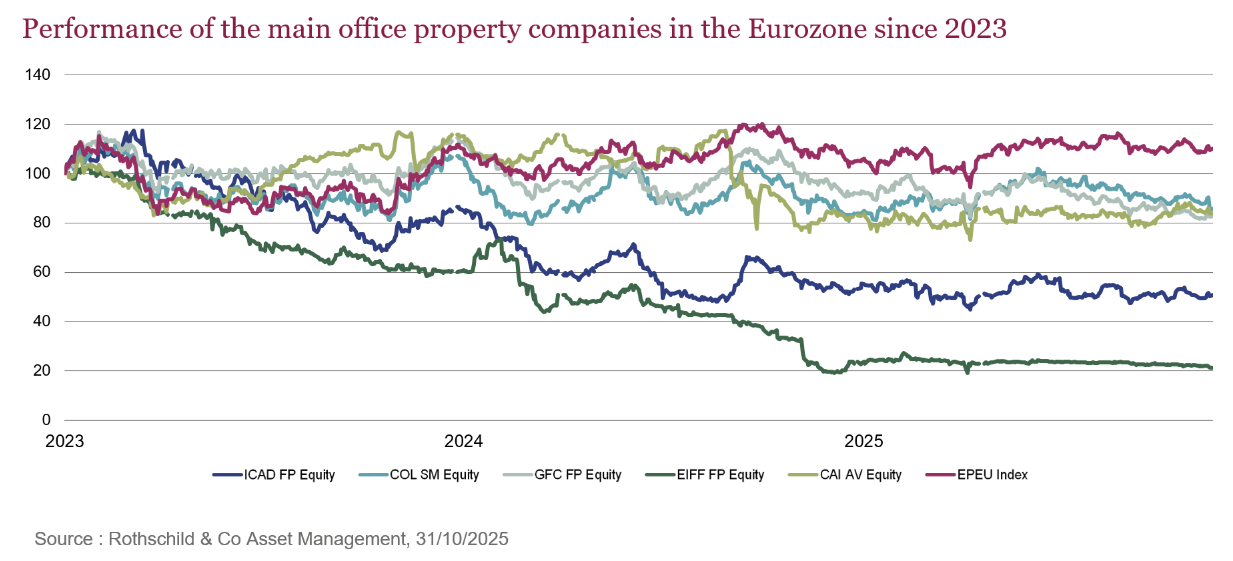

Since the end of the Covid-19 pandemic, office Real Estate companies have continued to struggle on the stock market. They are underperforming the Eurozone Real Estate index across all sectors.

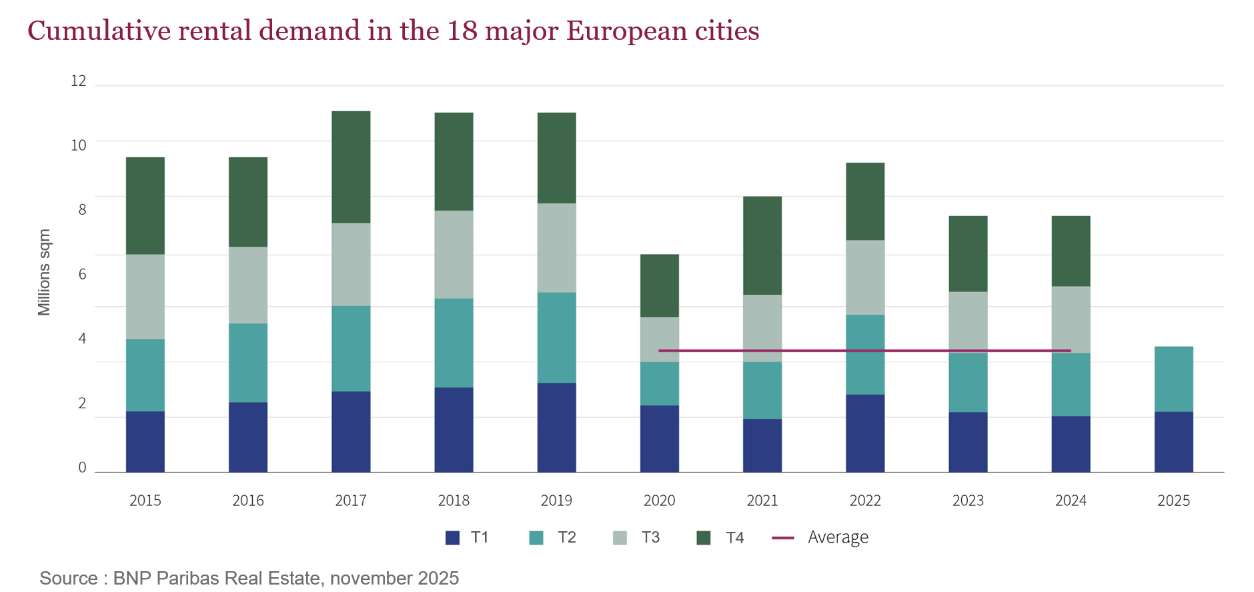

Disrupted by the surge in remote working and the energy transition, the office market has faced significant challenges, leading to a 20% drop in average of rental demand compared to the pre-Covid period, i.e. 4 million square meters, compared to an average of 5 million square meters in the first half of the year over the last five years for the eighteen European cities surveyed by BNP Paribas Real Estate (1) .

