With or without ESG, investor returns still paramount in US

A series of significant lawsuits highlight a core principle of the US economy: political agendas are personal, while investor returns are paramount.

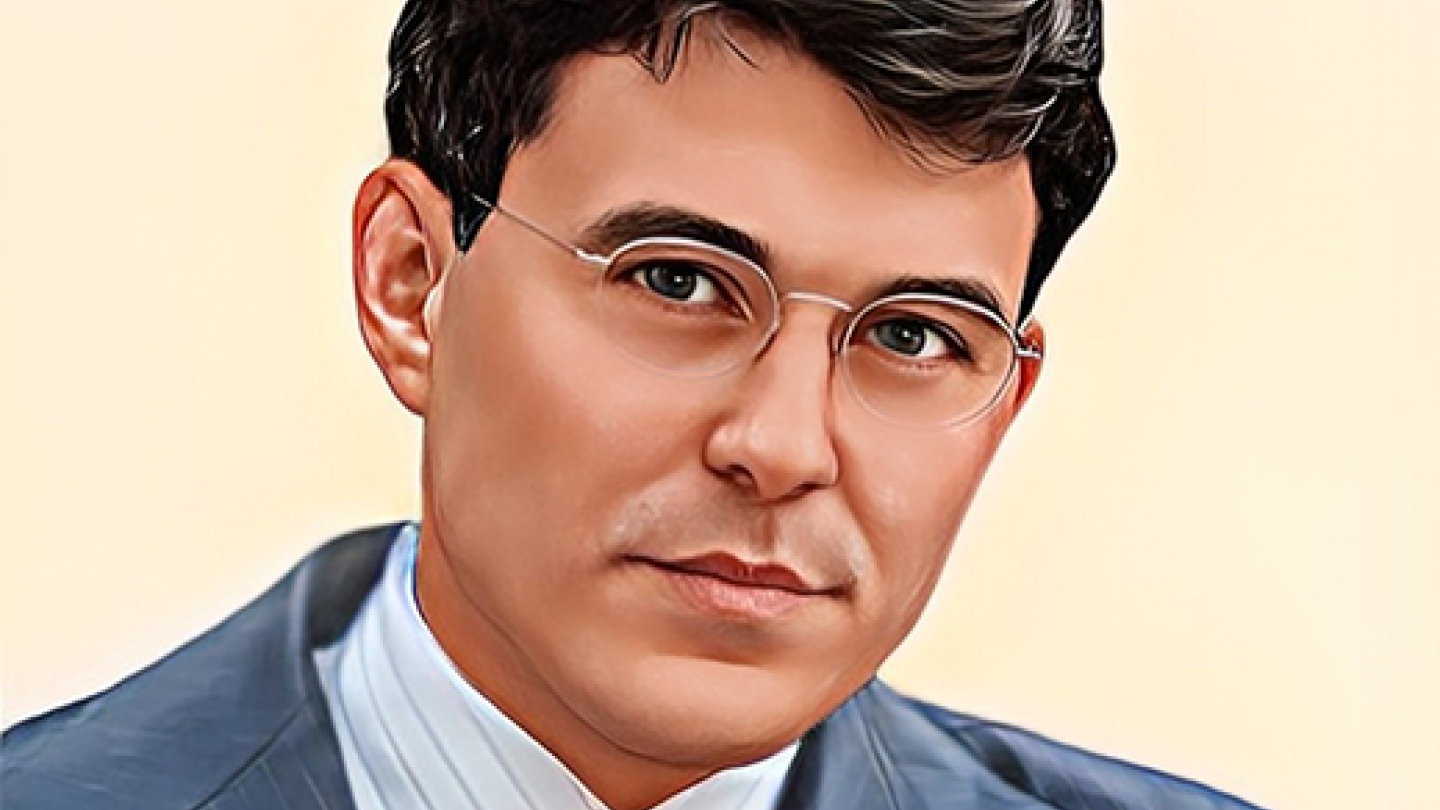

Invesco’s Hooper: European equities deserve more interest

Kristina Hooper, chief strategist at Invesco, understands that the endless debating about interest rates seems a bit excessive, “but back in the day, investors had to guess what was going to happen to interest rates by looking at the thickness of Alan Greenspan’s briefcase”.

ESG burnout looms for SEC due to political backlash

Political pressure is mounting on the Securities and Exchange Commission (SEC) over its efforts on climate reporting and Environmental, Social, and Governance (ESG). With the recent delay in final regulations, the question arises: Is the SEC bowing to pressure from critics?

SEC rejection of spot bitcoin ETFs faces challenges

Is the US Spot Bitcoin ETF Hype Overblown? The SEC’s rejection of spot bitcoin ETFs faces legal challenges, raising questions about their potential impact.

BlackRock defies market with interest rate forecast for 2024

BlackRock, during the presentation of its 2024 Global Outlook at its New York headquarters, indicated that the Federal Reserve is unlikely to cut interest rates until the second half of next year, a scenario the market currently sees as highly improbable. This divergence in expectations set the stage for the event, titled “Context is Everything”, where the asset manager shared its strategic insights.

Target-date ETFs break new ground in retirement plans

After a previous setback, BlackRock is launching new target-date ETFs, aiming at the vast market of Americans without pension plans, a move seen as promising for the self-employed.

BlackRock is reviving its target-date fund ETF series with a fresh approach, targeting the trillion-dollar market of Americans lacking pension plans, nine years after its initial failure.

Will the Magnificent 7 remain a driving force in S&P 500?

Forecasting the S&P 500’s trajectory, most major banks in the US, including their asset managers, predict a marginally positive year for the index in 2024. However, views diverge significantly on the fate of the ‘Magnificent Seven’ tech giants.

Do the risks still outweigh the opportunities in China?

China, once a beacon for investors, is facing unprecedented challenges, leaving institutional portfolio managers worldwide questioning its investability. ‘A valid concern, but the question whether or not China is still investable is too complex for a simple yes or no.’

That’s according to Arthur Kroeber, founder of Gavekal Dragonomics, an independent research firm specializing in the economics, politics, and social issues of China.

US inflation data challenges ‘higher for longer’ narrative

The suggestion that the Federal Reserve will maintain elevated interest rates is wavering after Tuesday’s unexpected declines in U.S. inflation figures, much to the delight of stock and bond markets.

Foreign investors defy junk threat in Italy

Italian government bonds face a downgrade to “junk status”. Nevertheless, after years, the interest of foreign investors in this “ticking time bomb” is increasing.

The prolonged exodus of foreign investors from Italian government bonds has halted this year. According to research by Amundi Investment Institute, the asset class saw positive inflows of 35 billion euros in the first seven months, driven by foreign interest.