The classic 60/40 investment strategy is still alive and well, though its merits have been a matter of debate in recent years.

The 60/40 portfolio is all about balance, as it gives investors exposure to the two biggest asset classes: equities and bonds. Equities offer the potential for growth and capital appreciation over time while bonds deliver more stable coupon income and should provide downside protection. This popular and simple approach has performed well in the long term and across a variety of market environments, though it can struggle during periods of elevated inflation.

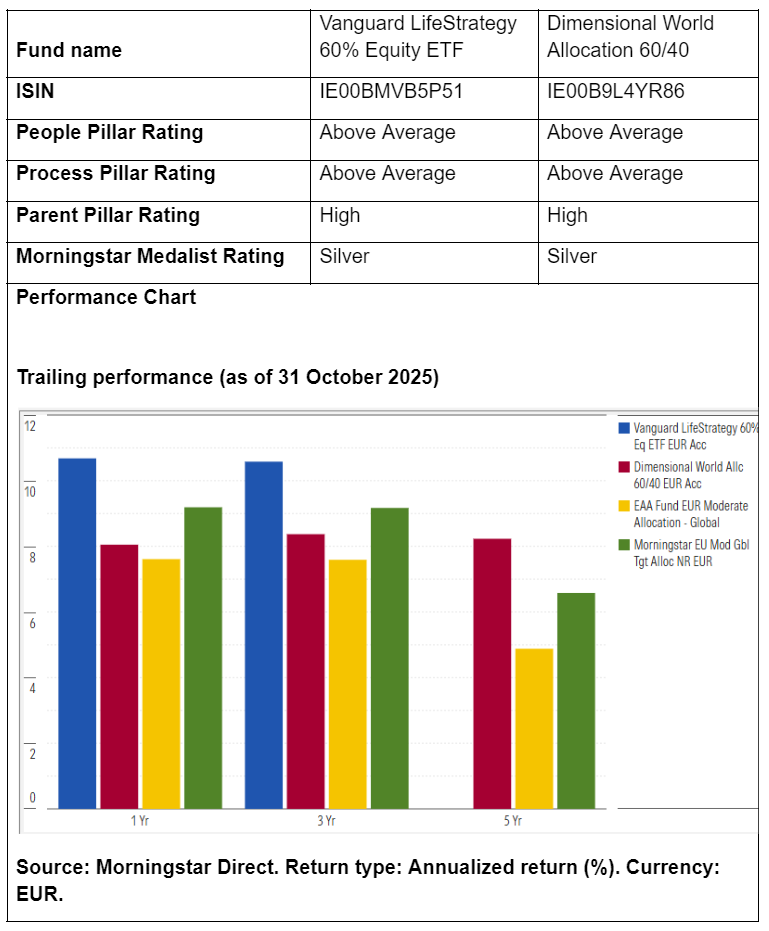

Against this backdrop, we take a closer look at two inexpensive analyst-rated 60/40 allocation funds in Morningstar’s EUR Moderate Allocation – Global category that stick to the traditional asset classes: Vanguard LifeStrategy 60 percent Equity ETF and Dimensional World Allocation 60/40.

People

Seasoned investment professionals, strong trading desks, and a team-based approach earn both strategies Above Average People ratings.

Dimensional follows a team-based approach to portfolio management, with an impressive assortment of individuals providing a high level of oversight. Eugene Fama and Kenneth French sit on the investment research committee and are joined by Nobel Prize-winning economist Robert Merton. Ten others round out the committee, including Dimensional founder David Booth. Many professors and academics serve as consultants, vetting research provided by the firm’s expansive research team.

Vanguard’s strategic asset allocation committee oversees the firm’s multi-asset funds. There, the committee’s voting members are senior leaders across the firm, including global head of portfolio construction and chief economist for the Americas, Roger Aliaga-Diaz, who became a co-manager in February 2023. The committee is supported by Vanguard’s investment strategy group, a global network of more than 70 investment professionals. Its research topics range from investor behavior to portfolio construction.

Process

Vanguard and Dimensional’s investment approaches are highly efficient and consistently executed, driving Above Average Process ratings.

Guided by global market-cap weights, Vanguard management’s approach offers broad exposure and diversification. The ETF avoids tactical tilts, allocations to actively managed funds, or niche asset classes and instead sticks with inexpensive, index-based exposure. Efficient execution is paramount, so the firm continuously strives for incremental improvements in its sampling, indexing and trading methods. This reflects Vanguard’s intense focus on minimizing trading costs.

Dimensional systematically targets risk premiums backed by decades of research. The underlying equity strategies tilt toward cheap, profitable, and small-cap stocks, following the Fama-French asset pricing model. The fixed-income team adjusts duration and credit quality according to their view of the yield curve and credit spreads. A vetting process ensures that these decisions are backed by robust research. Dimensional’s research team continuously churns out new insights for potential adjustments and improvements.

Portfolio

Vanguard uses low-cost index funds to gain broad exposure to global stocks and bonds, relying exclusively on its well-regarded index building blocks. The portfolio holds 13 underlying ETFs that cover global equity and bond markets, with significant weightings in Gold-rated Vanguard FTSE Developed World ETF, Silver-rated Vanguard FTSE All-World ETF, and the Bronze-rated Vanguard Global Aggregate Bond ETF (EUR Hedged). Vanguard’s Ucits range maintains minimal geographic bias relative to a market-cap-weighted portfolio; within the equity sleeve roughly 60 percent is allocated to US stocks and 40 percent to non-US stocks, while the bond sleeve is evenly split between US and international fixed income.

A similar picture emerges for the Dimensional World Allocation 60/40, though unlike Vanguard, Dimensional’s equity allocation consists of more than 12,000 individual holdings rather than underlying funds. As for the bond side its characteristics shift in a predictable manner, with duration rising or falling in line with movements in global yield curves.

Performance

For both funds, the 60 percent equity allocation has been a key driver of their strong three-year results versus category peers, which typically hold less than 50 percent in equities. An additional tailwind came from an overweighting in US stocks compared with peers, although that positioning has more recently become a headwind.

Dimensional World Allocation 60/40’s skew toward small and cheap stocks is a driver of relative performance. For example, the portfolio did well when value stocks were in favor in the early part of 2021 and when small caps did better than large caps between April and October 2022, and outperformed its benchmark. The Vanguard LifeStrategy 60 percent Equity ETFs longer-than-average duration profile increases its sensitivity to interest-rate changes, resulting in a disproportionately negative impact when rates surged in 2022.

Ultimately, at 25bps (Vanguard) and 33bps (Dimensional) these two funds provide inexpensive, globally diversified multi-asset portfolios.

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. Morningstar is part of the expert panel of Investment Officer.