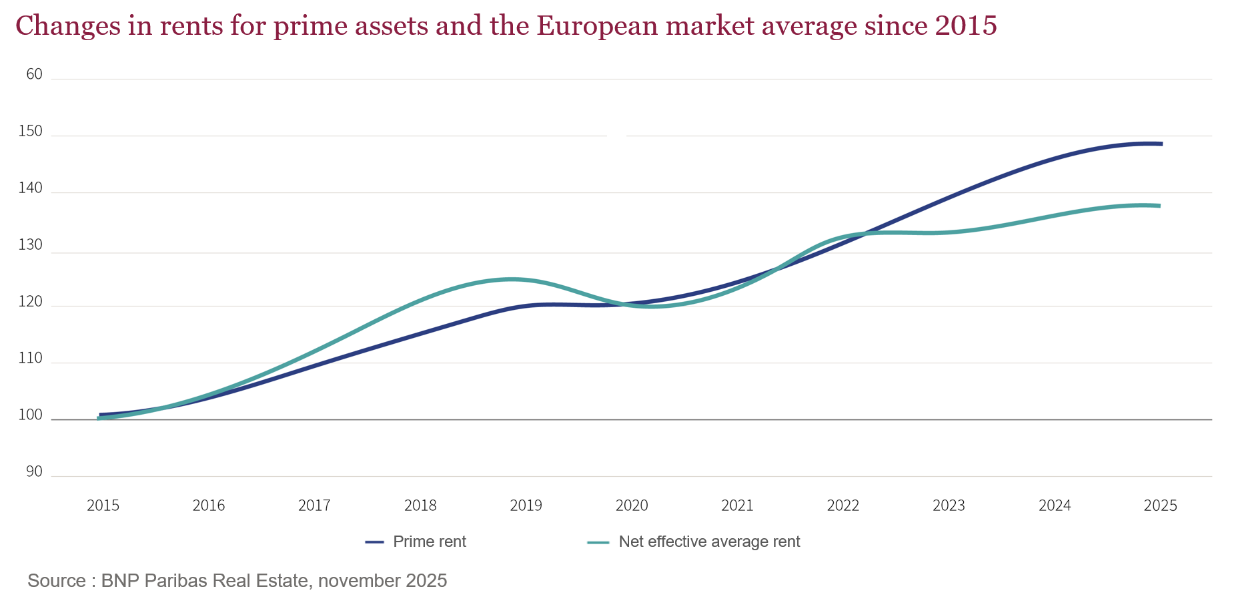

However, rental demand hides a sharp disparity that has emerged post-Covid between the best offices, categorised as ‘prime (2)’, and the rest. For the former, which includes all well-positioned offices — those in the city centres of major European cities and offering top energy performance (recently built and/or renovated buildings), rental demand has remained strong even though supply is limited. Vacancy rates in city centre markets are therefore very low (2.5% in Barcelona, 2.7% in Milan, 3.3% in Munich and 4.3% in Paris) compared to peripheral markets (10.7% on average) (1), leading to a significant divergence in rents.

This divergence between prime and non-prime assets is reflected in the operating performance of real estate companies. Gecina and Société Foncière Lyonnaise (acquired by Inmobiliaria Colonial), which have the largest portfolios in central Paris, reported rent increases of 20% during lease renegotiations in the first half of the year, and even +25% for Gecina in the central business district (1). Covivio, 50% of whose French office assets are located in Paris, Neuilly and Levallois, posted a slightly positive average reversion of +0.3% of total rents, or likely +3% based on an average annual renewal rate of 10% of leases (3). Finally, Icade, 80% of whose office portfolio is located outside Paris, suggests a decline in rents of between -20% and -30% based on a similar calculation assumption (3).

