In the run-up to the Senate elections later this year, a presidential candidate has been making some rather odd moves. After briefly plucking away the president of a, at least on paper, sovereign state, and more or less annexing Greenland, again on paper, the chair of the US central bank was next in line. As a result, crucial charts that already tend to stay out of the spotlight receive even less attention. Fortunately, not here.

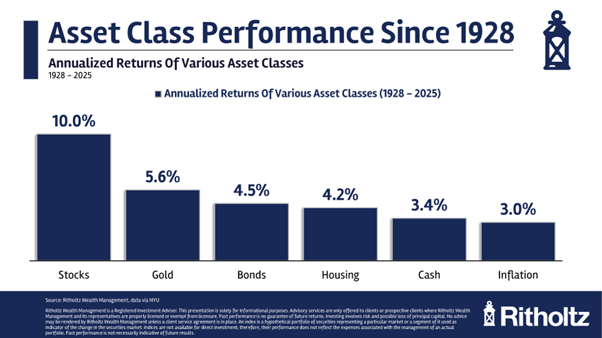

Take the chart below by Ben Carlson of Ritholtz Wealth Management, which shows the average annual returns of several major asset classes since 1928.

It makes clear that equities are by far the best-performing asset class. No surprise there, especially since bitcoin did not yet exist at the time. What will surprise many investors, however, is that gold runs off with the silver medal. Over nearly one hundred years, gold has outperformed bonds by more than one percentage point. It is primarily the price surge of recent years that has propelled gold into second place among the best-performing asset classes.

Scratching heads

That should raise questions for many investors. The dominant narrative is still that gold barely manages to keep pace with inflation, and even then only with substantial volatility.

That view is badly outdated. On average, gold has beaten inflation by 2.6 percent per year. And that is before even mentioning the past few years.

Many investors, partly unjustifiably, focus exclusively on returns. For those with a long investment horizon and no sleepless nights over falling markets, volatility is less relevant. These investors are likely to wonder why gold is either completely absent from their portfolio, or present only in a negligible allocation.

Risk is relative

There is no denying that gold is riskier than bonds in terms of volatility. But that is not the same as concluding that it therefore fits less well alongside equities in a portfolio.

Long-term data show that the correlation between equities and bonds is more often positive than negative. We have been misled by the period from the mid-1980s to 2020, when interest rates declined structurally and created a favorable relationship with equities. Outside that window, the evidence points more in the opposite direction.

By contrast, the relationship between equities and gold is often close to zero. That correlation is also fairly stable, meaning that gold brings a relatively consistent amount of diversification to a portfolio. Gold also tends to perform well when equities suffer sharp declines.

So much for the statistics. But because gold, unlike equities and bonds, sits at least partly outside the financial system, it also comes with other interesting characteristics.

Such as protection against geopolitical tensions, of which there is no shortage today, and against the growing trend of fiscal dominance. What is happening on the other side of the Atlantic is dramatic, even extreme, but not entirely unexpected.

In our debt-driven economic model, governments must look for “solutions.” One obvious option is lower interest rates. Trump believes he can force that outcome by placing figureheads at the Federal Reserve and taking legal action against its chair.

We do not do that in Europe, of course. But make no mistake: while the approach is more subtle here, the objective is the same. The ECB does not hesitate to turn on the money printer if one of the member states runs into trouble. And incidentally, the famous statement by former ECB president Draghi that the ECB would do “whatever it takes” was anything but subtle, and highly effective.

If you assume, as I do, that pressure on central banks, in whatever form, is here to stay, which would you rather hold in your portfolio: gold or bonds?

Jeroen Blokland analyzes eye-catching, topical charts on financial markets and macroeconomics. He is also manager of the Blokland Smart Multi-Asset Fund, which invests in equities, gold, and bitcoin.