a fresh perspective.

MFS Meridian Emerging Markets Debt digested a recent change at the helm as well. After the retirement of MFS manager Matthew Ryan in 2024, co-managers Ward Brown and Neeraj Arora took the lead after being co-managers since 2009 and 2019, respectively. The team has grown steadily, now featuring a solid group of around nine sovereign emerging-markets analysts plus dedicated credit specialists. At this strategy, the team’s collaborative culture, its leaders’ experience, and their deep familiarity with the strategy, stand out.

Process

T. Rowe Price and MFS offer distinct approaches to emerging-market-bond investing, each with clear strengths.

At T. Rowe Price, Muaddi has made meaningful process enhancements since taking the helm, notably tightening risk controls and formalizing position limits. By capping exposure to higher-risk frontier markets and distressed issuers, Muaddi has struck a balance between seeking out undervalued opportunities and protecting investors from outsized risks. The fund’s willingness to invest in unloved names, combined with a disciplined sizing framework and a long-term holding period, gives it a unique edge. Investors benefit from a process that utilizes diverse alpha drivers and can be opportunistically adventurous yet responsibly managed.

MFS, meanwhile, stands out for its collaborative and flexible investment process. A benchmark switch to the JPMorgan EMBI Global Diversified Index in July 2022 better reflects the fund’s actual exposures, and the managers have maintained the freedom to invest beyond the benchmark, including in corporate bonds and local-currency debt. Regular meetings between managers and analysts foster a team-based approach, blending top-down macro views with bottom-up credit analysis.

Portfolio

T. Rowe Price Emerging Markets Bond stands out for its flexibility, allowing up to 35 percent in off-benchmark corporate debt and 25 percent in local-currency bonds. The team actively seeks opportunities in frontier markets like Angola and Côte d’Ivoire but sizes these positions prudently. They are not uncomfortable avoiding index heavyweights such as the United Arab Emirates and Saudi Arabia, given longer durations and often expensive valuations. They have long avoided Chinese state-owned enterprises and cautiously participate in special situations, always keeping positions modest and within strict limits. The portfolio’s duration remains close to its benchmark, but geographic exposures can differ significantly.

MFS Meridian Emerging Markets Debt also embraces off-benchmark investing, with 30-40 percent of the portfolio in emerging-markets currencies, local debt and corporate bonds. Corporate debt exposure typically ranges from 11 percent to 30 percent, while currency positions are capped at 20 percent. Local currency exposure varies, sometimes rising to 11 percent or dropping to zero. Unlike T. Rowe Price, MFS actively manages duration but keeps it within one year of the benchmark.

Performance

T. Rowe Price Emerging Markets Bond has seen a shift in performance drivers since Muaddi took over the lead in 2021. Previously, the fund relied on intrepid security selection and high-conviction country bets, for better or worse. Under Muaddi, returns have been strong, thanks to incremental returns from smaller, well-timed positions in recovery stories like El Salvador and Sri Lanka, but also the windfall from legacy holdings by his predecessor in defaulted Venezuelan bonds that rallied in 2023. Nonetheless, Muaddi and Hall have made good use of the fund’s flexible approach, delivering encouraging results while carefully managing risk.

MFS Meridian Emerging Markets Debt has a strong long-term track record, but its year-to-year results can vary. For instance, in 2016 and 2017 the underweight to Mexico stung during liquidity-driven rallies. However, their off-benchmark corporate debt picks and ability to sidestep troubled countries paid off in 2019 and 2020. Modest duration adjustments have also helped, notably in 2022, showing the team’s ability to adapt to changing market conditions.

Elbie Louw CFA CIPM is a senior analyst in manager research at Morningstar Benelux. Morningstar is a member of the Investment Officer expert panel.