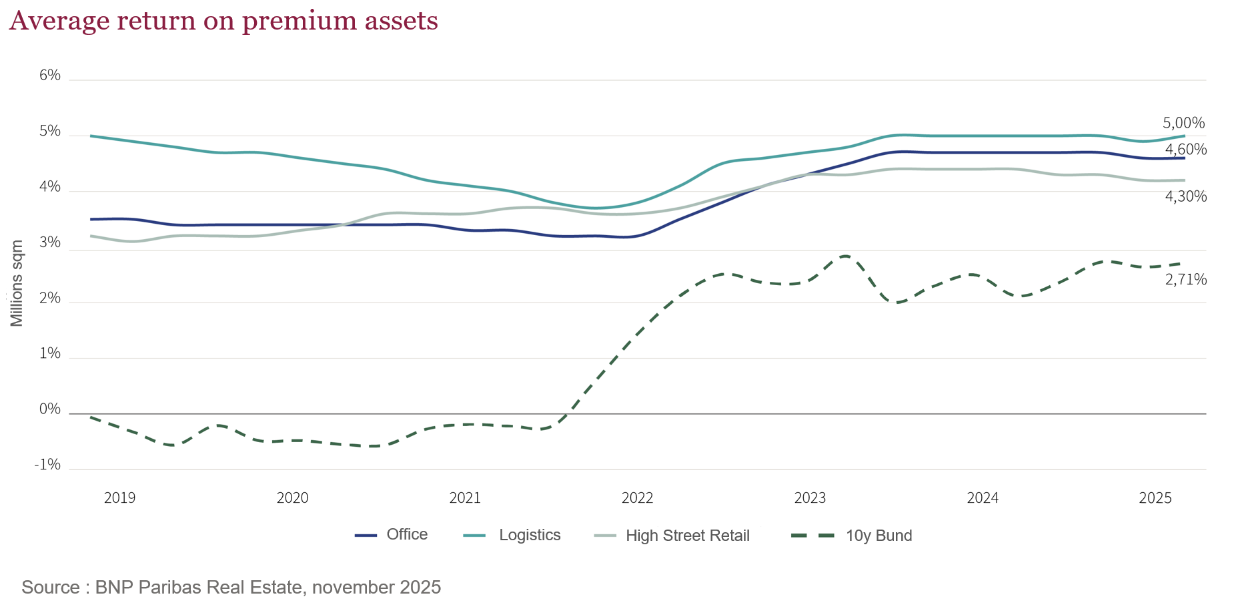

The investment market reflects rental trends. Offices accounted for only 26% of total capital invested in the first nine months of 2025, compared with an average of 39% over the last ten years in Europe1. Obsolete second-tier properties are unsellable. Transaction volumes for prime assets remain penalised by a risk premium which, despite yields rising by just over 100 basis points on average from their low point (4), remains tight amid continued uncertainty over the direction of long-term interest rates. On the stock market, the penalty is even more severe, with an average discount of 47% on the net assets of office property companies (4).

What is the short- to medium-term outlook?

As for demand for square meters, the wave of rationalisation of office real estate following the rise of remote working is now behind us. The outlook for growth and employment for 2026 remains broadly satisfactory in Europe at this stage. It is still too early to have a clear picture of the impact of AI on office employment. In the United States, according to various studies (ADP, Stanford, Harvard), junior employees in professions exposed to AI have clearly been impacted, unlike more experienced profiles, for whom employment has increased.

The future supply of square meters has declined since its peak in 2022 in Europe, reflecting the difficult rental market and rising construction costs, which have led to a squeeze on developers' margins. Savills, a property broker, anticipates 3.1 million square meters of deliveries in Europe in 2026, the lowest level since 2017, while the annual average stands at more than 3.5 million over the period, and a halving of speculative supply to 1.6% of stock. However, Paris's central business district (CBD) will see a big year for completions in 2026, with 340,000 m², or around 2% of the intramural stock, which could temporarily give tenants a little more room for negotiation and calm the rise in rents. This is particularly true given that the gap with peripheral areas has reached a new high.

What insights can we derive from the current market dynamics?

Public markets now offer the opportunity, through the level of discount, to acquire stakes in exceptional assets at prices 25% below market prices (discount on gross assets value), equivalent to returns 100 basis points higher than those seen on the private market at the bottom of the cycle (4). We believe it is unlikely that a new shock could validate such a significant price decline, unless we anticipate a further considerable rise in long-term interest rates and/or a tsunami of AI affecting office employment. The 7% yield on securities also offers attractive carry (4). R-co Thematic Real Estate's allocation to Real Estate offices represents 14% of the portfolio, 80% of which is in prime offices (6).

[1] Source: BNP Paribas Real Estate, November 2025.

[2] Prime assets: buildings that meet the latest standards and enjoy a central location.

[3] Sources: Companies, Rothschild & Co Asset Management, 31/10/2025.

[4] Source: Bloomberg, 31/10/2025.

[5] Source: Savills, November 2025.

[6] Sources: Rothschild & Co Asset Management, 31/10/2025.

For more information, visit Rothschild & Co AM website.