The appointment of Kevin Warsh as the new chair of the Federal Reserve was met with relief by markets worldwide. Gold crashed 9 percent, silver 28 percent. It was not only American investors who reacted. The whole world was watching. And that is exactly the point.

Because here is what many investors have forgotten: the Fed is not just another central bank. It is thé central bank. To paraphrase The Lord of the Rings: “One bank to rule them all.”

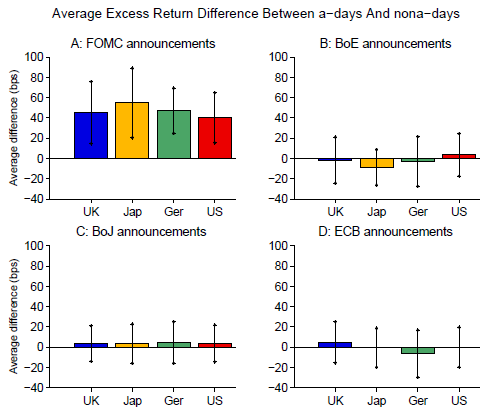

Recent academic research by Brusa, Savor, and Wilson reveals a striking pattern. On days when the Federal Reserve announces its interest rate decision, stock markets around the world rise spectacularly. In the US, the average return on FOMC days is 23.5 basis points higher than normal. But in Japan it is 28.6 basis points, in Brazil 43.8, and in South Africa 28.1 basis points. Of the 38 countries studied, 37 show significantly higher returns on Fed days.

What is remarkable? This effect does not exist for other central banks. When the European Central Bank, the Bank of Japan, or the Bank of England announce their decisions, little happens, not even in their own domestic markets. German stocks barely react to ECB decisions. Japanese investors seem more concerned about the Fed than about their own central bank.

Figure 1: Average excess return on an announcement day

This is not a matter of economic size. The eurozone is economically comparable to the US. Nor is it about policy inactivity. All major central banks conduct active monetary policy, including unconventional measures. It appears that the Fed simply sets the global price of money, while other central banks are spectators.

Why? One explanation is the dominant role of the dollar in international trade and capital markets. Another is the Fed’s lead in research capacity and data. Whatever the reason, the result is clear: the Fed steers the global financial system in a way no other institution does.

And that makes Trump’s recent behavior all the more troubling. He called Jerome Powell a clown and had his Justice Department launch criminal investigations against Fed governors. Fourteen international central bankers felt compelled to publicly defend the independence of central banks, an unprecedented intervention.

Warsh’s appointment calms the markets, but it does not solve the fundamental problem. If Trump had truly been able to fire Powell, he would have done so. The question is not whether Trump will intervene in the Fed again, but when.

For institutional investors, this means that risk models that assume Fed independence need to be reconsidered. The academic literature shows that FOMC days explain the lion’s share of global equity returns. But what happens if those decisions become politically influenced? We are not talking about the US alone. We are talking about the entire world. Because, as the research shows, there is only one central bank that truly matters. And it is now under political pressure like never before.

Warsh may become a capable chair. But the real test will come when Trump once again demands rate cuts. Then we will see whether the institution that steers global financial markets can maintain its independence. Investors around the world can only watch, and adjust their positions.

Gertjan Verdickt is an assistant professor of finance at the University of Auckland and a columnist at Investment Officer.